並非每一家新創公司的倒閉都像 FTX 或 Theranos 那樣引人注目。它們並非都如此燃燒明亮,爆炸如此壯觀。往往情況並非如此,不會有高調的法庭案件和坐牢的情況。Amanda Seyfried 不會在 Hulu 的電影中飾演你。

大多數初創公司失敗的故事並不那麼令人振奮。時機不對,資金枯竭,資金用盡。最近,許多宏觀經濟因素也開始發揮作用。過去幾年對初創公司來說尤其艱難。根據最近的PitchBook調查,「約有3200家美國私人風險投資支持的公司今年倒閉。」

這些公司總共籌集了超過270億美元。更明顯的是,這個數字還不包括在上市後失敗或找到買家的公司。畢竟,這樣的公司真的很難被稱為「新創企業」。

值得一提的是,“失敗”是主觀的。破產算是失敗嗎?這對於公司的健康狀況肯定不是一個好兆頭,但許多公司都設法在某種程度上東山再起。這個特定問題一直是舊的TechCrunch虛擬茶水間討論的話題。

為了一篇名為“我們失去的新創公司”的文章,我選擇將清單限制在那些——據我們所知——已經走到了無法回頭的地步的新創公司。已經完蛋了。渴望著峽灣。

當最後的日子從日曆上消失時,讓我們花一點時間來紀念一些沒有成功的新創公司。

編織

成立於2019年 $1000萬籌集

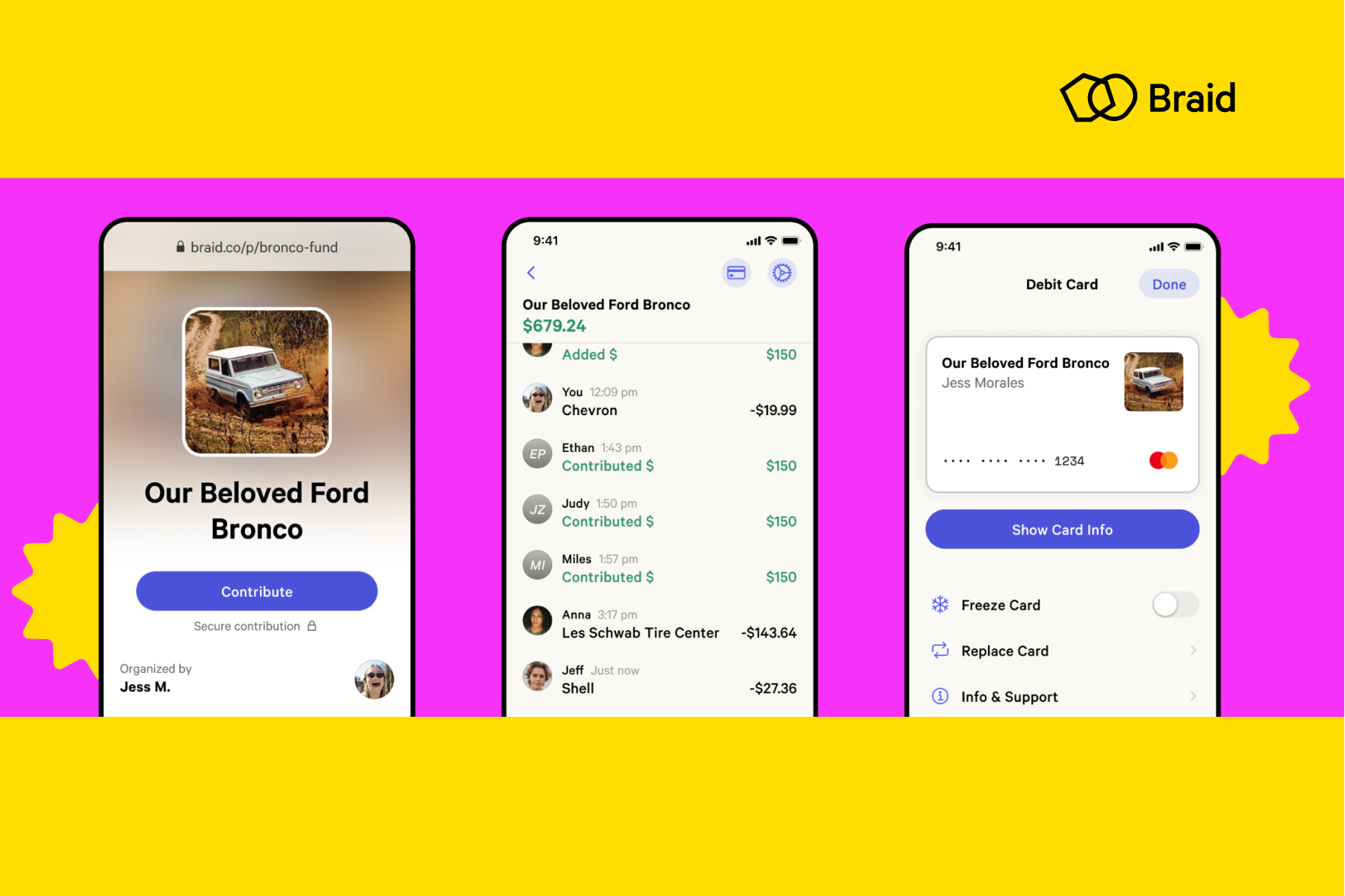

圖片來源: Braid

去年十月,Braid,一家成立四年的初創公司,旨在使共享錢包在消費者中更普及,宣布已經關閉。Braid成立於2019年1月,由阿曼達·佩頓和托德·伯曼(後於2020年離開)創立,總部位於舊金山的Braid致力於為朋友和家人提供一個受聯邦存款保險公司保障的多用戶帳戶,旨在輕鬆“共同籌集、管理和花費錢”。Braid從Index Ventures、Accel和其他投資者“多輪次”籌集了總共1000萬美元的資金。

這次結束令人耳目一新的是佩頓對於導致Braid衰亡的坦誠。在 一篇部落格文章 中,佩頓表示Braid在九月關閉了大門,並概述了她在創建公司的過程中的經歷——和錯誤——最終意識到這不會是一個可行的商業冒險。估計有91%的初創公司失敗。如果更多的創始人像佩頓那樣分享他們的經驗,讓其他人能夠從中學習,也許這個數字會下降。

CloudNordic

圖片來源: Convoy