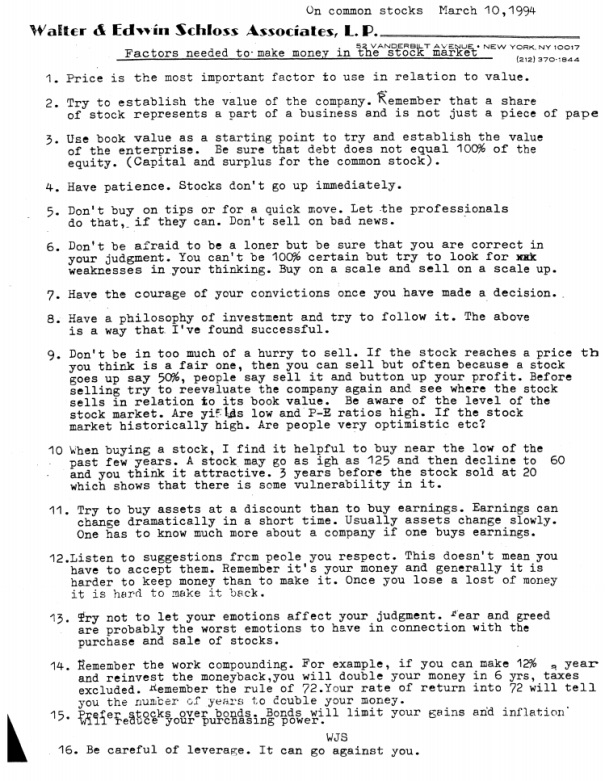

The 16 Factors Needed To Make Money In The Stock Market, by the famed Value Investor and fellow student — alongside Warren Buffett — of Benjamin Graham.

Sixteen Factors

- Price is the most important factor to use in relation to value.

- Try to establish the value of the company. Remember that a share of stock represents a part of a business and is not just a piece of paper.

- Use book value as a starting point to try and establish the value of the enterprise. Be sure that debt does not equal 100% of the equity (capital and surplus for the common stock).

- Have patience. Stocks don't go up immediately.

- Don't buy on tips or for a quick move. Let the professionals do that, if they can. Don't sell on bad news.

- Don't be afraid to be a loner but be sure that you are correct in your judgment. You can't be 100% certain but try to look for weaknesses in your thinking. Buy on a scale [down] and sell on a scale up.

- Have the courage of your convictions once you have made a decision.

- Have a philosophy of investment and try to follow it. The above is a way that I've found successful.

- Don't be in too much of a hurry to sell. If the stock reaches a price that you think is a fair one, then you can sell. But often, because a stock goes up — say 50% — people say sell it and button up your profit. Before selling, try to reevaluate the company again and see where the stock sells in relation to its book value. Be aware of the level of the stock market. Are yields low and P/E ratios high? [Is] the stock market historically high? Are people very optimistic etc?

- When buying a stock, I find it helpful to buy near the low of the past few years. A stock may go as [high] as 125 and then decline to 60 and you think it attractive. Three years before, the stock sold at 20; which shows that there is some vulnerability in it.

- Try to buy assets at a discount than to buy earnings. Earnings can change dramatically in a short time. Usually, assets change slowly. One has to know much more about a company if one buys earnings.

- Listen to suggestions from people you respect. This doesn't mean you have to accept them. Remember, it's your money and generally, it is harder to keep money than to make it. Once you lose a [lot] of money it is hard to make it back.

- Try not to let your emotions affect your judgment. Fear and greed are probably the worst emotions to have in connection with the purchase and sale of stocks.

- Remember the word compounding. For example, if you can make 12% a year and reinvest the money back, you will double your money in six years; taxes excluded. Remember the rule of 72. Your rate of return into 72 will tell you the number of years to double your money.

- Prefer stocks over bonds. Bonds will limit your gains and inflation will reduce your purchasing power.

- Be careful of leverage. It can go against you.

Walter Schloss, Walter & Edwin Schloss Associates, L.P. (1994).

Schloss about Graham

"I took Ben’s course in Advanced Security Analysis at the New York Stock Exchange Institute (New York Institute of Finance)... Many bright Wall Streeters such as Gus Levy of Goldman Sachs, who later became the top arbitrageur in the country, used to take his course. I often wondered how much money people made on Ben’s ideas by transforming them into investments."

Walter J. Schloss, Benjamin Graham and Security Analysis: A Reminiscence (1976) [PDF].

Parallels with Graham

Rule #1 about the importance of price is consistent with what Buffett and Graham too have said. Rule #10 too falls within Graham's definition of pricing, and is thus a valid application of Graham's principles.

In the 2018 Balance of Power interview for Bloomberg Markets, Warren Buffett says yet again:

"The principles [of investing] haven't changed at all... It's exactly what Ben Graham wrote in 1949."

Warren Buffett, Bloomberg Markets: Balance of Power (2018).