The SaaS market has kept up the momentum from January’s surge in growth, with positive activity for both B2B and B2C in February.

Although slightly lower than the strong start to the year, revenue growth was up 7.5% for B2B and 11.7% for B2C.

Sales are picking up slightly in B2B, while for B2C there was a significant bump in upgrades that helped drive up revenue. Venture capital investment is on the rise, signaling a potential shift in investor confidence, but this is still a time to be cautious and double down on driving retention and combating churn.

This is the latest in our ongoing SaaS Market Reports, which track the movement of the ProfitWell Subscription Index, and its underlying growth and retention trends. This month, we examine February 2024 performance.

KP and Ben discuss this month's data. Scroll down to read the full report.

Growth continues for B2B SaaS

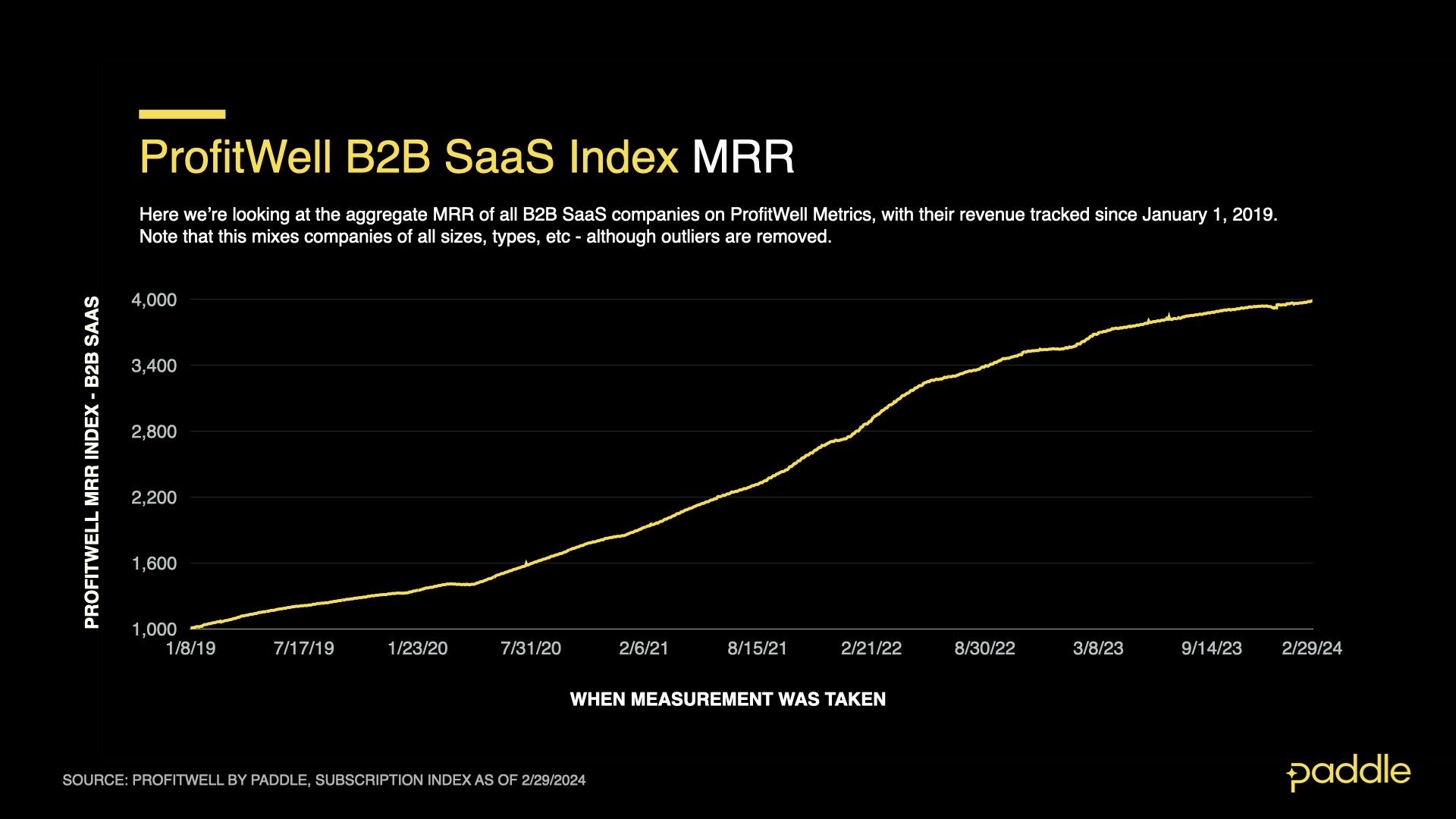

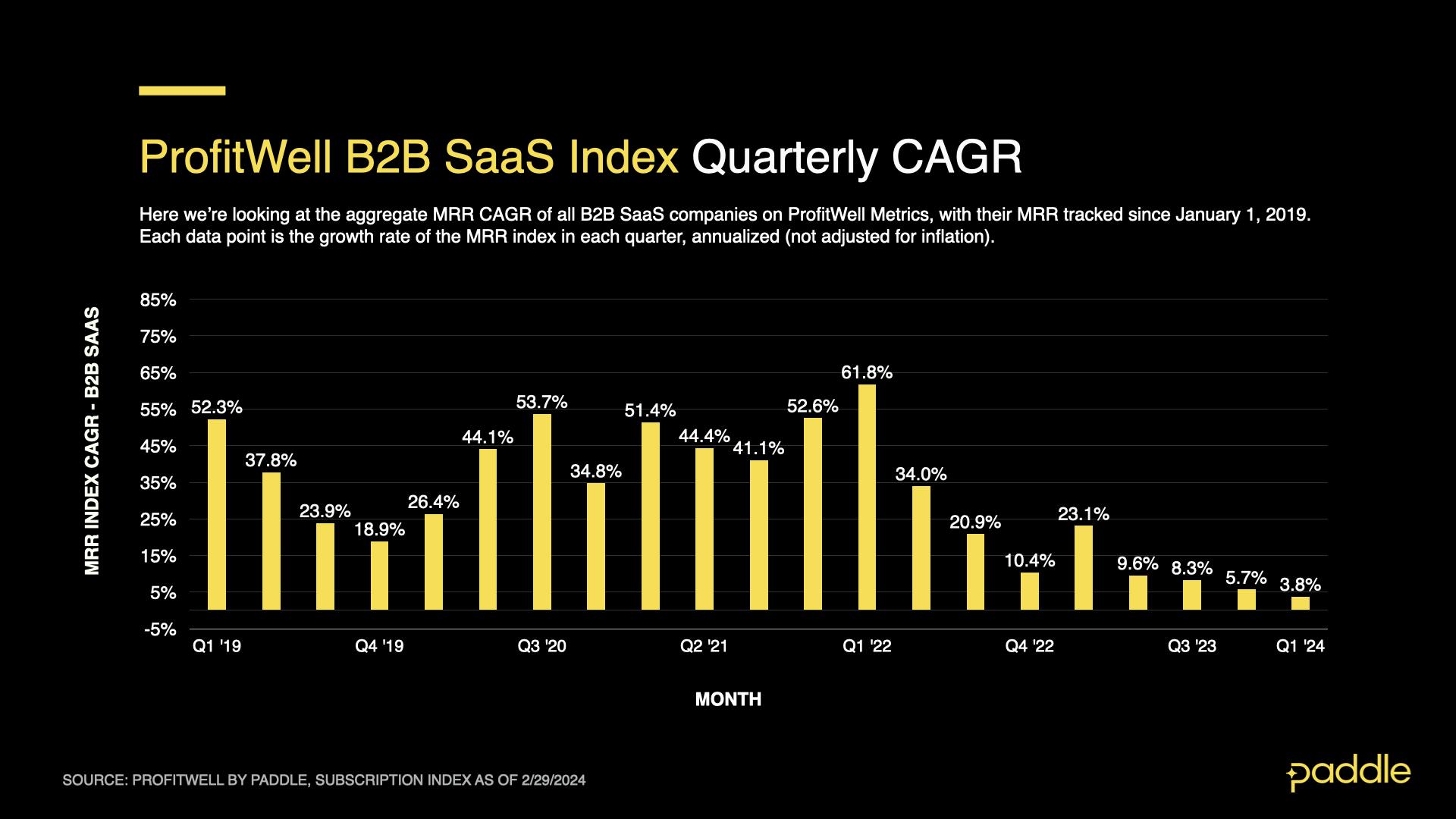

The ProfitWell B2B SaaS Index tracks the cumulative monthly recurring revenue (MRR) from a sample of the 34,000+ companies on ProfitWell Metrics. By measuring the revenue performance of this cross-section of companies over time, we can objectively observe how quickly the sector is growing (or not). The index does not adjust for inflation.

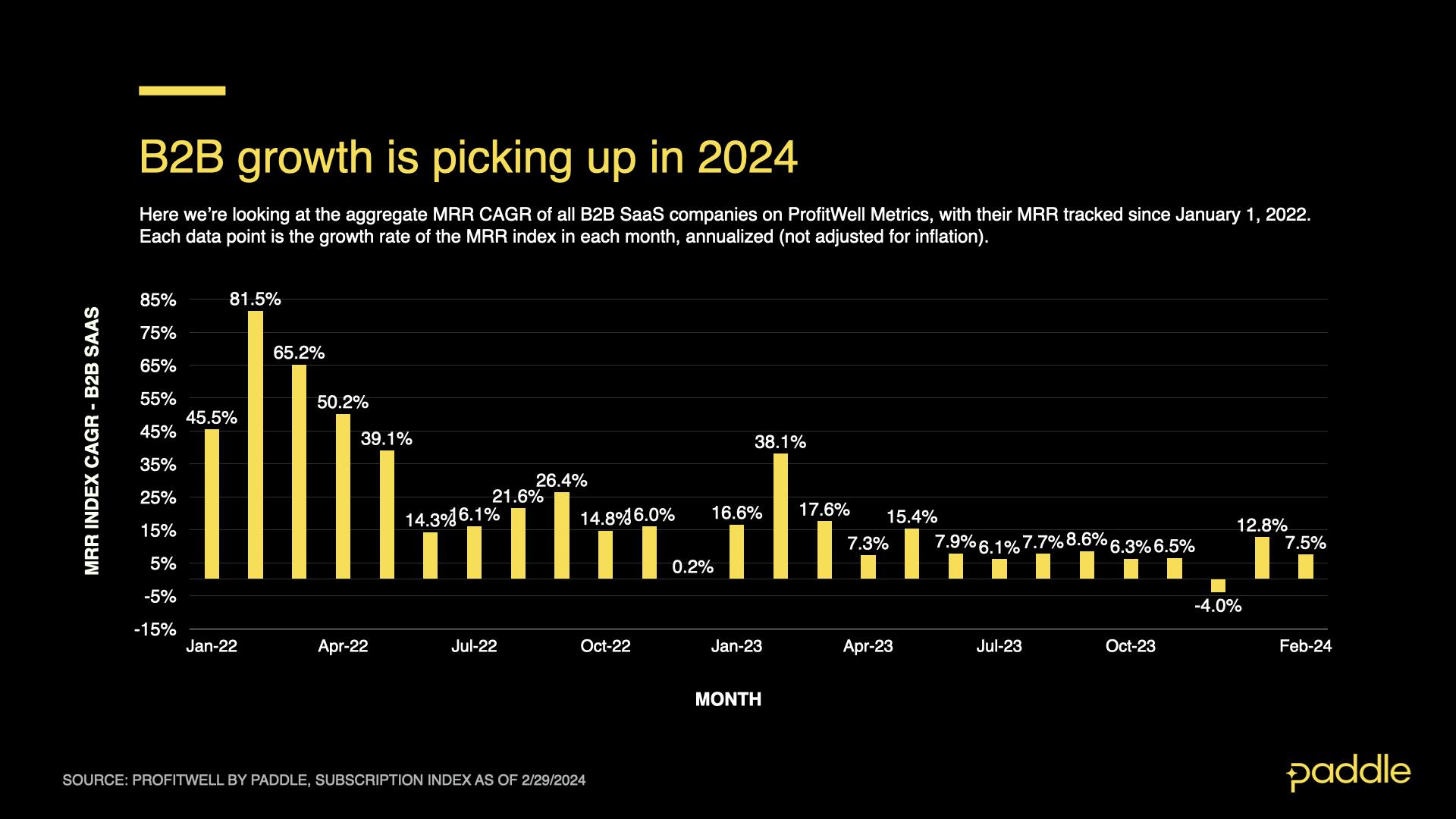

Two months into 2024 and growth is continuing for B2B SaaS. MRR CAGR for February was up 7.5%, slightly down on January, but still the second-best performing month since September 2023. While reactivation MRR caused January’s bounce back, this month’s growth has come from a pick-up in new sales and a slowdown in churn.

B2B sales are picking up

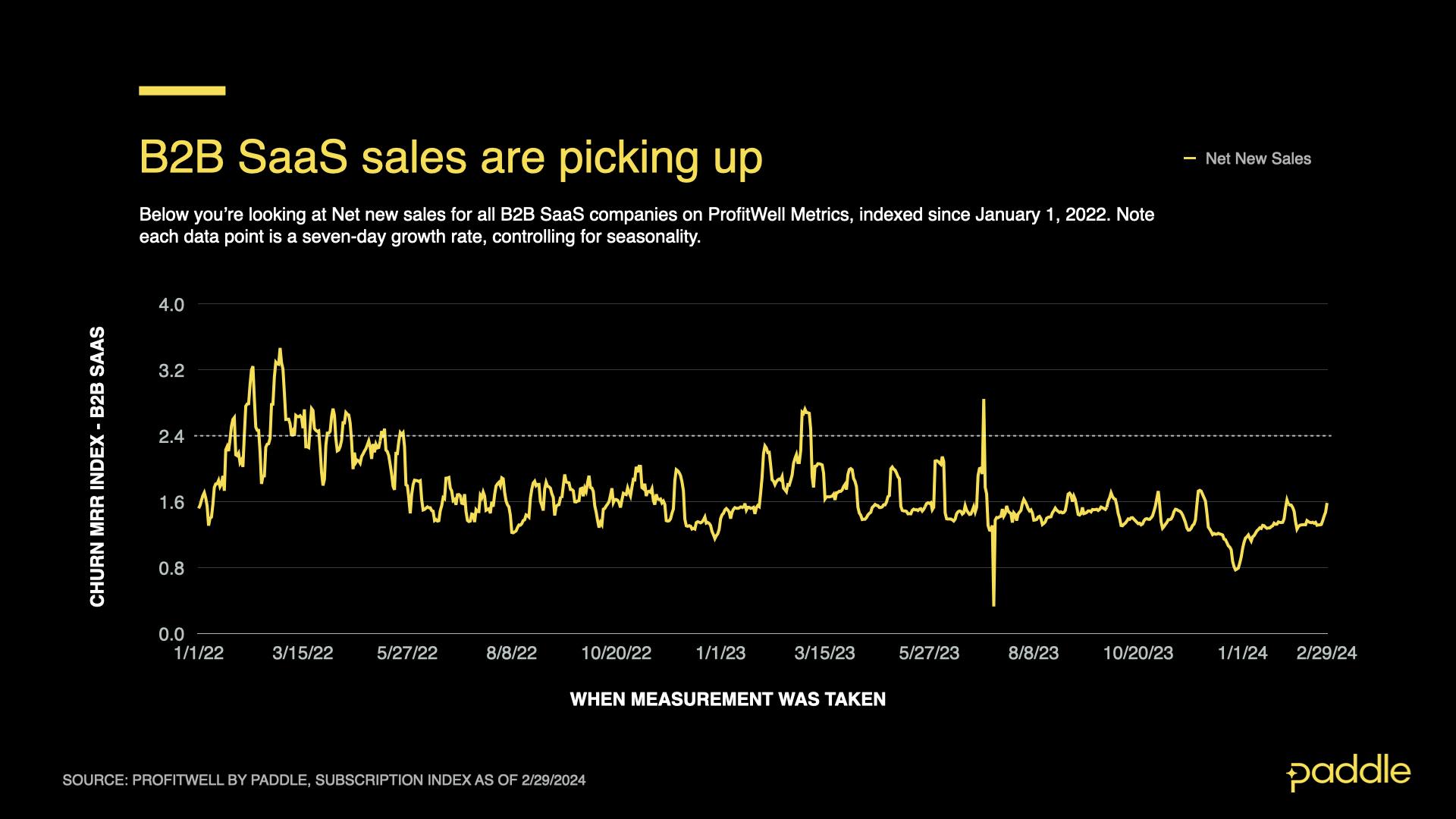

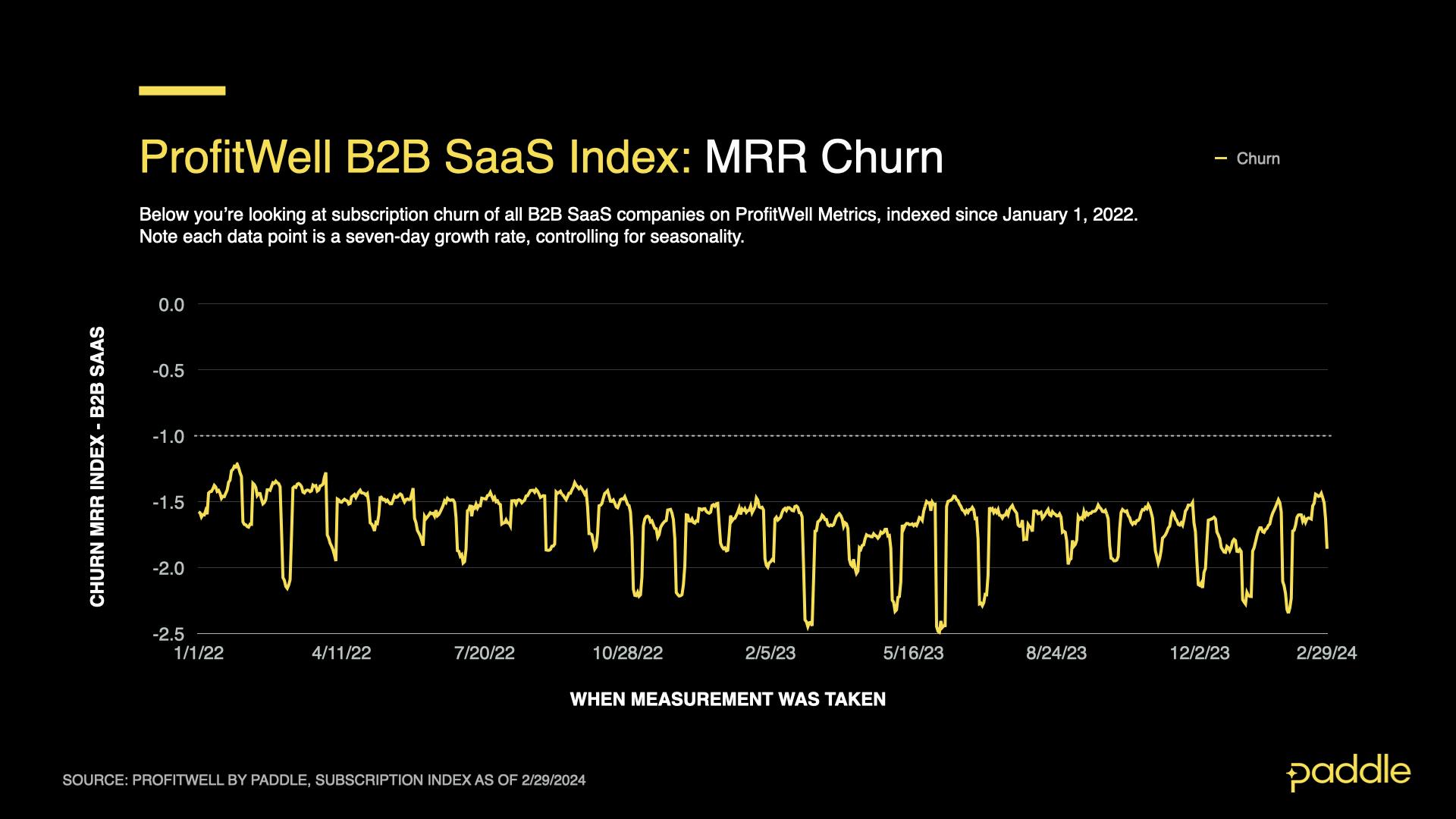

For the ProfitWell B2B SaaS Sales Index, a 1.00 reading represents sales on an “average” day in 2019, while a 1.10 reading would be 10% higher sales. The ProfitWell B2B SaaS Churn Index is calculated similarly, but will be negative, with -1.00 being an “average” 2019 figure).

Because these indices are seven-day averages, they should be read as directional indicators, not direct inputs into the main SaaS index.

February’s new sales ended the month at an average of 1.4, up 11.4% on January. While new sales are picking up, they’re still down 31% from February 2023, indicating that it remains a tougher market to land new sales.

As we mentioned last month, B2B sales cycles have been increasing, especially for those selling into the enterprise - a sign that there continues to be more scrutiny on products and spending.

On a positive note, churn was down 7.5% from January which brought it back in line with mid-2023 levels, before churn hit an all-time high. Compared to February 2023, churn was just slightly up 1.2%.

Initial figures for Q1 show Quarterly MRR CAGR tailing off, registering at 3.8%. Final Q1 figures will be in the March Report.

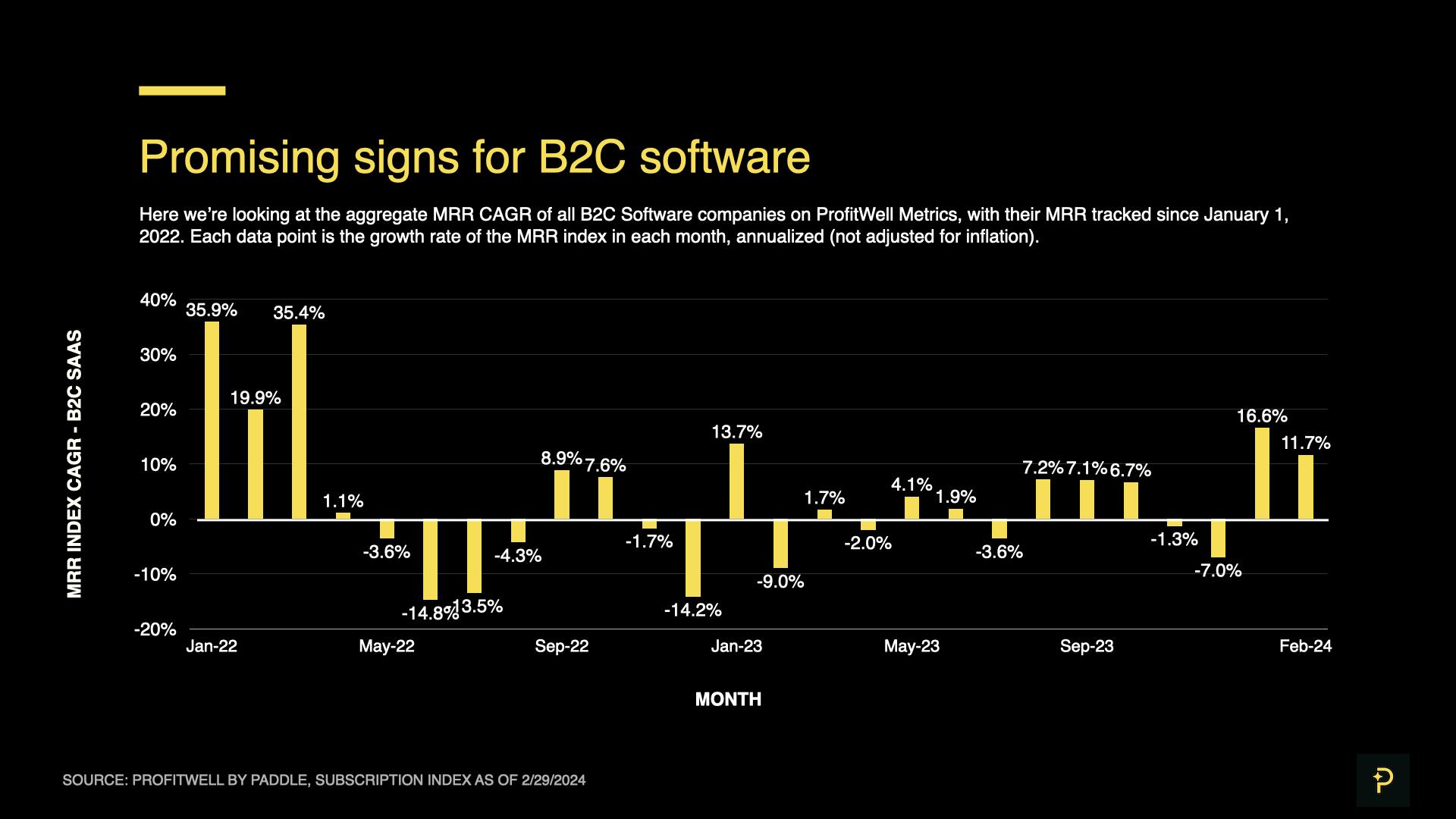

Promising signs for B2C software

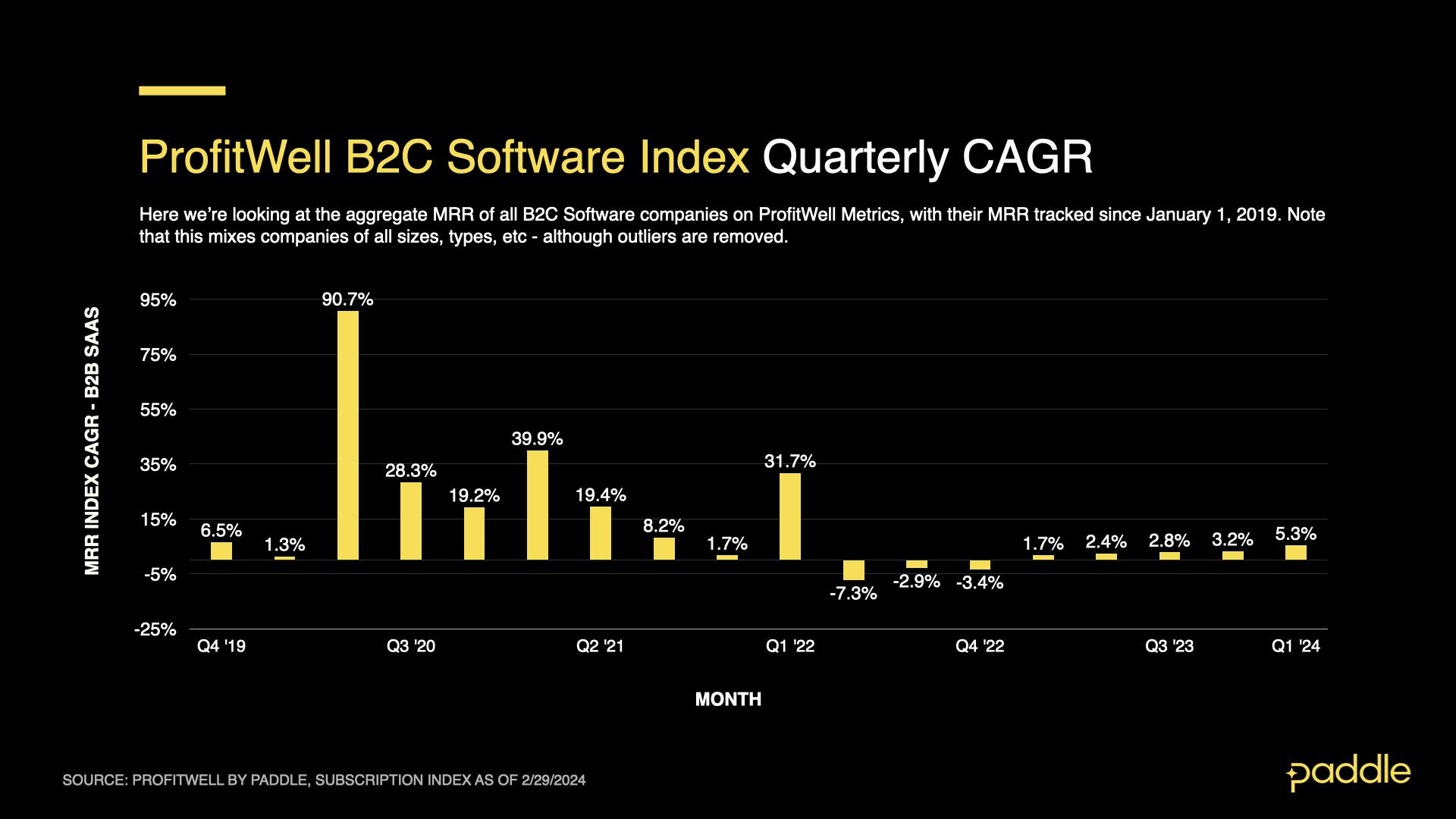

Mirroring trends in B2B, monthly CAGR for B2C continues to grow, albeit at a slower rate. February’s revenue growth ended at 11.7%, a 4.9% decrease from January but recovering from November and December 2023. The very good news is that February 2024 performed much better compared to this time last year when revenue declined by 9%.

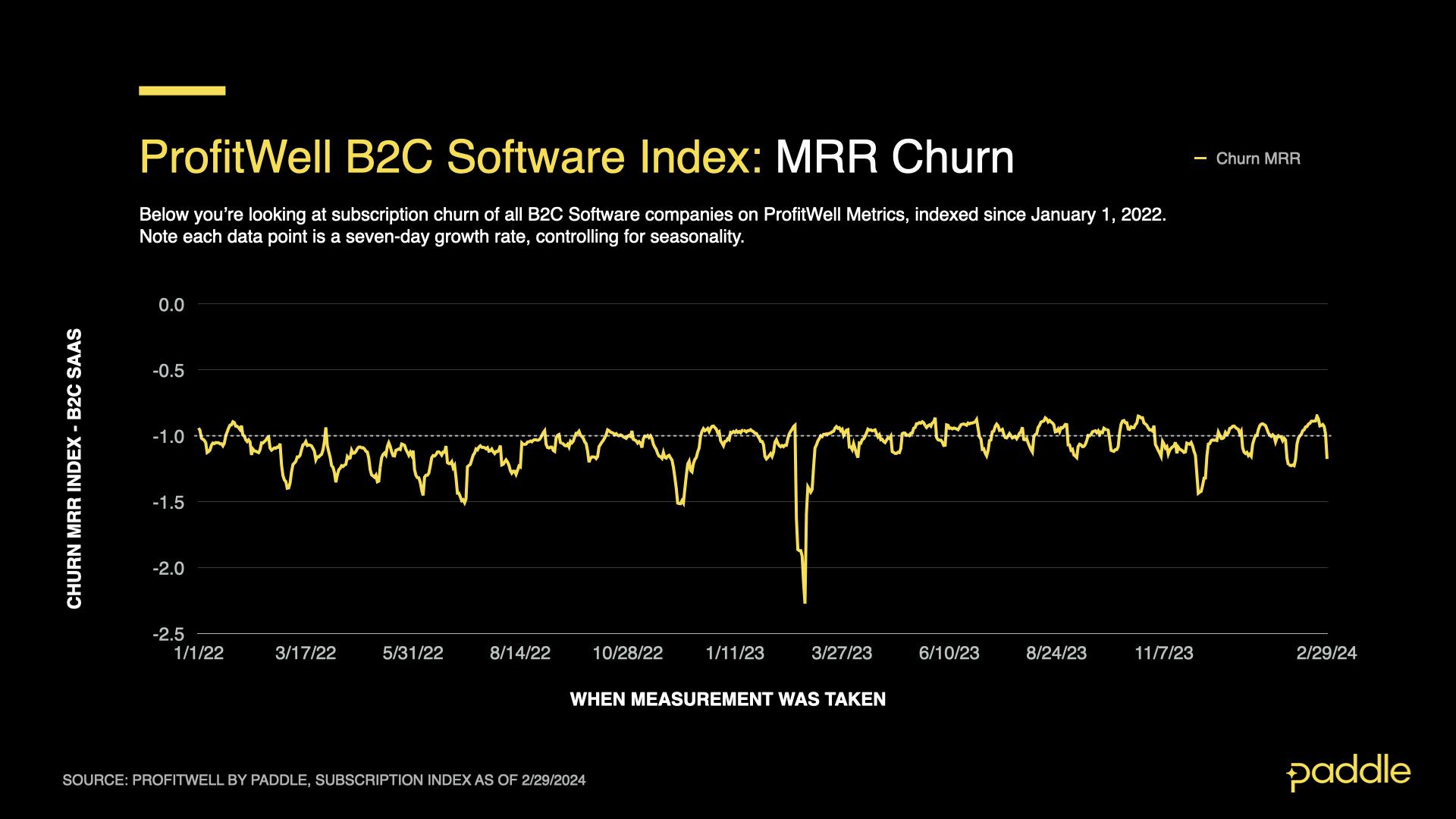

Digging into the numbers, we found that the churn index declined by 0.9% between January and February 2024. In fact, churn has been slowly declining since its last jump in November 2023, when churn increased by 14.7% from October 2023.

This time last year, churn was at an all-time high of -1.233. It has dropped significantly, by 18% since then. Meanwhile, new sales dropped by 7.9% from last month and a 4% decrease compared to this time last year.

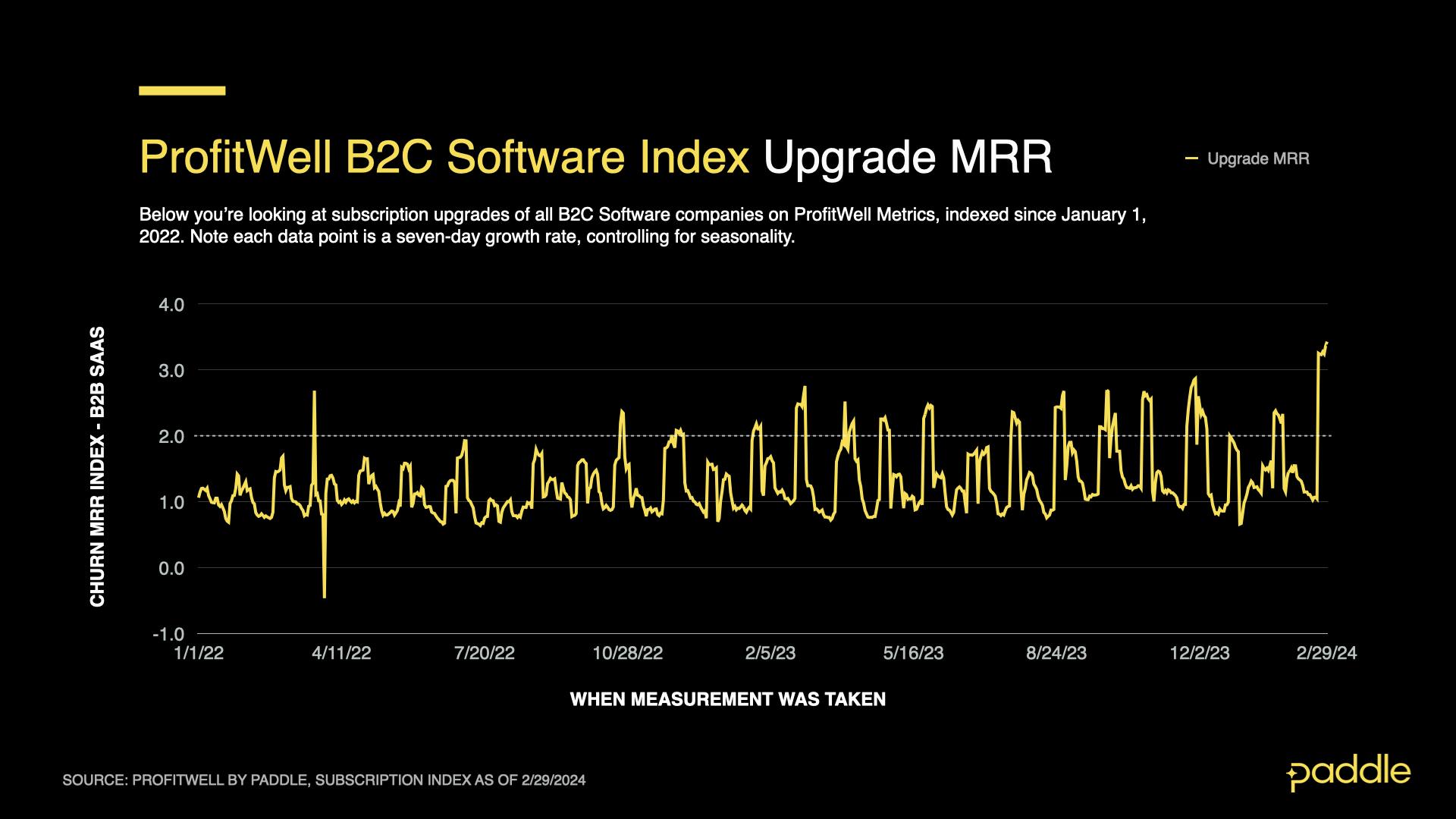

Particularly interesting is the growth in upgrades, which went up from 1.475 in January to 1.734 in February, a 17.5% increase.

Overall, it looks like this will be the 5th consecutive quarter of growth for B2C. This gives us much to be optimistic about for 2024 while maintaining caution about the market coming out of 2023.

Investment is starting to rebound

Venture capital investment activity can indicate confidence in the market and there are signs that investor sentiment is turning a corner after 2023.

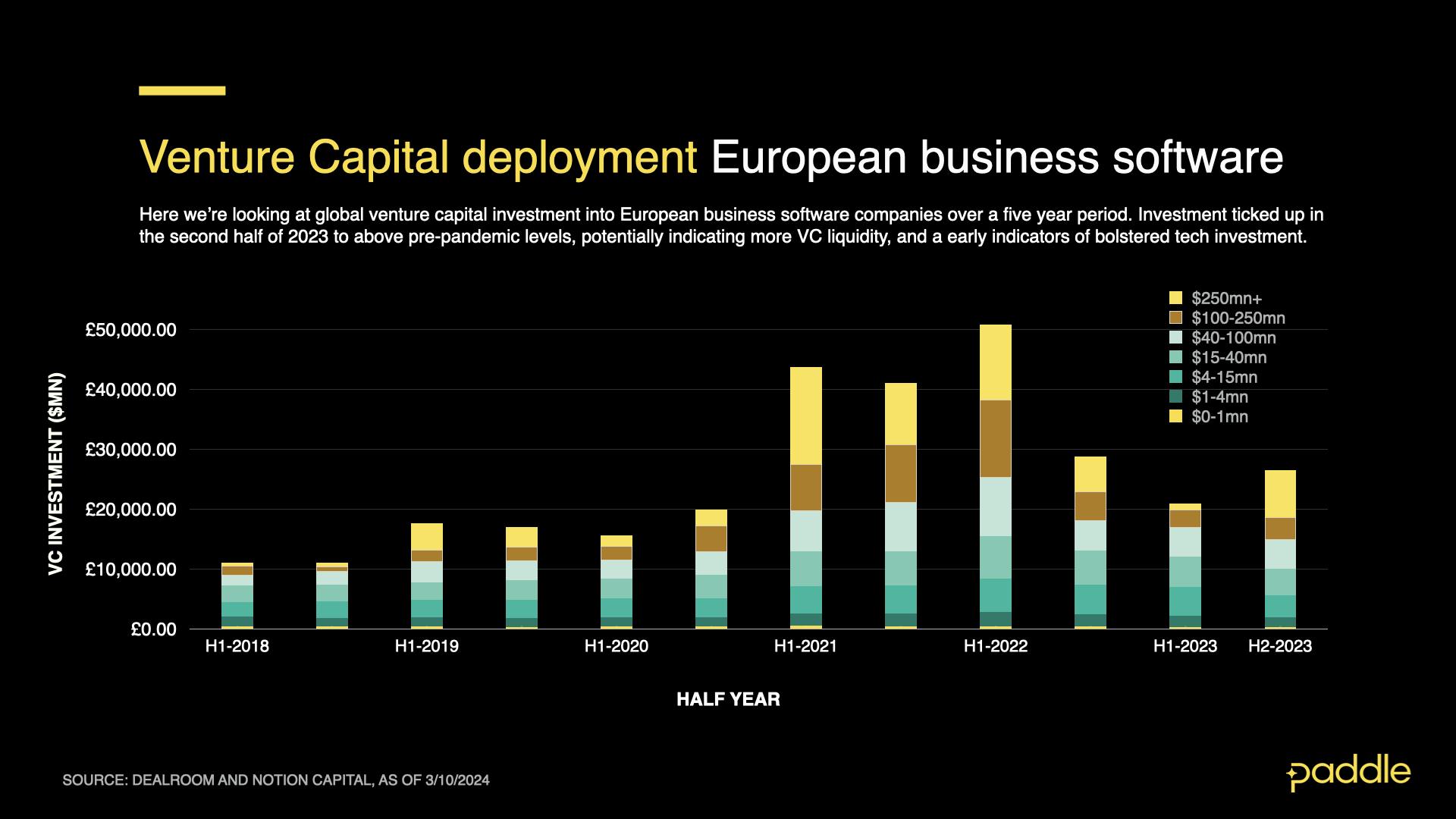

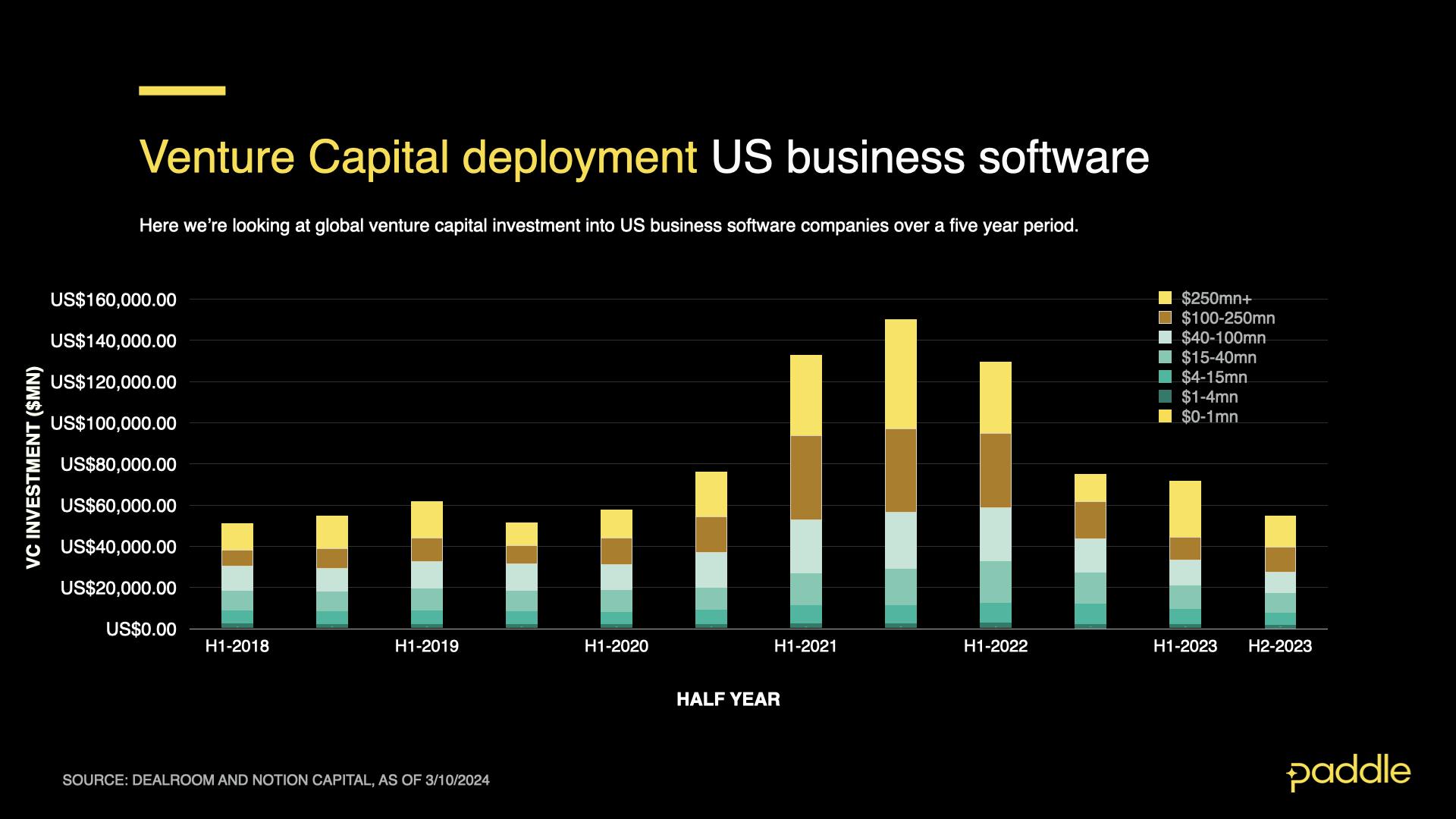

Here we’re looking at global venture capital investment into business software in Europe and in the United States over a five-year period.

In Europe, investment ticked up in the second half of 2023 to above pre-pandemic levels, potentially indicating more VC liquidity and an early indicator of bolstered tech investment.

The US hasn’t quite seen a rebound just yet but it looks likely that the Fed will begin cutting interest rates in the second half of the year which will likely bring more capital into the market.

Where you should focus

Double down on retention

If you think of your customer pool as a bucket and your churn as holes in the bucket, if you’re not careful, you will be left with a leaky bucket where no amount of new sales can fill it up to the top.

Reducing and recovering failed payments

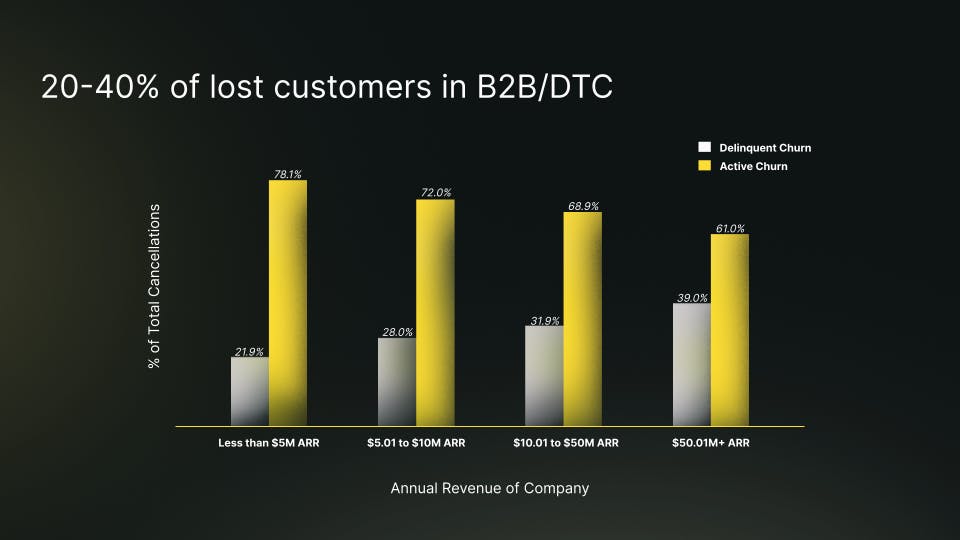

Our data shows that 20 - 40% of users churn, not because they want to, but because they forgot to renew their card details or the card payment failed (and was never tried again). This is called involuntary churn.

Fixing involuntary churn is the first step to fixing your leaky bucket. The first and most obvious solution is to minimize payment failure. This typically includes a comprehensive payment routing infrastructure using multiple payment service providers and having various merchant accounts around the world to process payments. Another way to reduce involuntary churn is by retrying failed card payments at different times of the month. There are many off-the-shelf, automated services that do this, and Paddle’s Retain is one of them.

Minimizing cancellations

When it comes to voluntary churn, where customers actively choose to cancel their subscriptions, we see many companies either make it too easy or too difficult to cancel. Rarely do we see companies offer alternatives to canceling, such as downgrading to a cheaper plan or simply pausing the subscription for some time.

From our data, we know that a well-thought-out cancellation flow that offers additional customer support and/or alternative options for canceling a subscription can reduce cancellations by 10 - 25%. Companies that see the biggest reduction in churn with well-crafted cancellation flows are the ones with subscription plans below $100 per month.