By subscribing you agree to receive the Paddle newsletter. Unsubscribe at any time.

Reflecting on the first quarter of 2024, we’ve noticed signs of improved health in SaaS. Whether the market is going through a recalibration or reconciliation, this past quarter offers us a glimpse into what the new normal will look like for SaaS.

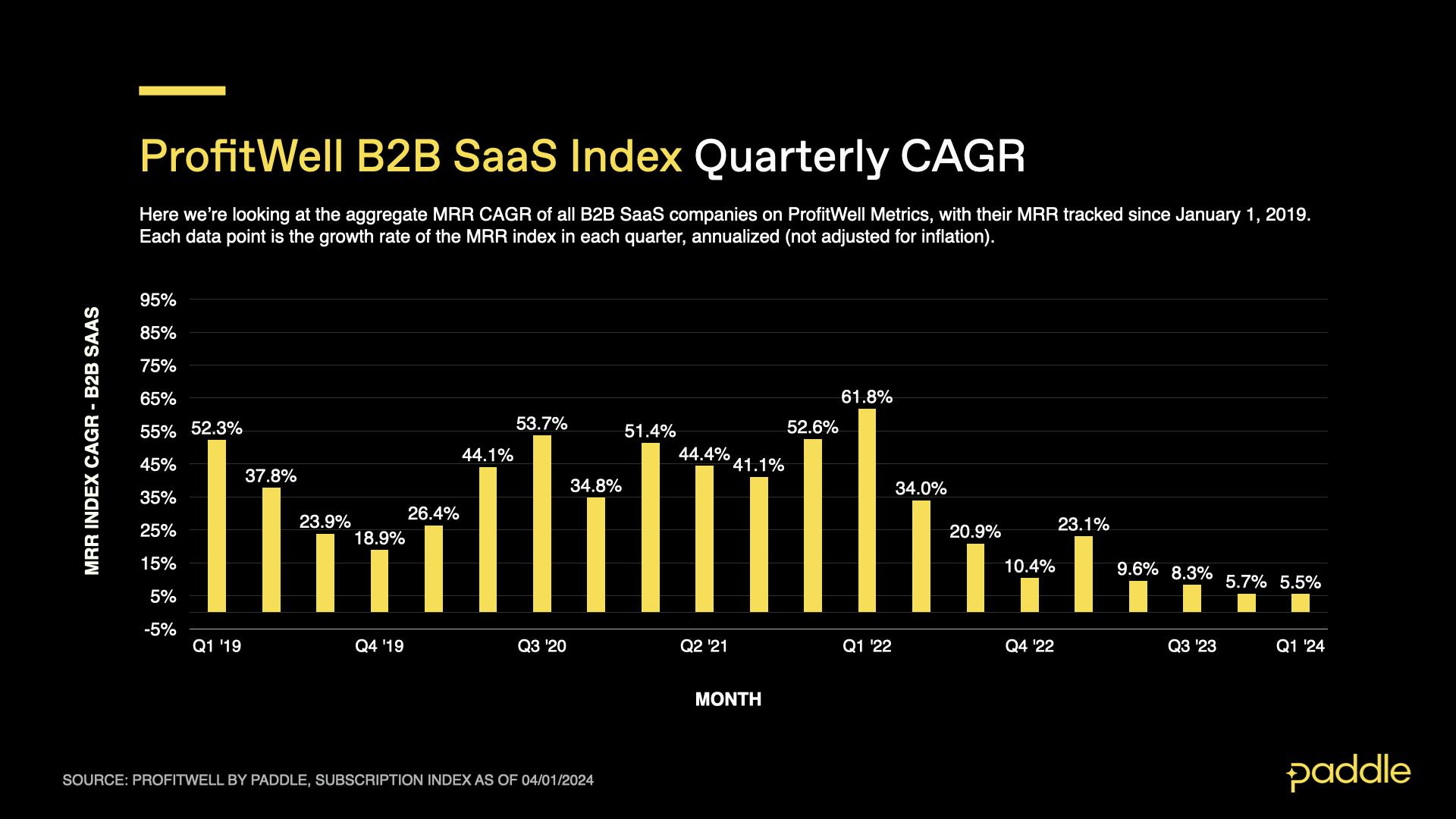

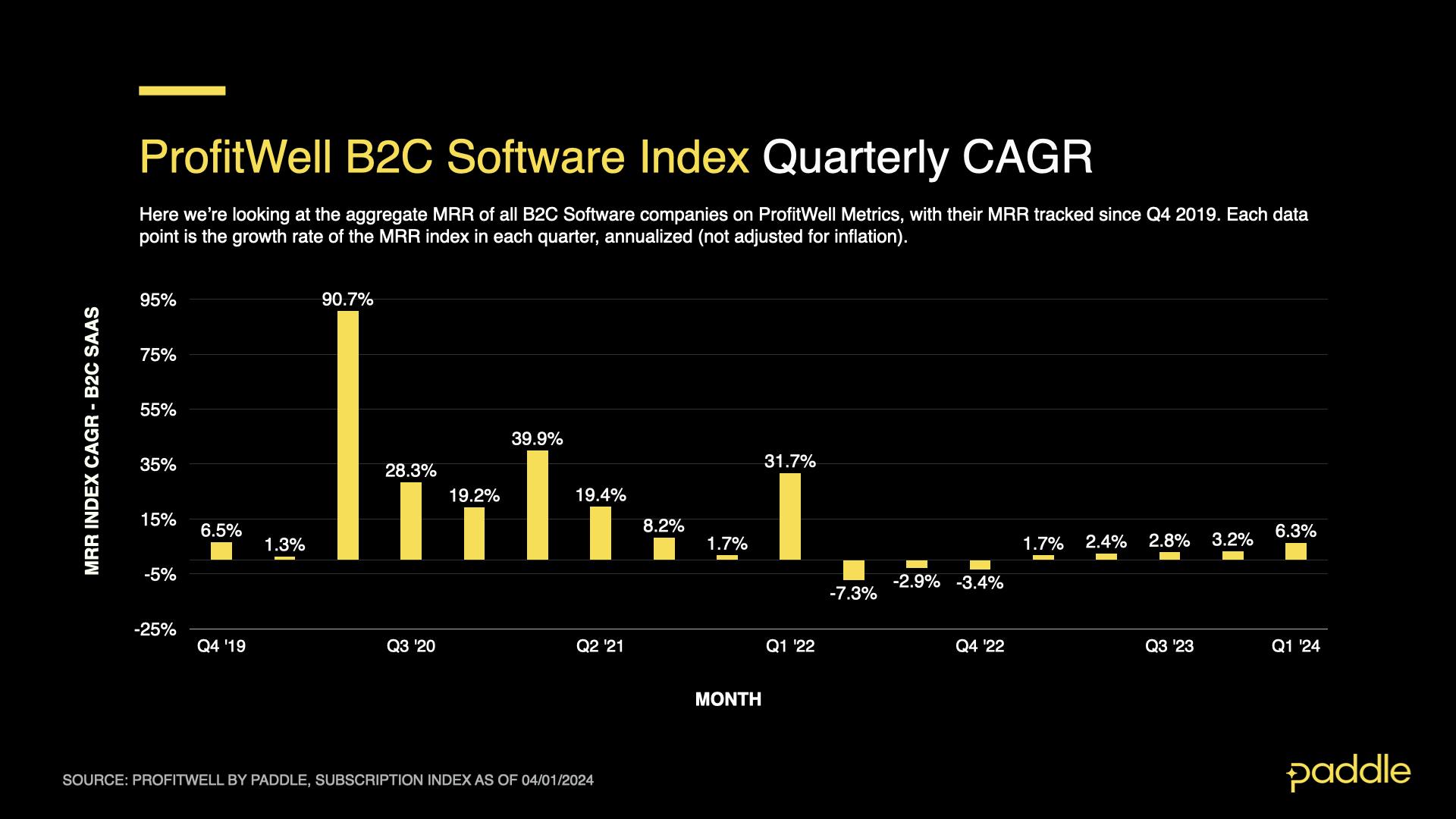

Quarterly growth for B2B came in at 5.5%, while B2C grew 6.1% marking its best quarter since Q1 2022.

The end of Q1 saw a combination of positive indicators, with upticks in sales, reduced churn rates, and notable shifts towards upgrades and downgrades to keep customers longer.

These underscore a concerted effort within the B2B sphere to fortify relationships and continue to deliver value to existing customers.

Meanwhile, on the B2C front, a resurgence in growth is evident, bolstered by increased sales activity.

This is the latest in our ongoing SaaS Market Reports, which track the movement of the ProfitWell Subscription Index, and its underlying growth and retention trends. This month, we examine March 2024 and Q1 2024 performance.

KP and Gavin discuss this month's data. Scroll down to read the full report.

Growth slows for B2B but we’re entering a new normal

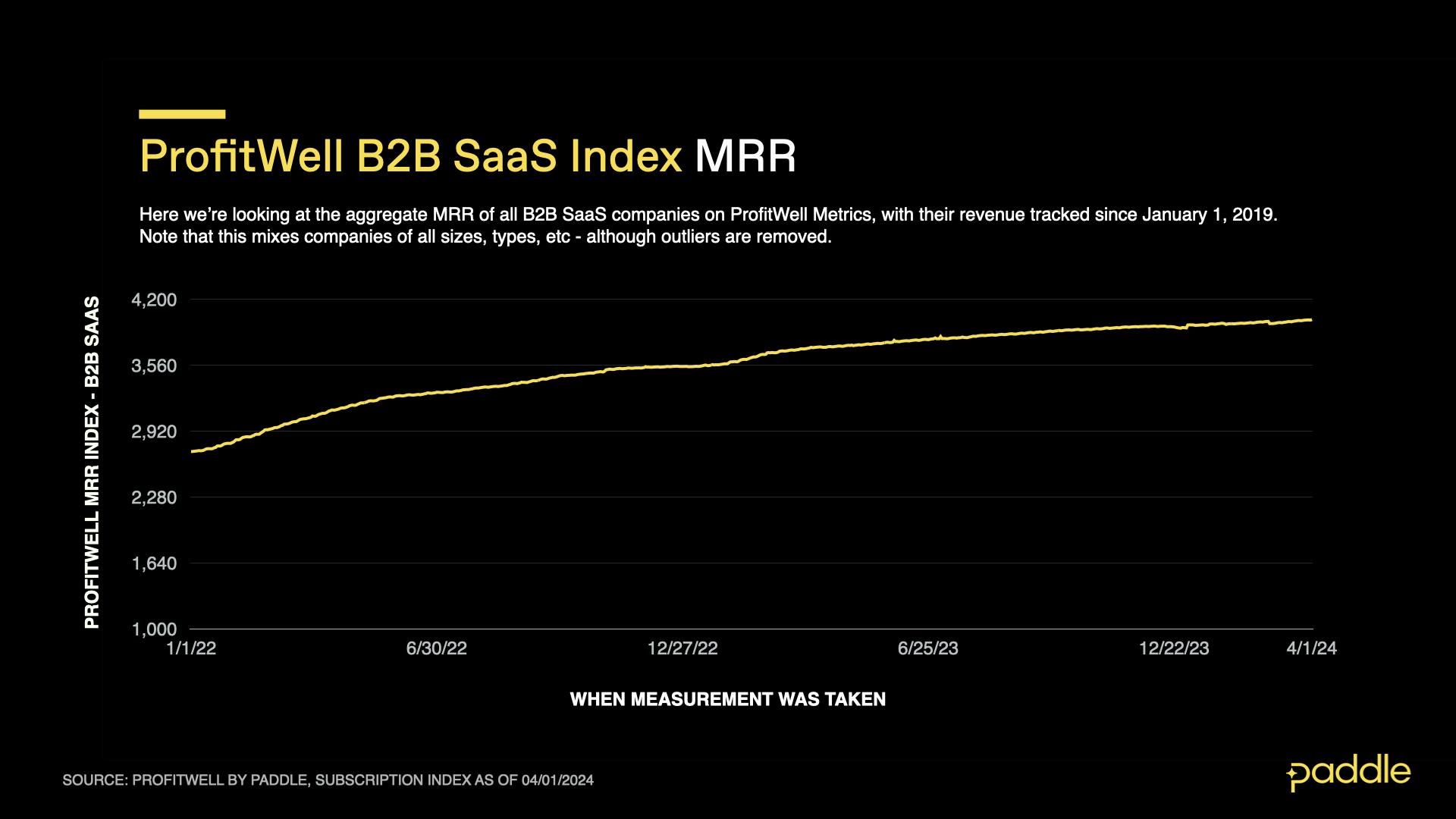

The ProfitWell B2B SaaS Index tracks the cumulative monthly recurring revenue (MRR) from a sample of the 34,000+ companies on ProfitWell Metrics. By measuring the revenue performance of this cross-section of companies over time, we can objectively observe how quickly the sector is growing (or not). The index does not adjust for inflation.

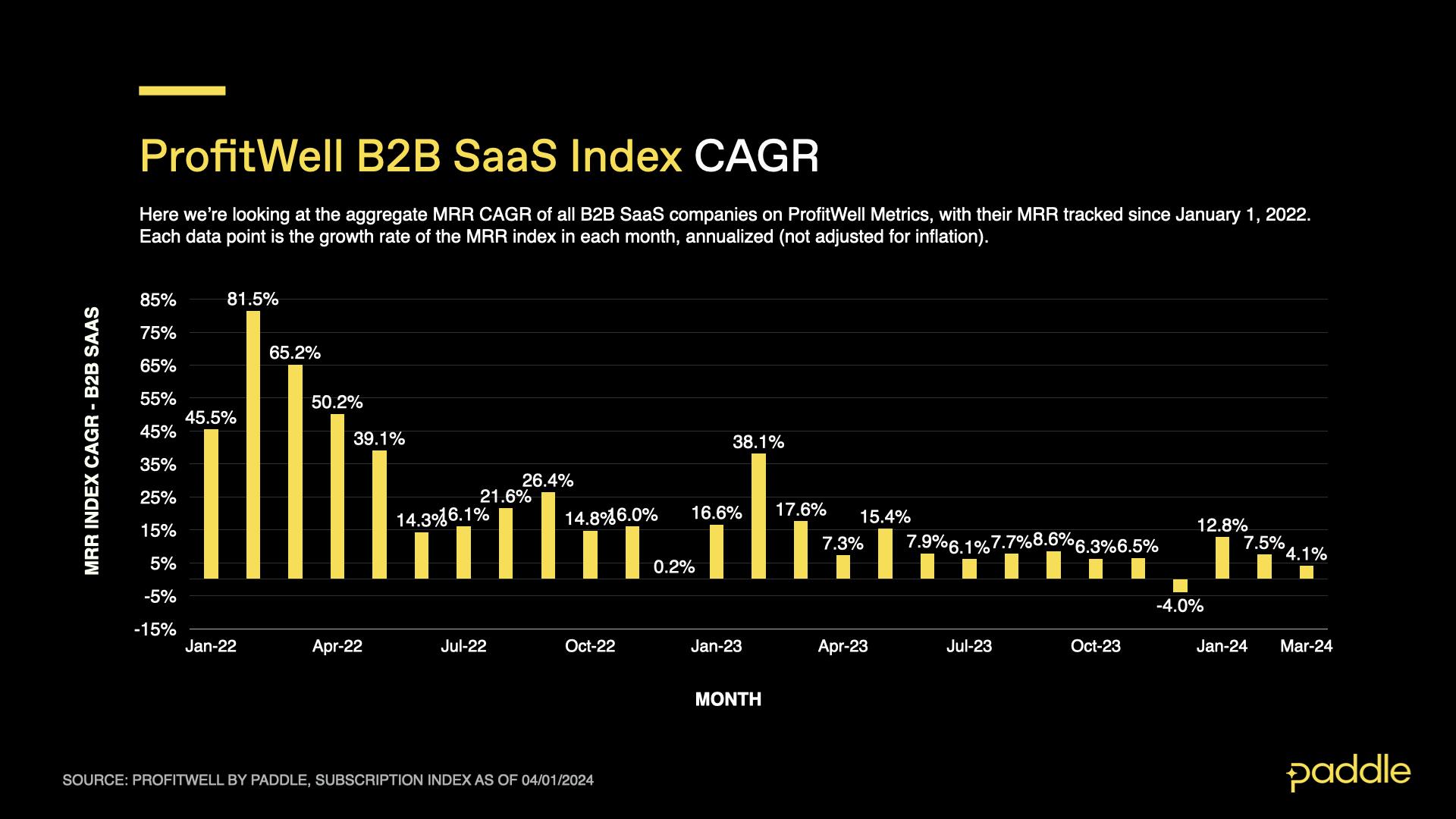

Headline MRR for B2B grew at an annualized growth rate of 5.5% in Q1. This was the slowest quarterly growth we’ve recorded. But rather than be a cause for concern, we see this more as a normalization and recalibration of where growth will be for the immediate future.

As we’ll explain below, B2B companies have focused on reining in high levels of churn as retention and expansion have become so much more important in a low-growth environment.

For March, MRR CAGR was up 4.1% which still shows positive market movement, albeit slower than January and February.

March’s growth came from an encouraging combination of sales heading up, churn going down, and, interestingly, an uptick in both upgrades and downgrades. This latter point is a strong sign that companies are moving customers to different tiers or plans to keep them from churning.

B2B sales have improved from December’s low point

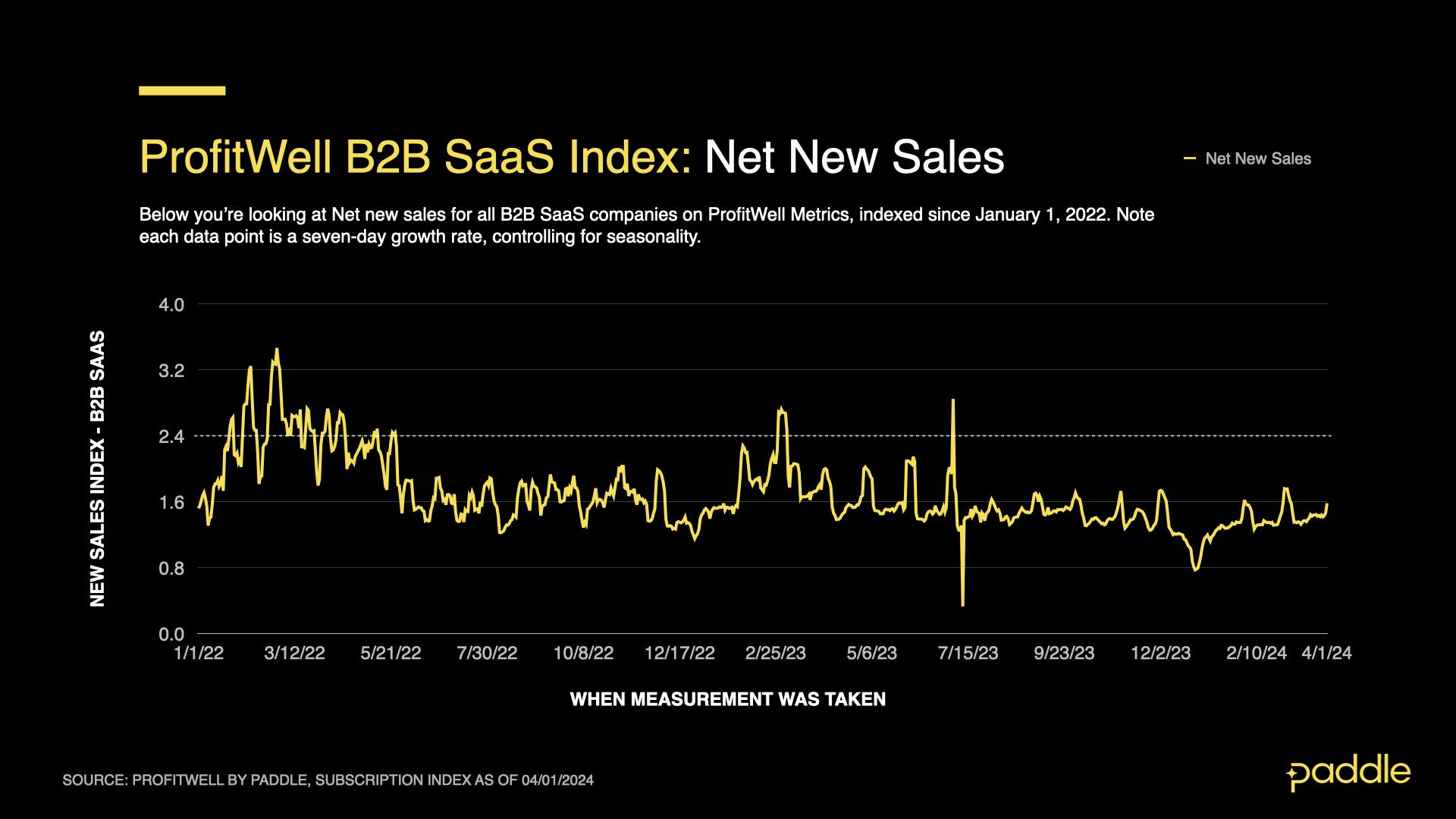

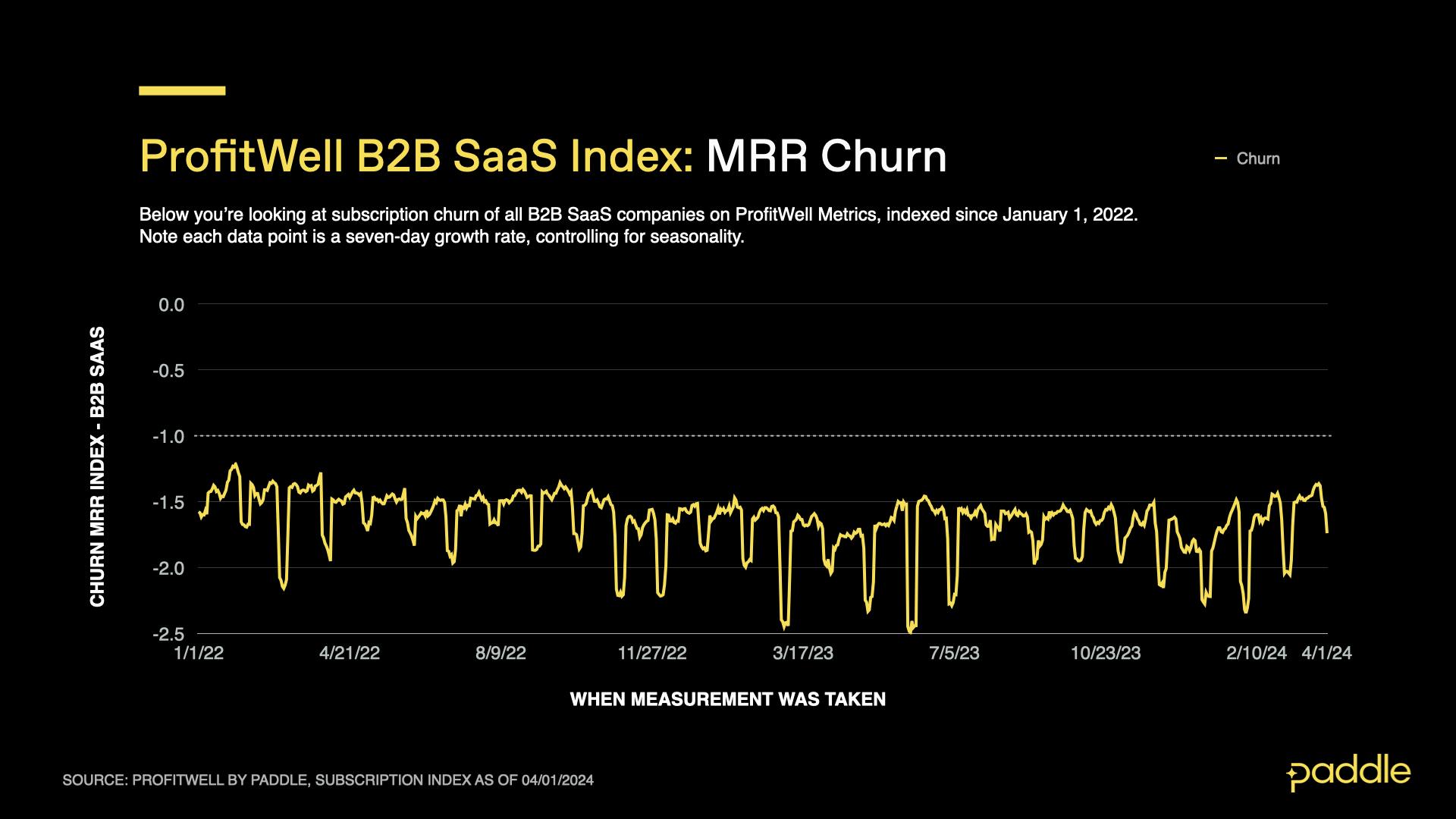

For the ProfitWell B2B SaaS Sales Index, a 1.00 reading represents sales on an “average” day in 2019, while a 1.10 reading would be 10% higher sales. The ProfitWell B2B SaaS Churn Index is calculated similarly, but will be negative, with -1.00 being an “average” 2019 figure).

Because these indices are seven-day averages, they should be read as directional indicators, not direct inputs into the main SaaS index.

New sales for March ended at an average of 1.46, up 4% from February and up 20% from December 2023 when they hit a 2-year low.

If we look at a quarterly view of new sales, the averages are still down on the last few high-growth years (namely 2021 and 2022) but are up on pre-pandemic performance. This is further evidence we see that the market is settling on a lower level, especially for new sales.

Churn falls to an 18-month low

At a monthly view, churn in March averaged -1.59, down 12% from a year ago and the lowest figure since October 2022, 18 months ago.

Churn hit an all-time high of -1.85 in December but has improved 14% since then. Again this points to companies actively combatting churn and looking to drive more revenue from their existing customer base which is significantly cheaper.

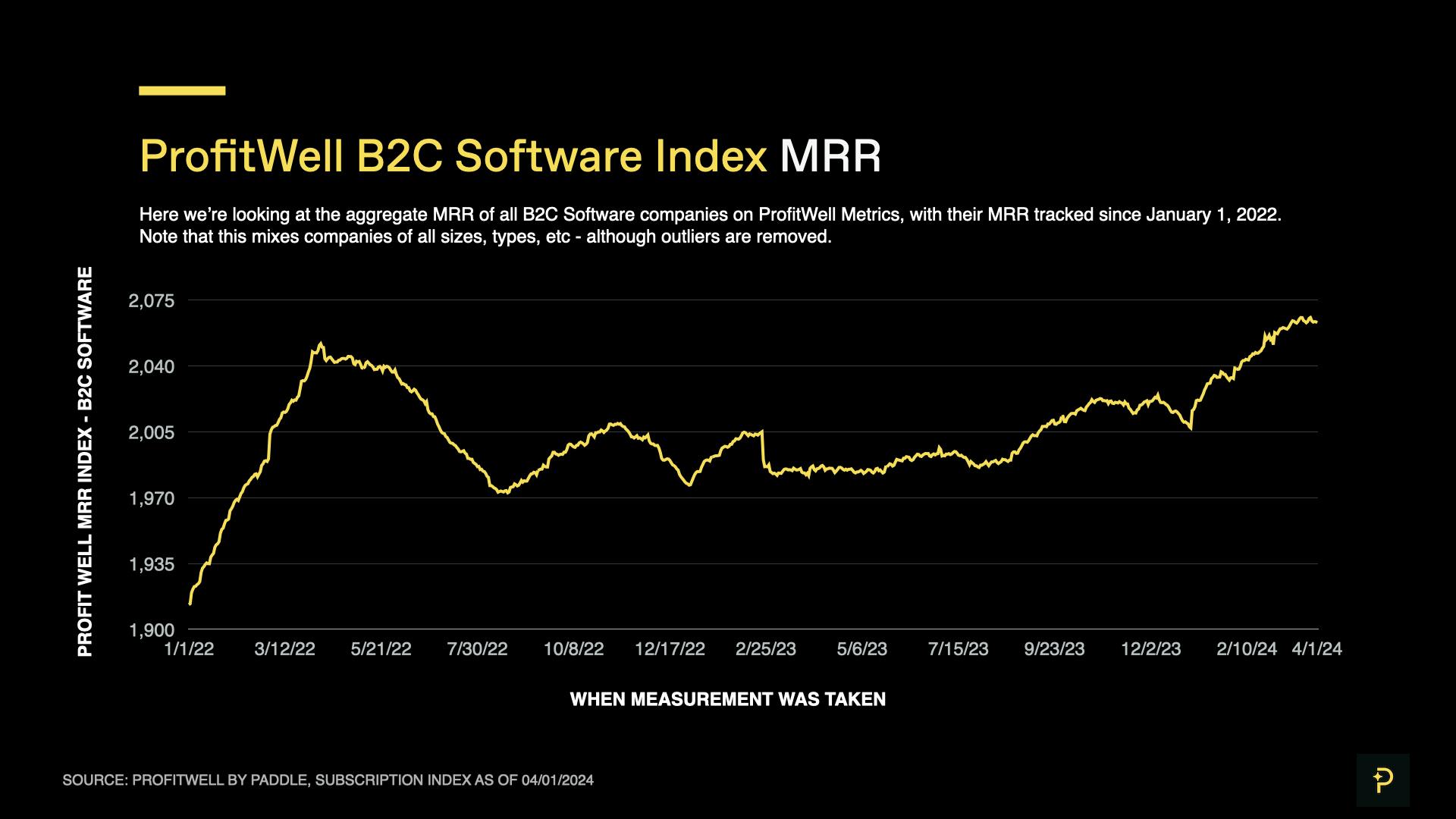

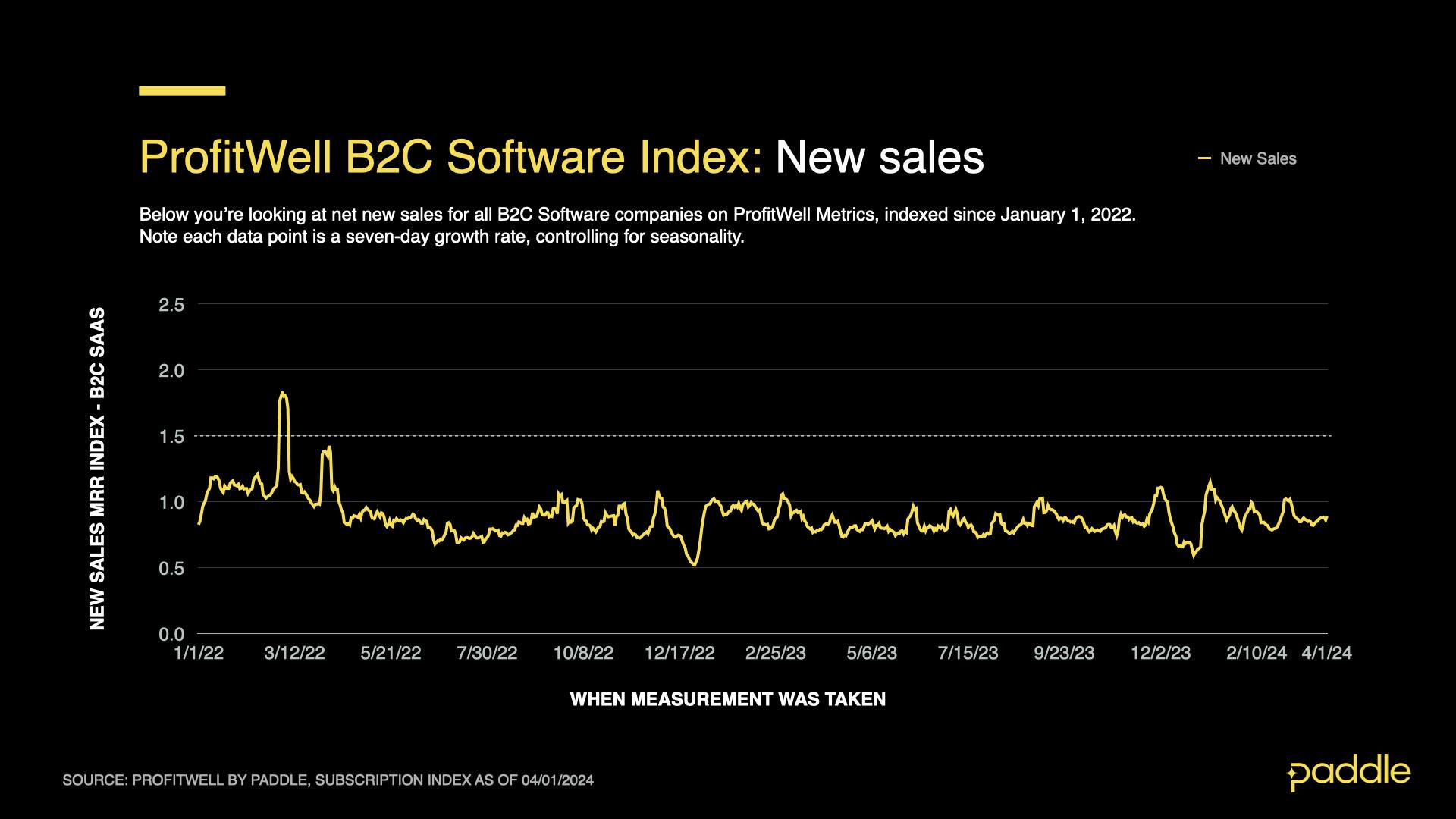

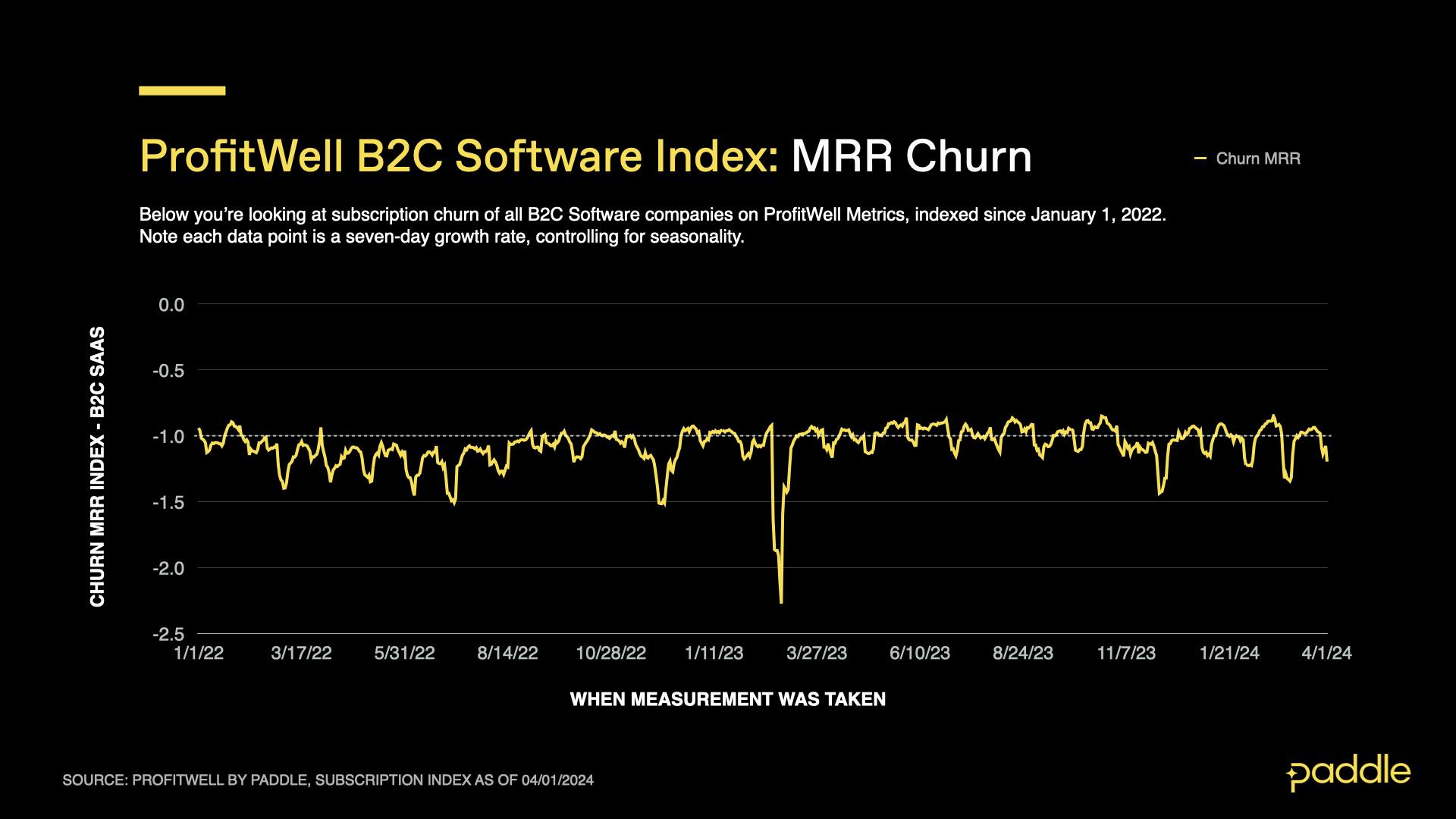

B2C has its best quarter since Q1 2022

Looking at B2C, CAGR performance for Q1 2024 ended at 6.3%, over double the growth seen in the previous quarter and the best quarterly performance since Q1 2022.

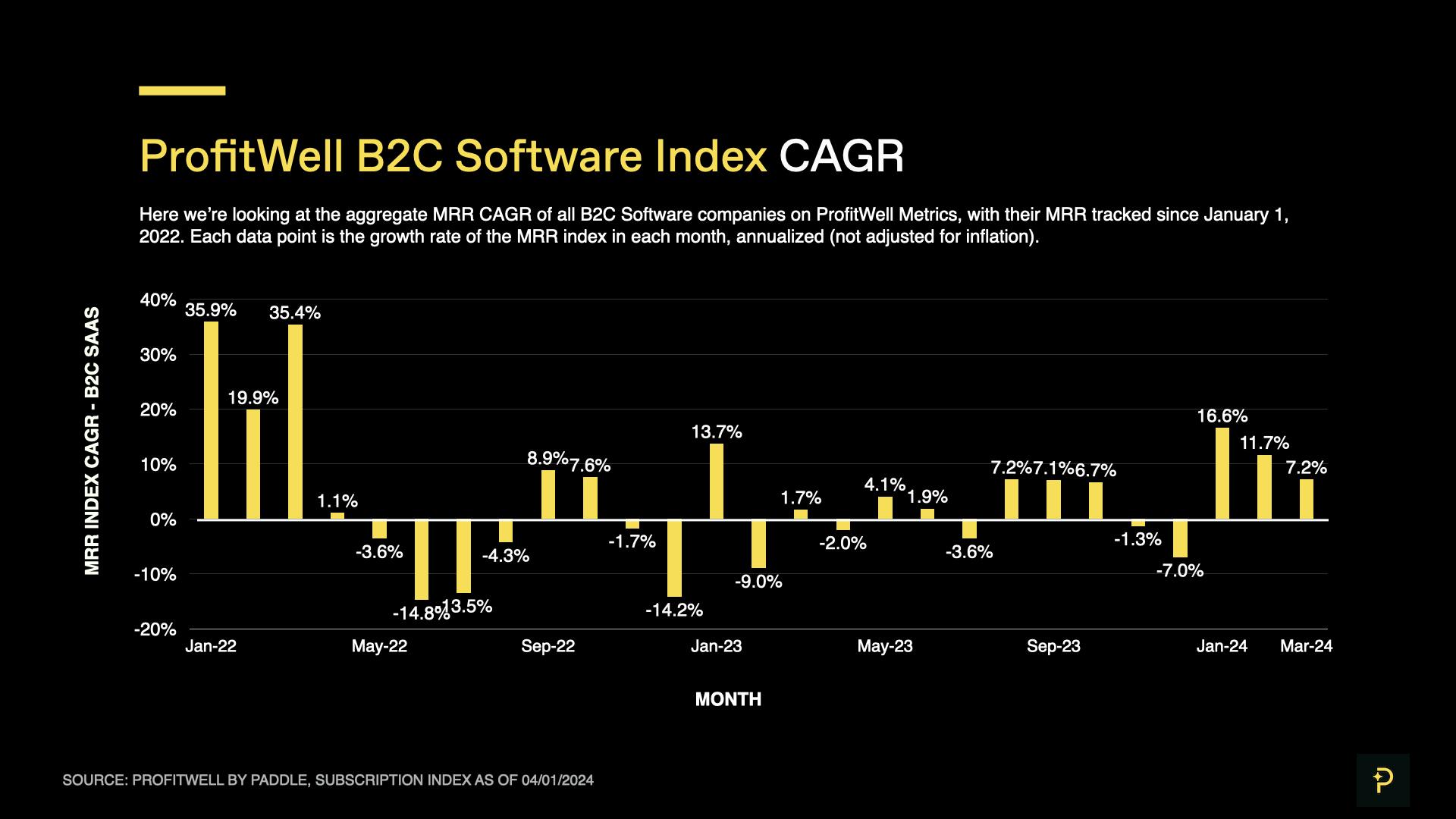

There has been a consistent uptick in new sales activity in the B2C market since the end of 2023 which has contributed to this, alongside February’s spike in upgrades.

The monthly CAGR was 7.2% in March 2024, signaling slower growth than in January and February. However, this was a substantial improvement from March 2023 when growth was just 1.7%.

New sales were up 2.7% from last month and 0.7% higher than this time last year.

However, churn also went up by 5.8% this month, but remained 6.3% lower than this time last year.

This month, we also saw expansion revenue tactics take a hit, with upgrades down by 4.9% while downgrades surged up 27.9%.

With lower barriers to switching, the B2C market can change much faster than B2B so it's important to understand the needs of your customer base (which is likely diverse). From here you can hone in on customer engagement to drive a more personalized and proactive approach to support expansion revenue.

Pricing sensitivity could also be at play here so demonstrating value and ensuring your price point is correct for the regions and types of customers you serve is crucial.

Strategies to consider

Balancing PLG and SLG makes a lot of sense right now

We're in a more difficult selling environment today than we were two to three years ago and balancing PLG with SLG has become a critical SaaS GTM approach. The greater market focus on retention and long-term customer success has made it an obvious answer to try and merge these two sales motions effectively. Very few companies will be able to truly scale by relying solely on one or the other.

For those who started out as a PLG offering, layering on a sales motion means product teams can provide sales with product usage data to bring on target accounts at an enterprise level and win long-term customers.

For those who have a largely SLG motion, opening your product up with PLG widens your TAM and also forces you to create a product experience that sells itself. More people using the product drives greater adoption and more opportunities to bring in a salesperson at the right time on the right account.

When you successfully merge these two motions, you have a more efficient overall sales function where expansion and retention are built-in.

**Our SaaS pricing experts, Sanji, Nika and Evan shared their insights on how companies can approach this and do it effectively in this recent webinar. **

Experiment with new channels to unlock growth opportunities

To continue growing, companies need to find ways to increase efficiency while decreasing costs. A growing trend in the mobile app space has been to drive customers to complete purchases outside of the app stores.

In the last few months, we’ve seen a sharp increase in app sellers working with Paddle to build out and sell products through their own web stores to reduce the high fees incurred for each transaction; whether purchasing off the app store or through an in-app purchase.

Selling through web stores also allows these companies to reach a bigger audience and collect valuable user information that sellers don’t normally get through the app stores. It affords sellers more control over their sales and marketing experience too.

Andrey Shahktin of FunnelFox, Vitaly Davydov of Adapty, and Ollie Julien of Paddle discuss the benefits of selling mobile apps on the web and how to get started.

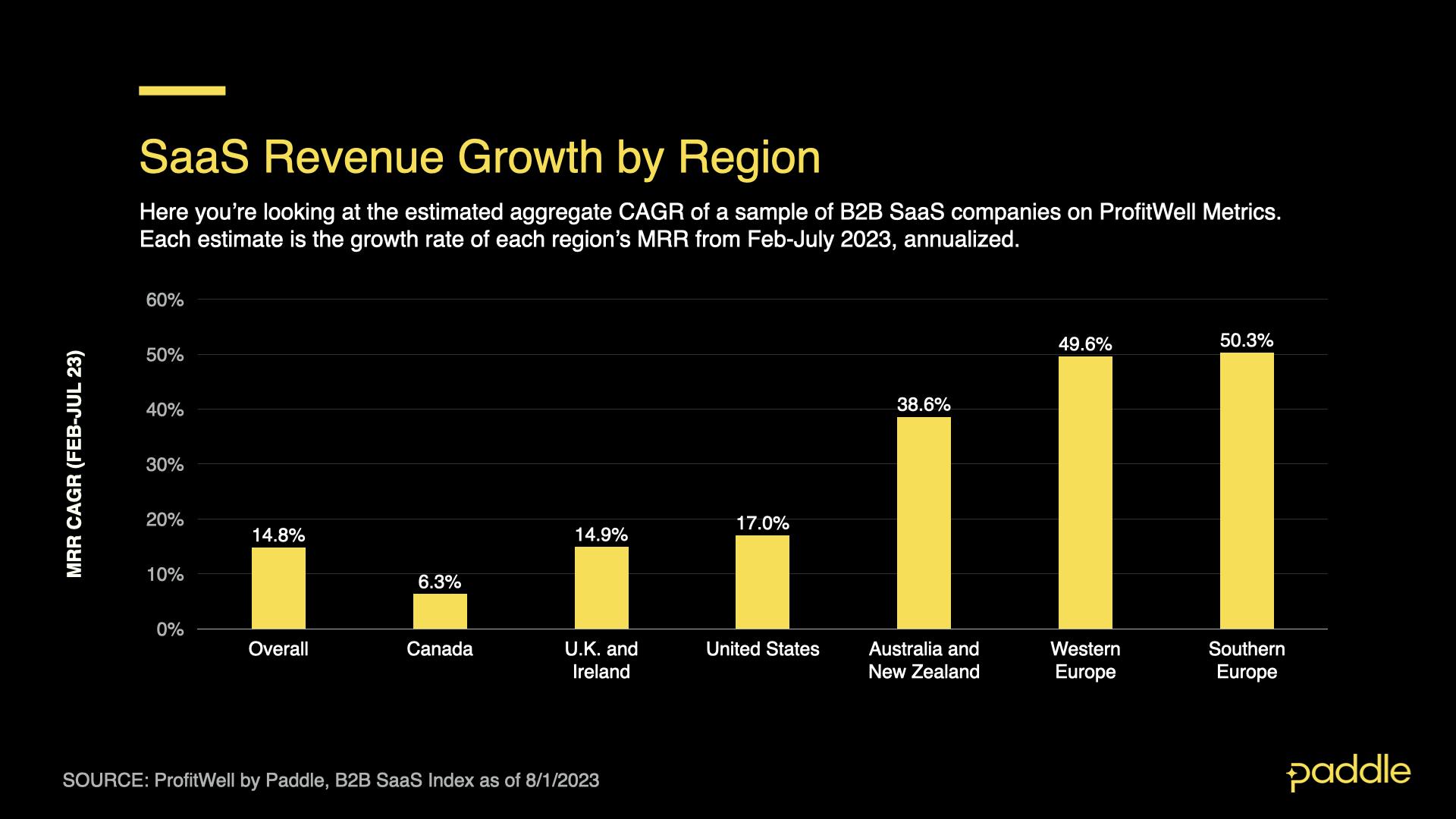

A continuing theme in our reports has been the need to explore different levers to drive growth and one strategy that isn’t going away anytime soon is the opportunity of going global.

While growth has slowed in the traditional major markets of The US and Canada, and the UK, we’re actually seeing markets in Europe, Australia, and New Zealand continue to grow significantly.

But conquering international markets doesn’t just happen overnight. Companies often jump into a new market without properly preparing their product and their team to succeed.

**Here are some helpful resources for SaaS companies looking to drive revenue growth globally: **

- Elena Verna’s proven strategies to unlock international SaaS growth - SaaS growth expert, Elena Verna, and Paddle CMO, Andrew Davies share the top tips to achieve your international SaaS expansion ambitions.

- Born Global is a new series that delves into the personal and professional journeys of SaaS entrepreneurs from around the world. These stories uncover the challenges and triumphs of starting and growing a business, including hurdles like payments, compliance, tax, pricing, retention, metrics, costs, and growth... you get the idea.

We publish monthly reports on the ProfitWell Subscription Index to show you where the market is headed — and help you form strategies to respond. All backed by data from the 34,000+ companies on ProfitWell Metrics.

Missed our previous market reports? You can find them here

Subscribe below to be the first to receive the next SaaS Market Report.