- International Speedway Corporation owns and manages NASCAR and IndyCar race tracks.

- Warren Buffett writes that he's been exclusively following Benjamin Graham's Value Investing framework for 57 years.

- ISCA clears nearly all of Graham's criteria for Enterprising investment, his most potentially profitable category.

International Speedway Corporation owns and/or operates 13 of the premier motorsports entertainment facilities in the United States, with more than one million combined grandstand seats. ISCA's website says that it derives approximately 90 percent of its revenues from NASCAR-sanctioned racing events.

Benjamin Graham is known as the "father of value investing". His former student, Warren Buffett, describes him as the second most influential person in his life after his own father.

ISCA handsomely clears all of Graham's qualitative criteria for Enterprising investment — Graham's most potentially profitable strategy — while falling short of the quantitative requirement by a negligible 5.27%.

Enterprising Investment Criteria

Previously, we discussed Graham's investment strategies in How To Build A Complete Benjamin Graham Portfolio.

Graham recommended five investing strategies - Blue Chips, Defensive, Enterprising, NCAV, and Special Situations.

For Enterprising (euphemistic for aggressive) investors, Graham recommended stocks "selling at multipliers under 10" that also had:

1-A. Current assets at least 11⁄2 times current liabilities.1-B. Debt not more than 110% of net current assets.2. Earnings stability: No deficit in the last five years covered in the Stock Guide.3. Dividend record: Some current dividend.4. Earnings growth: Last year's earnings more than those of 1966.

5. Price: Less than 120% net tangible assets.

The above rules are from Chapter 15: Stock Selection for the Enterprising Investor of Graham's magnum opus, The Intelligent Investor.

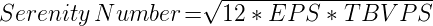

Graham's quantitative criteria for Enterprising investment are the lower of 120% of net tangible assets, or a P/E ratio of 10. With a derivation similar to the Graham Number, we get the following Intrinsic Value calculation.

Given below are ISCA's Sales and Balance Sheet figures.

- Annual Sales: $671.00 Million

- Current Assets: $325.60 Million

- Intangibles: $297.00 Million

- Goodwill: $118.40 Million

- Total Assets: $2,208.20 Million

- Current Liabilities: $85.60 Million

- Long Term Debt: $255.60 Million

- Total Liabilities: $748.30 Million

- Shares Outstanding: 44.70 Million

Note: Graham analyses are done exclusively with annual data.

Per Share Values

Given below are ISCA's TBVPS and EPS values used to calculate its Enterprising Price (Serenity Number).

- Book Value Per Share: $33.04

- Tangible Book Value Per Share: $26.32

- Earnings Per Share / EPS: $2.48

- EPS - 1 Year Ago: $1.66

- EPS - 2 Years Ago: $1.21

- EPS - 3 Years Ago: $1.45

- EPS - 4 Years Ago: $0.97

- EPS - 5 Years Ago: $1.18

- EPS - 6 Years Ago: $1.46

- EPS - 7 Years Ago: $1.13

- EPS - 8 Years Ago: $0.14

- EPS - 9 Years Ago: $2.71

Enterprising Graham investment requires 5 years of uninterrupted positive earnings.

Qualitative Rating

From the above data, we see that ISCA:

- Has nearly 2.5x the Current Ratio required for Enterprising Graham investment.

- Exceeds the Net Current Assets to Long Term Debt ratio requirement by 3.9%.

- Has uninterrupted positive earnings in each of the past ten years, twice that required for Enterprising Graham investment.

- Has uninterrupted dividend payments for the past 20 years, 20x that required for Enterprising Graham investment (data not included here).

Intrinsic Value

Using the above data, we also get an Enterprising Price (Serenity Number) of $27.99 for for ISCA.

But Graham's Intrinsic Value formulas need to be adjusted for current bond yields. This means that we need to multiply the Serenity Number above by 1.41 to arrive at the true Intrinsic Value for ISCA.

Intrinsic Value = $27.99 x 1.41 = $39.47

This is actually very close to ISCA's Previous Close of $41.55, the difference being a mere $2.08 or 5.27%.

It may be helpful to remember that Graham himself wrote:

It would not be illogical for an investor to buy such an issue at a small discount from its indicated or appraisal value, on the theory that it is only a small distance away from a primary classification and that it may acquire such a rating unqualifiedly in the not too distant future.

- Chapter 7, The Intelligent Investor.

Another way to put this would be that considering today's bond yields, Enterprising grade stocks only need an Intrinsic Value of 70% to be considered true Graham stocks.

This is because 1.41-1 = 0.7 or 70%.

At 67.36%, ISCA falls short of that requirement by a whisker. But then, as explained in the Qualitative Rating section, ISCA far exceeds the qualitative criteria that Graham required.

Conclusion

A Reuters report — also verified by CNBC — states that the France family, which controls NASCAR, is working with investment bank Goldman Sachs to identify a potential deal for the company.

International Speedway Corp — which owns 12 of the 23 NASCAR Cup Series tracks — reported a 1.6 percent drop in admissions revenue in 2017, blaming it substantially on NASCAR events. This may possibly explain ISCA's bargain price levels.

In the meantime, ISCA easily clears all of Graham's qualitative criteria for Enterprising investment — his most potentially profitable strategy — while falling short of its calculated Intrinsic Value by a negligible $2.08 or 5.27%.

Please note that no stock ever qualifies alone under Graham's framework. Every stock is always a constituent of a portfolio of similar stocks. International Speedway Corp therefore qualifies for investment as part of a diversified portfolio of value stocks.