The Value Investing framework of Benjamin Graham — Warren Buffett's mentor — uses a combination of the Price-to-Earnings and Price-To-Book ratios, giving more comprehensive insight than either ratio used alone.

The Ratios

Price-to-Earnings (P/E)

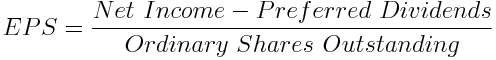

Earnings Per Share (EPS) indicates how much profit the company makes per share.

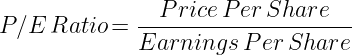

EPS combined with Price gives an idea of the rate of return one can expect on one's investment. EPS and Price are usually measured together as the P/E ratio, or Price-to-Earnings ratio.

Price-To-Book (P/B)

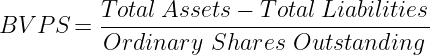

Book Value Per Share (BVPS) is the theoretical liquidation value of the stock. BVPS indicates how much one would be paid per share if the company were to close tomorrow.

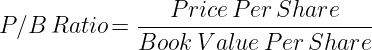

BVPS combined with Price gives a rough idea of the collateral on one's investment. BVPS and Price are usually measured together as the P/B ratio, or Price-to-Book ratio.

Graham Number

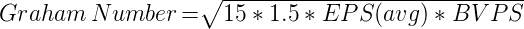

Graham required that a stock for Defensive investment should have:

6. Current price should not be more than 15 times average earnings of the past three years. 7. Current price should not be more than 1½ times the book value last reported.

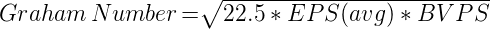

As a rule of thumb we suggest that the product of the multiplier times the ratio of price to book value should not exceed 22.5.

Benjamin Graham, Chapter 14: Stock Selection for the Defensive Investor, The Intelligent Investor.

These two rules together yield what is known today as the Graham Number. The Intrinsic Value of an Defensive grade stock is therefore its Graham Number.

Note: The "multiplier" Graham refers to is simply another term for the P/E Ratio.

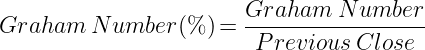

Graham Number(%)

Graham Number(%) is Graham Number ÷ Previous Close.

So a stock with a Graham Number(%) of 200% will have a P/E value of 7.5 and a P/B value of 0.75 — or a higher value in one corresponding to a lower value in the other — yielding a total multiple of 5.625 (22.5 ÷ 2²).

Note: The Graham Number, despite its higher versatility, is part of a framework and not meant to be used in isolation.

Graham Number(%) is thus a combination of the Price-to-Earnings and the Price-To-Book ratios, and yields better results than either ratio used on its own.

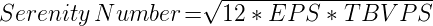

Serenity Number

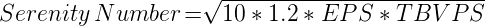

For more Enterprising (or aggressive) investors, Graham recommended:

"issues selling at multipliers under 10... Price: Less than 120% net tangible assets."

Benjamin Graham, Chapter 15: Stock Selection for the Enterprising Investor, The Intelligent Investor.

These rules yield a similar price calculation, referred to on GrahamValue as the Serenity Number.

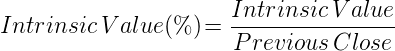

Intrinsic Value(%)

Intrinsic Value(%) is Intrinsic Value ÷ Previous Close.

The Intrinsic Value of an Enterprising grade stock is its Serenity Number.

An Enterprising grade stock with an Intrinsic Value(%) of 200% will have a P/E value of 5 and a P/B (tangible) value of 0.6 — or a higher value in one corresponding to a lower value in the other — yielding a total multiple of 3 (12 ÷ 2²).

Finding Stocks

The below Preset Links will load GrahamValue's two Graham screeners with stocks having Graham Number(%) higher than 200%, and Intrinsic Value(%) higher than 200% (both Defensive and Enterprising), respectively.