"By far the best book about investing ever written... a sound intellectual framework for making [investment] decisions."

Warren Buffett, Preface (1986): The Intelligent Investor (by Benjamin Graham).

Benjamin Graham recommended three categories of stocks, with seventeen qualitative and quantitative specifications.

These were the highest quality (and costliest) stocks Graham recommended, and were required to have:

1. Not less than $100 million of annual sales. 2-A. Current assets should be at least twice current liabilities. 2-B. Long-term debt should not exceed the net current assets. 3. Some earnings for the common stock in each of the past ten years. 4. Uninterrupted [dividend] payments for at least the past 20 years. 5. A minimum increase of at least one-third in per-share earnings in the past ten years using three-year averages at the beginning and end. 6. Current price should not be more than 15 times average earnings of the past three years. 7. Current price should not be more than 1½ times the book value.

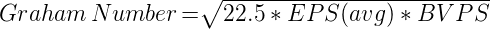

As a rule of thumb we suggest that the product of the multiplier times the ratio of price to book value should not exceed 22.5.

Benjamin Graham, Chapter 14: Stock Selection for the Defensive Investor, The Intelligent Investor.

Graham allowed for individual exceptions to the above, if the portfolio as a whole cleared all criteria. Graham also noted that Utilities were more likely to clear the above; and modified criteria #1, #2-A and #2-B for Utilities and Financials[1].

Graham recommended a minimum portfolio size of 10 for Defensive grade stocks; or in other words, not more than 10% of one's portfolio per Defensive grade stock[2].

Note: Criterion #1 requires adjustment for Inflation and defaults to 500 million on GrahamValue[3].

For more Enterprising (or aggressive) investors, Graham recommended stocks "selling at multipliers under 10" that also had:

1-A. Current assets at least 1½ times current liabilities. 1-B. Debt not more than 110% of net current assets. 2. Earnings stability: No deficit in the last five years covered in the Stock Guide. 3. Dividend record: Some current dividend. 4. Earnings growth: Last year's earnings more than those of 1966.

5. Price: Less than 120% net tangible assets.

Benjamin Graham, Chapter 15: Stock Selection for the Enterprising Investor, The Intelligent Investor.

GrahamValue recommends a minimum portfolio size of 20 for Enterprising grade stocks; or in other words, not more than 5% of one's portfolio per Enterprising grade stock. Graham's own recommendation was closer to 30 and 3.3%, but open-ended[2].

Note: For criterion #4, GrahamValue compares last year's earnings to that of 4 years ago.

Net Current Asset Value is Graham's most well-known category of stocks, but actually included criteria for Earnings and Diversification as well.

[1.] A diversified group of common stocks at a price less than the applicable net current assets alone — after deducting all prior claims, and counting as zero the fixed and other assets.

[2.] Eliminated those which had reported net losses in the last 12-month period.Benjamin Graham, Chapter 15: Stock Selection for the Enterprising Investor, The Intelligent Investor.

Graham recommended a portfolio size of 30 for NCAV grade stocks; or in other words, not more than 3.3% of one's portfolio per NCAV grade stock[2].

Note: Apart from the 2nd criterion above for an EPS (TTM), Graham analyses are done almost exclusively with annual data[6].

Given below is a YouTube Playlist of Video Tutorials, covering both Graham's framework and its application on GrahamValue.

Size of Playlist: 10 Videos

Total Viewing Time: 32 Minutes

Note: The filter calculators required for some of the videos are given in the links in the Footnotes.

GrahamValue's Assessments

GrahamValue applies all of the above Graham criteria to Global Equity Markets, giving the following four results.

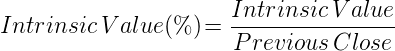

Intrinsic Value is the price corresponding to a stock's Graham Grade. The Intrinsic Value for each Graham Grade is calculated as follows[10]. Intrinsic Values are marked Zero for Ungraded stocks.

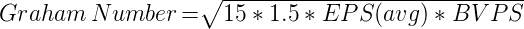

a. Defensive Price (Graham №)

The Intrinsic Value is calculated from the quantitative criteria (#6 and #7) for Defensive investment, and is popularly known as the Graham Number[8].

Note: Graham Numbers on GrahamValue are calculated using the average EPS of the past three years, just as Graham required.

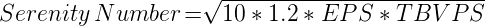

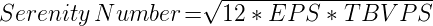

b. Enterprising Price (Serenity №)

Graham's quantitative criteria for Enterprising investment are the lower of 120% of Tangible Book Value Per Share (TBVPS), or a Price-to-Earnings (P/E) ratio of 10. With a derivation similar to the Graham Number, we get the following Intrinsic Value calculation.

Note: This extrapolated derivation is the only deviation that GrahamValue makes from Graham's published principles, and is required for automating Graham's Intrinsic Value adjustment for Interest Rates[4].

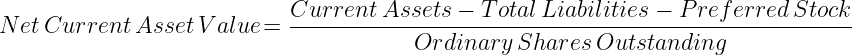

c. NCAV Price (Net-Net)

Graham recommended the applicable Net Current Assets alone, deducting all prior claims and counting as Zero the fixed and other assets. The corresponding Intrinsic Value calculation is popularly known as Net Current Asset Value (NCAV / Net-Net)[9].

Note: GrahamValue deducts Preferred Stock (both Redeemable and Non-Redeemable) in its NCAV calculation.

Intrinsic Value(%) is Intrinsic Value ÷ Previous Close, expressed as a percentage. An Intrinsic Value(%) of 100% or more indicates that the stock's Intrinsic Value exceeds its price.

Graham Grade, Intrinsic Value and Intrinsic Value(%) — in combination — give a complete unadjusted Graham assessment for a stock.

Intrinsic Value(%) measures what Graham defined as the Margin of Safety[11].

Note: Defensive and Enterprising grade stocks require their Intrinsic Value(%) adjusted for current Interest Rates[4].

Each stock is additionally given the following Graham Ratings that can be used for customized filtering and stock selection. The Graham Ratings are defined such that they're better when higher, and that Graham's Defensive requirements default to 100%.

For reference, the minimum ratings required for each Graham Grade are given below.

This list scrolls horizontally on narrow screens.

Graham Rating

Minimum Values

Defensive

Enterprising

NCAV (Net-Net)

Size in Sales (100% ⇒ 500 Million)[3]

100%[5]

N/A

N/A

Current Assets ÷ [2 x Current Liabilities]

100%

75%

N/A

Net Current Assets ÷ Long Term Debt

100%

90%

N/A

Earnings Stability (100% ⇒ 10 Years)

100%

50%

N/A[6]

Dividend Record (100% ⇒ 20 Years)

100%

5%

N/A

Earnings Growth (100% ⇒ 33% Growth)

100%[5][7]

N/A

N/A

Graham Number(%)[8]

100%[4][5]

N/A

N/A

NCAV or Net-Net(%)[9]

N/A

N/A

100%

[2 x Equity] ÷ Debt

100%[1]

N/A

N/A

Size in Assets (100% ⇒ 250 Million)[3]

100%[1][5]

N/A

N/A

Preset Links

The preset links below will open the Advanced Graham Screener with the required Graham Ratings selected.

[1] Substitute rating for Public-Utilities and Financial Enterprises.

[2] See Graham's notes on position sizing across stock grades.

[3] Requires adjustment for Inflation; defaults 500M and 250M.

[4] Requires adjustment for Bond Yields and Interest Rates.

[5] Requires adjustment for non-U.S. Interest Rates and Inflation.

[6] Requires a positive EPS (TTM), the only non-annual figure.

[7] Requires adjustment for Inflation; uses three-year averages.

[8] Graham Number ÷ Previous Close, similar to Intrinsic Value(%).

[9] NCAV Price ÷ Previous Close, similar to Intrinsic Value(%).

[10] GrahamValue does not use the "Benjamin Graham Formula".

[11] Similar to Upside, and measures the Margin of Safety.