April 2024 saw the B2B SaaS market achieve its strongest month in over a year, driven by significant reductions in downgrades and a continued decline in churn.

MRR growth hit 22.6%, a staggering 18.5% jump from March’s growth and the highest monthly growth since February 2023. A significant drop in downgrades helped spur this upswing and while net new sales remained stable, the overall growth paints a cautiously optimistic picture for the sector.

Meanwhile, B2C SaaS enjoyed its first four consecutive months of stable growth in two years, suggesting a new normal post-pandemic.

In this report, we dive into the metrics behind these trends, examine the potential for sustained growth, and explore strategic opportunities for SaaS companies to capitalize on this evolving market.

This is the latest in our ongoing SaaS Market Reports, which track the movement of the ProfitWell Subscription Index, and its underlying growth and retention trends. This month, we examine April 2024 performance.

KP and Gavin discuss this month's data. Scroll down to read the full report.

B2B: More good times… for a bit?

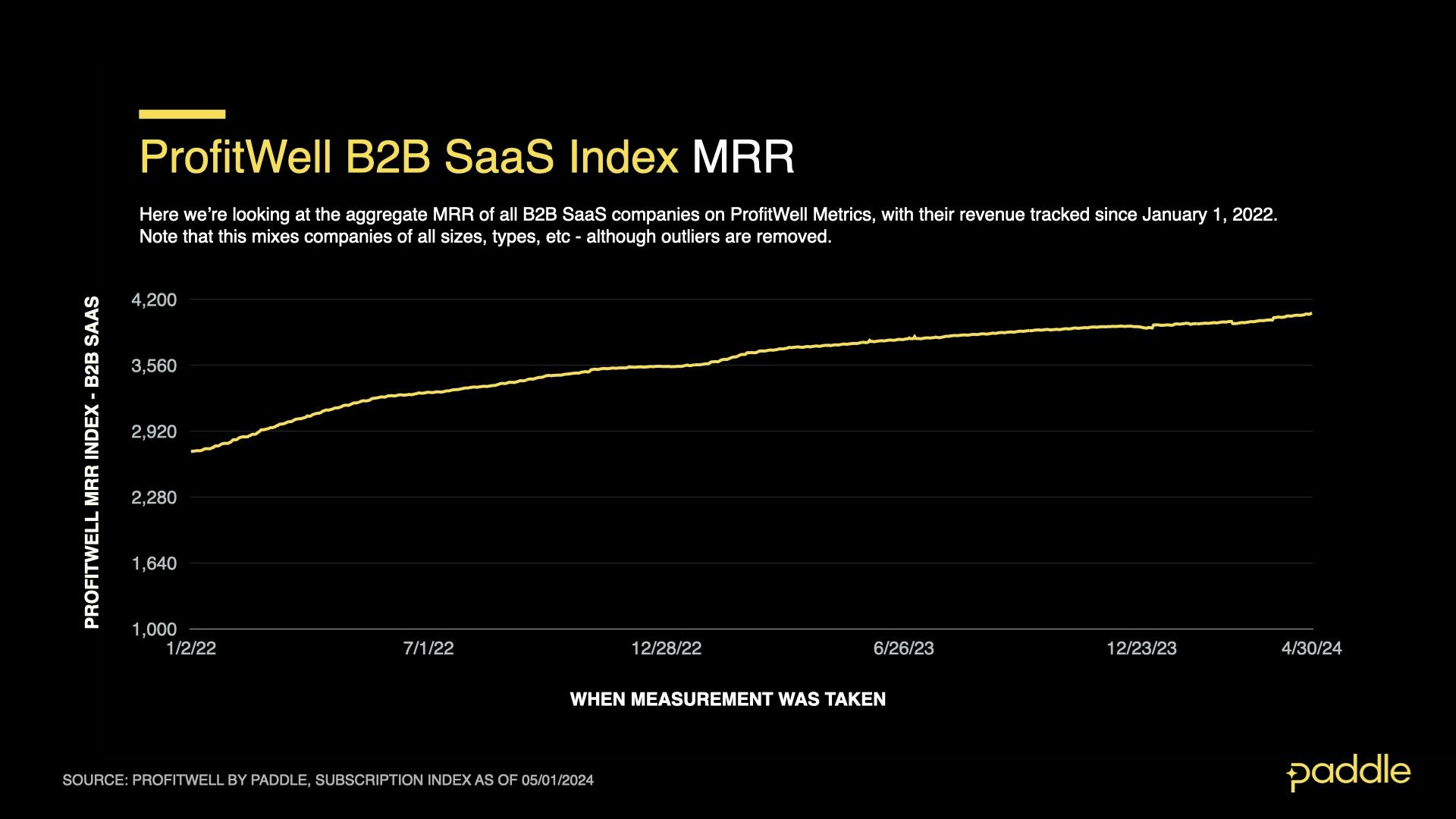

The ProfitWell B2B SaaS Index tracks the cumulative monthly recurring revenue (MRR) from a sample of the 34,000+ companies on ProfitWell Metrics. By measuring the revenue performance of this cross-section of companies over time, we can objectively observe how quickly the sector is growing (or not). The index does not adjust for inflation. Explore the free demo of ProfitWell Metrics here.

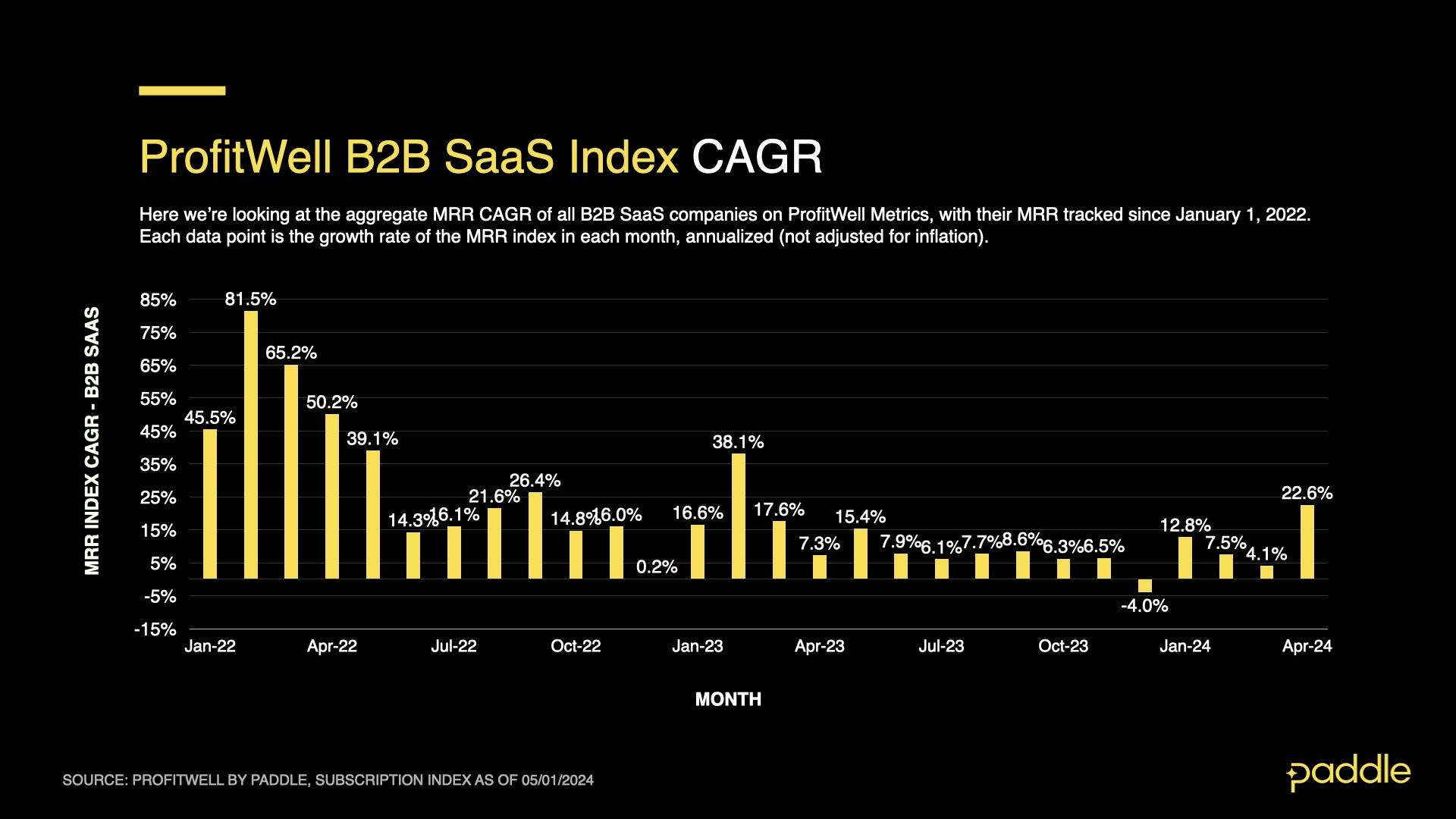

Continuing the B2B SaaS market’s momentum from Q1, this month we saw a big jump in MRR growth. When annualised, April’s MRR growth reached 22.6% CAGR, its highest since February 2023, where it briefly touched 38.1% CAGR.

As mentioned in our last report, our expectation is for the B2B SaaS market to “level out” at a new, more sustainable growth rate. While we still believe this to be the case, April’s data shows we may be in store for a few more months of elevated growth before things level out.

Good news aside, we don’t think this elevated growth will continue. Instead, this month’s growth spike tracks with an annual pattern in our B2B index - slow growth in December, followed by spikes in Q1 of the new year, and then a “leveling out” at a more reasonable growth rate for the rest of the year.

We saw a similar pattern last year, where MRR growth dipped to 0.2% in Dec 2022, spiked to 38.1% in February 2023, then stabilized between 6-8% from June onwards.

New sales are still a challenge

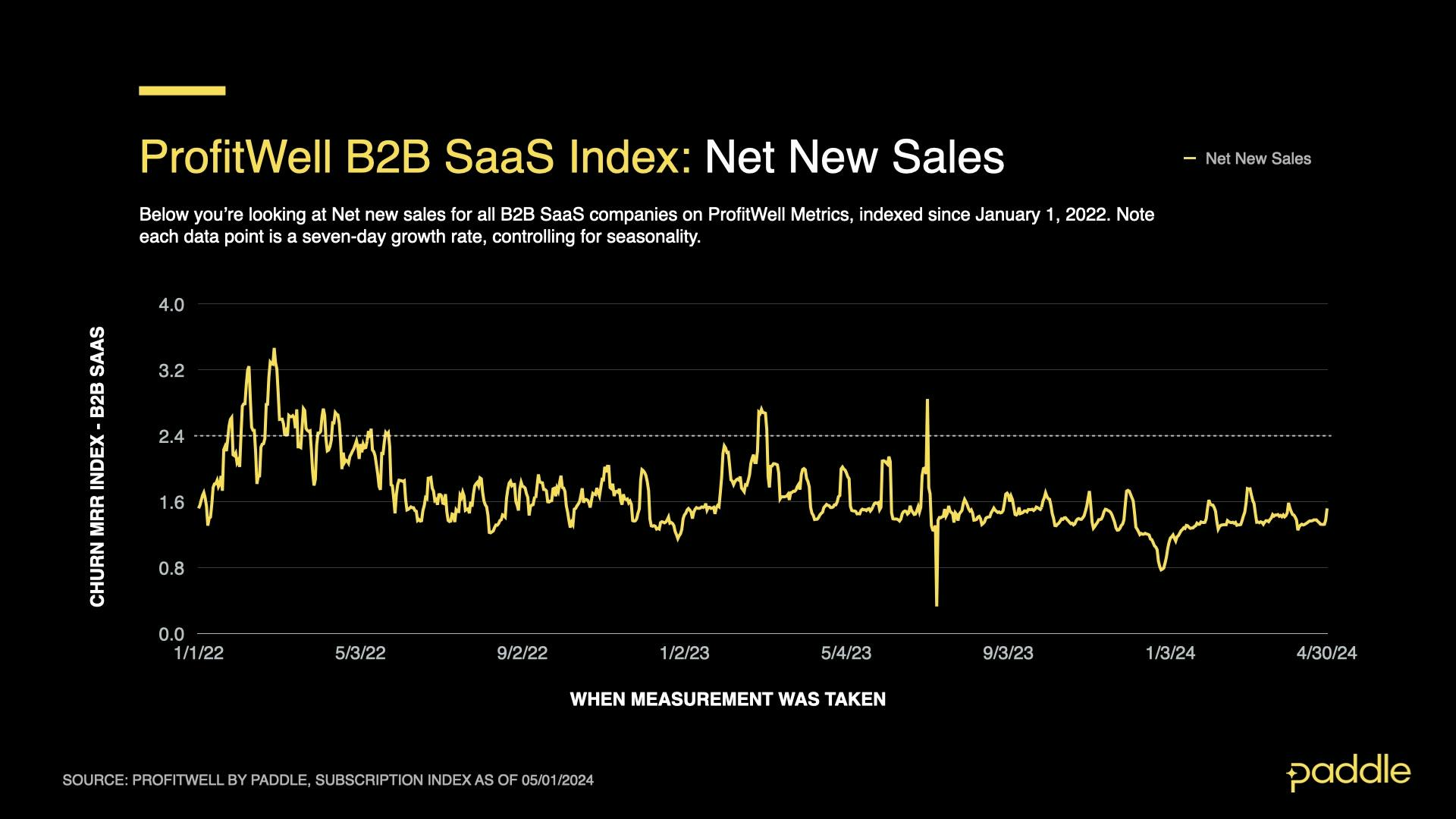

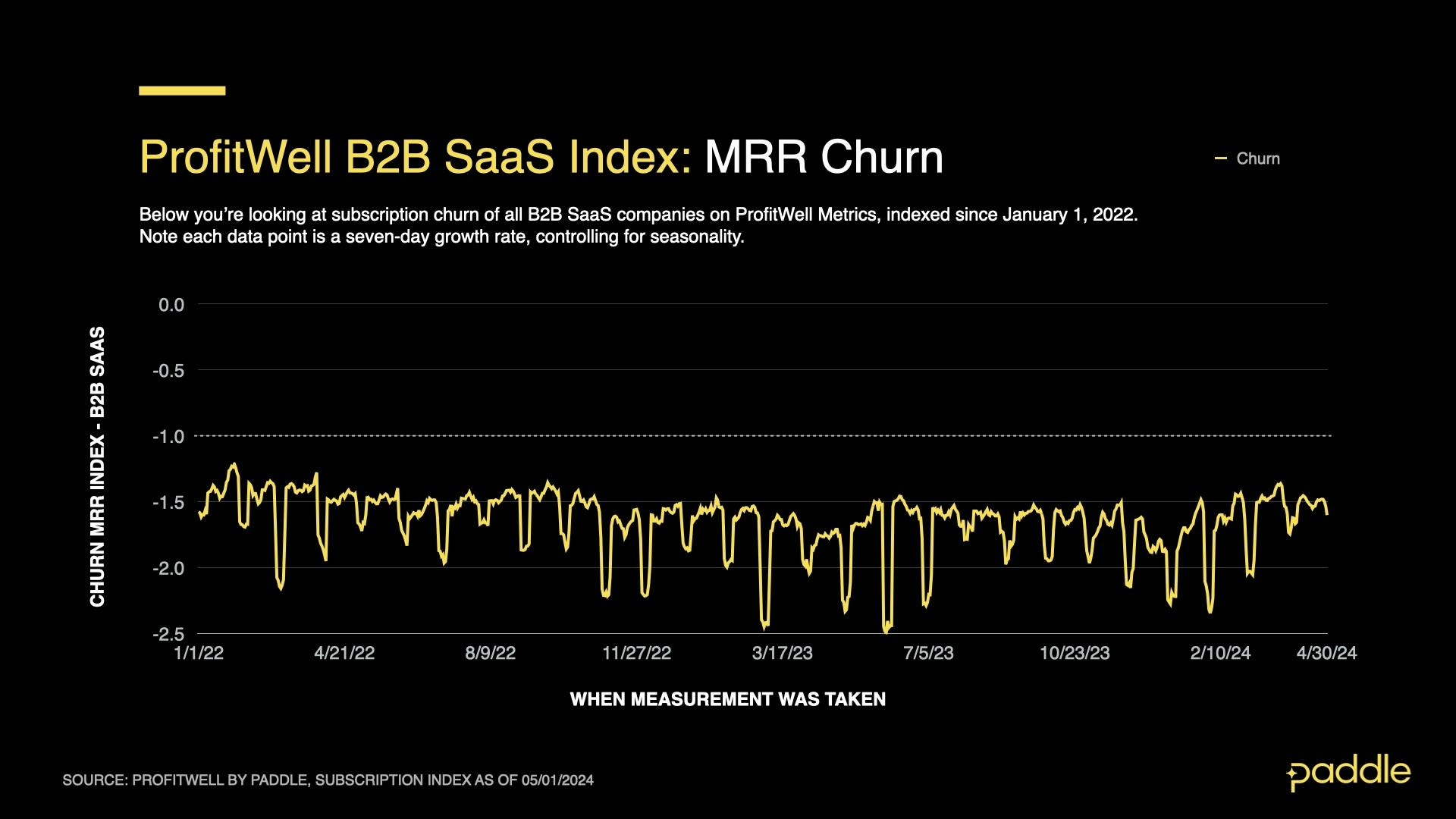

For the ProfitWell B2B SaaS Sales Index, a 1.00 reading represents sales on an “average” day in 2019, while a 1.10 reading would be 10% higher sales. The ProfitWell B2B SaaS Churn Index is calculated similarly, but will be negative, with -1.00 being an “average” 2019 figure).

When we look closely at the Profitwell Metrics data, we can see that the increased MRR growth is not driven by net new sales, which have remained stable, and, in fact, have decreased to an average of 1.378 this month, a drop of 5%, when compared to sales in March.

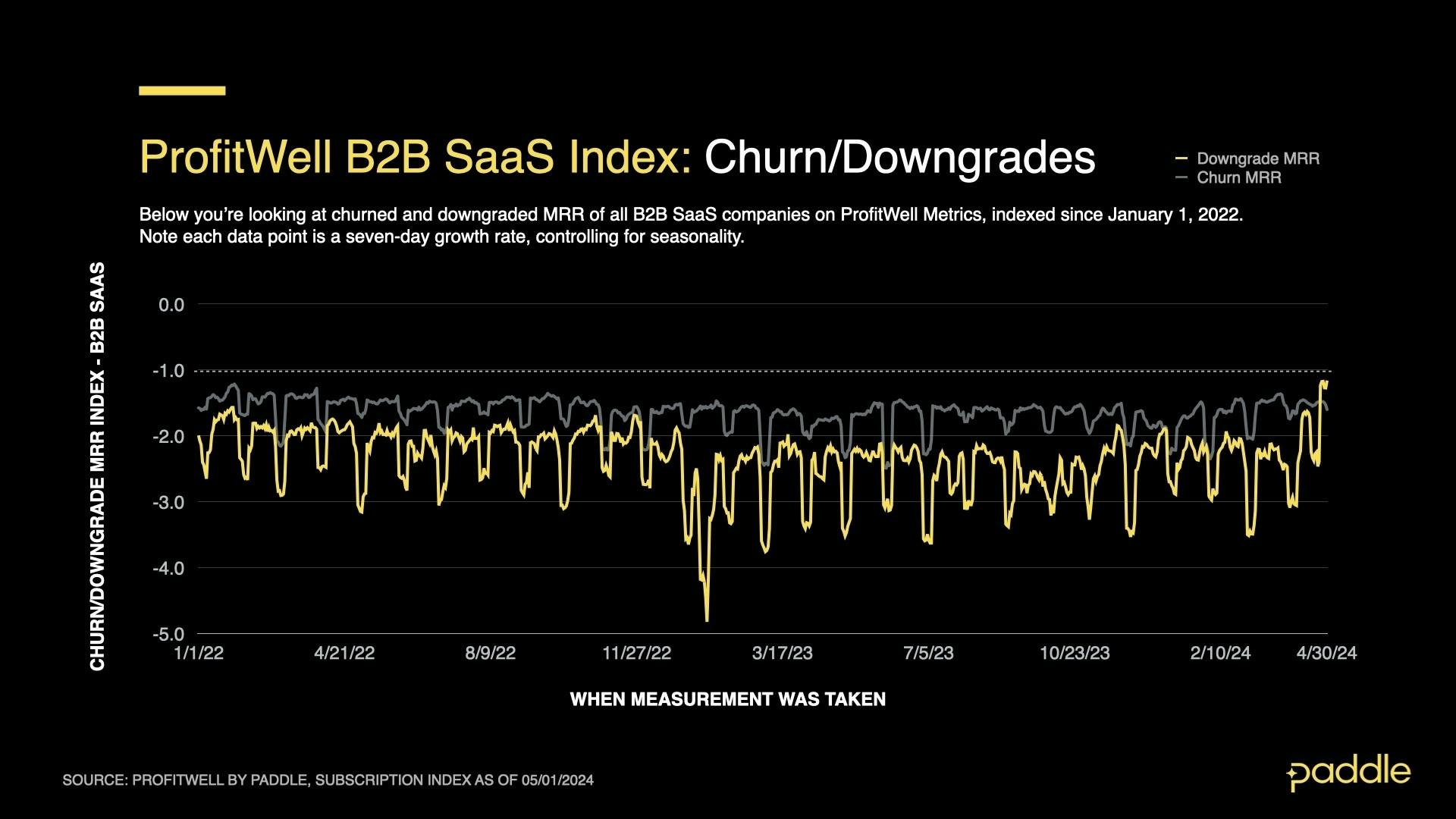

Churn continues to drop

Despite reaching an 18-month low last month (-1.376), churn continued its trend of slowly and steadily dropping in Q1, going 2.6% lower than March’s numbers.

In addition, major surges of churn (common at the beginning of each month), were significantly attenuated compared to January, February, and March this year, contributing in part to April’s spike in B2B revenue growth.

Downgrades drive B2B growth

Interestingly, April’s growth was almost entirely driven by a reduction in downgrades - with a sustained 17% drop over the month, and a sharp 55% drop over the final week, to the lowest levels since June 2021. We’ll dive more into this below.

Upgrades also saw a sustained 6.2% increase over April, with a 36% spike on the last two days of the month.

It remains to be seen whether downgrades will continue to fall, driving growth over the coming months - but with net new sales levelling out, and 2023’s pattern of growth as a reference, we can still expect B2B revenue growth to settle to a new normal in the last half of this year.

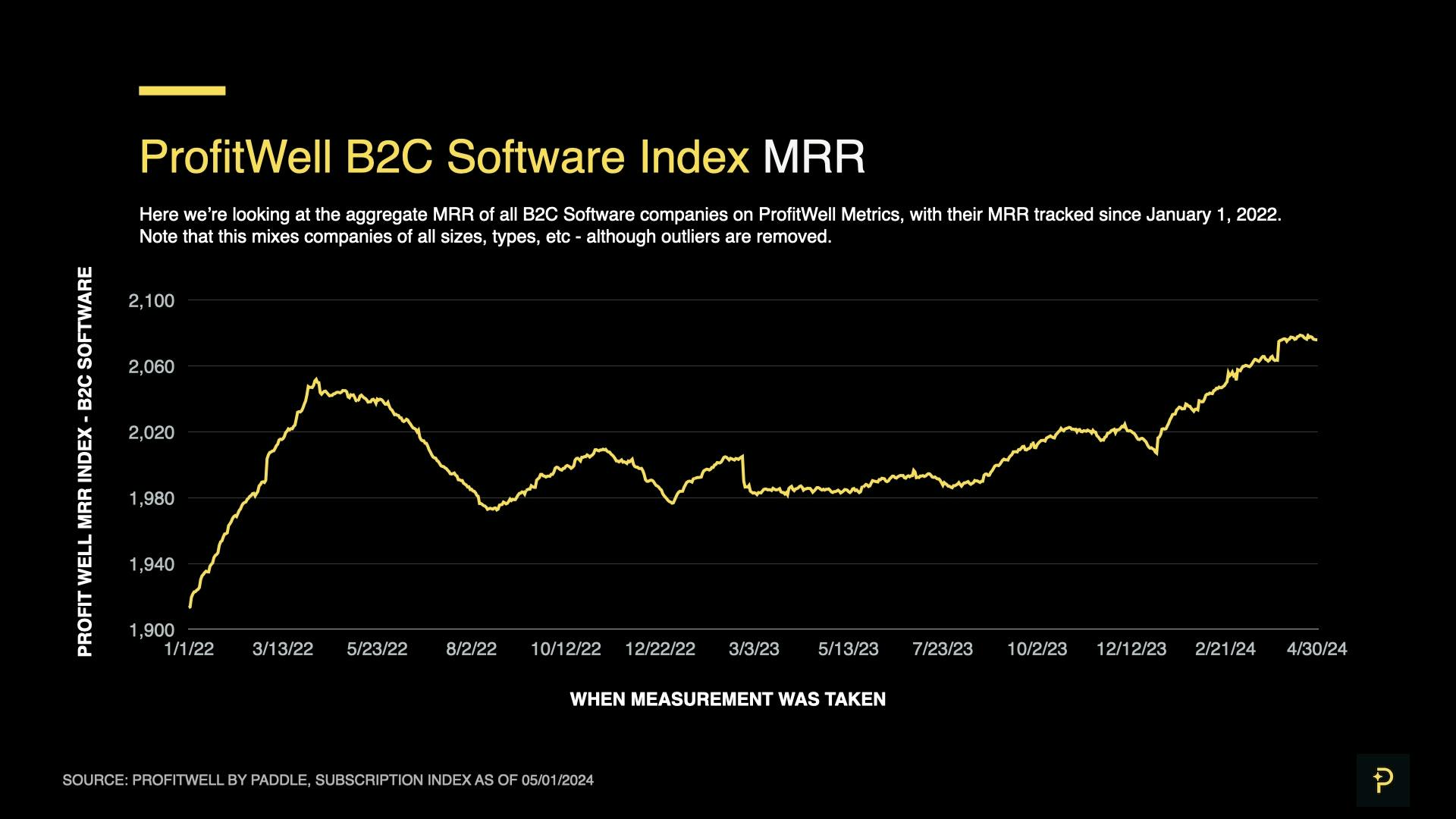

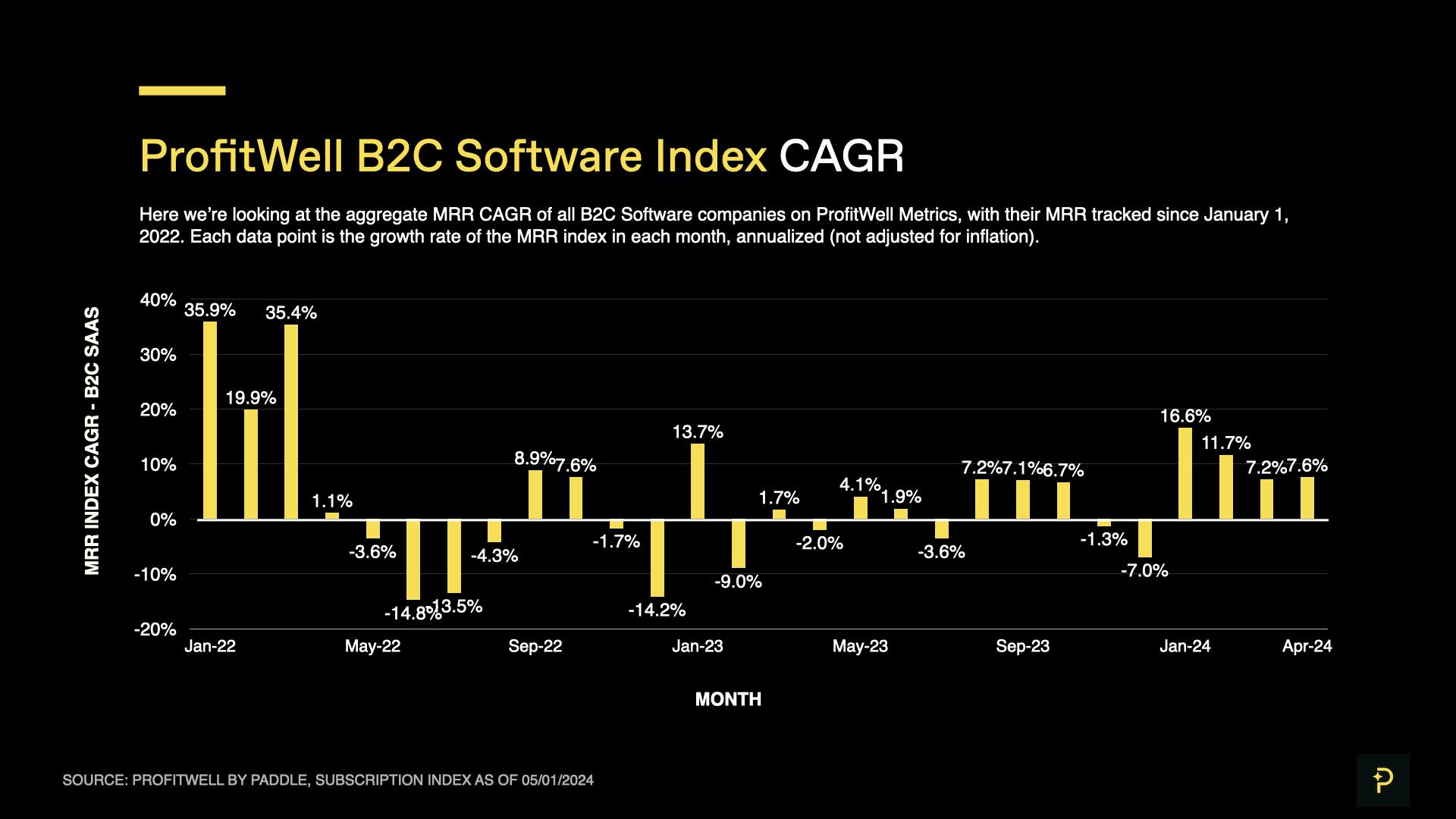

B2C: Landing on a new normal

Revenue growth in B2C, on the other hand, appears to have stabilized at 7.6% CAGR this month. This is unsurprising, as consumers react more quickly to market conditions than businesses, and can be used as a bellwether for future B2B performance.

4 consecutive months of stable growth for the first time in 2 years

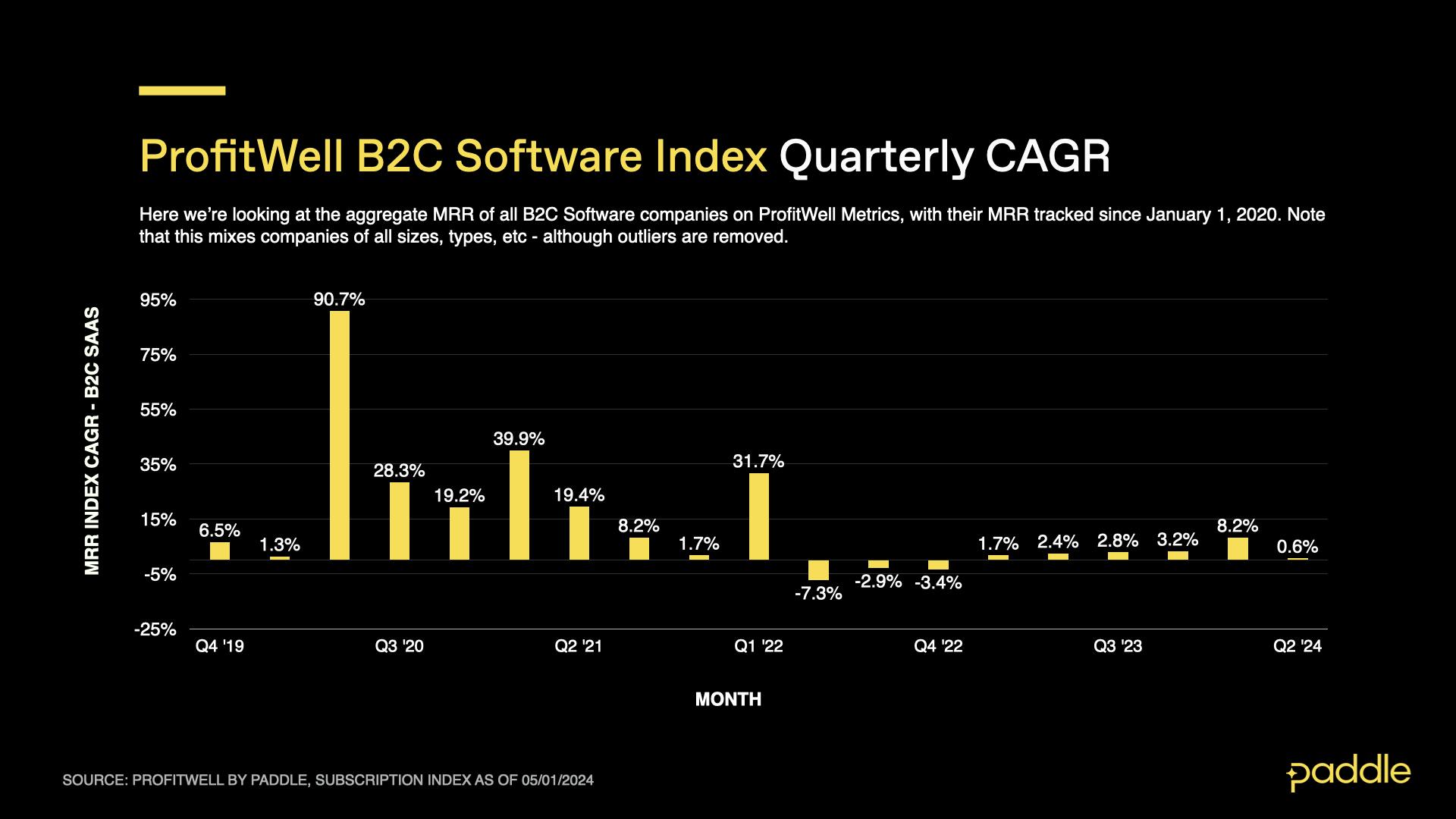

April’s positive growth marked 4 consecutive months of stable growth for the first time in 2 years - as compared to the frequent boom-bust cycles the market experienced in 2022 and 2023, in the aftermath of COVID.

As you can see from the quarterly view, Q4 2019 and Q1 2020 show similar growth to what we’re experiencing now. If B2C growth does stabilize to pre-pandemic levels, we can expect an annualized revenue growth rate of around 7% in the coming months.

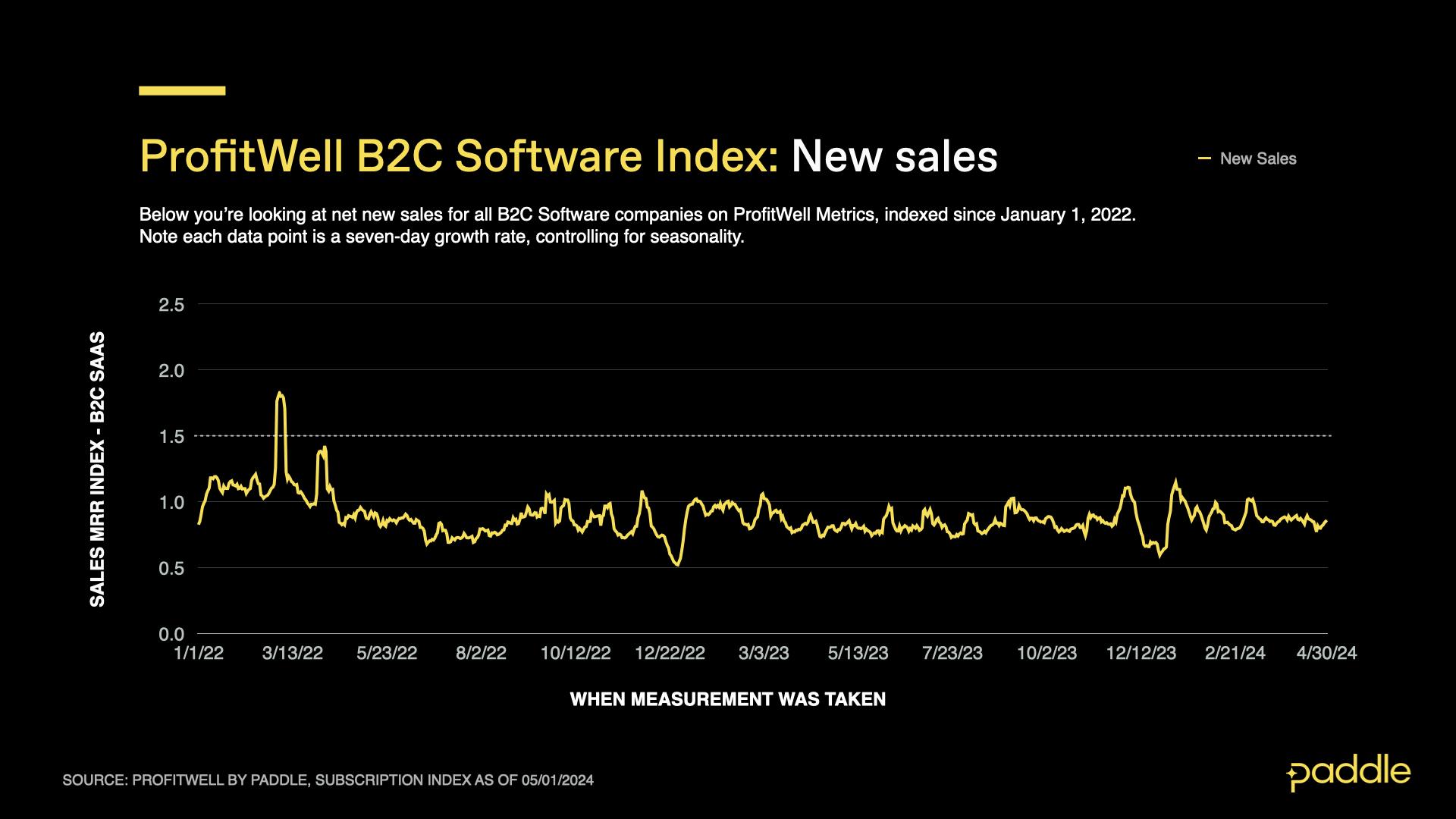

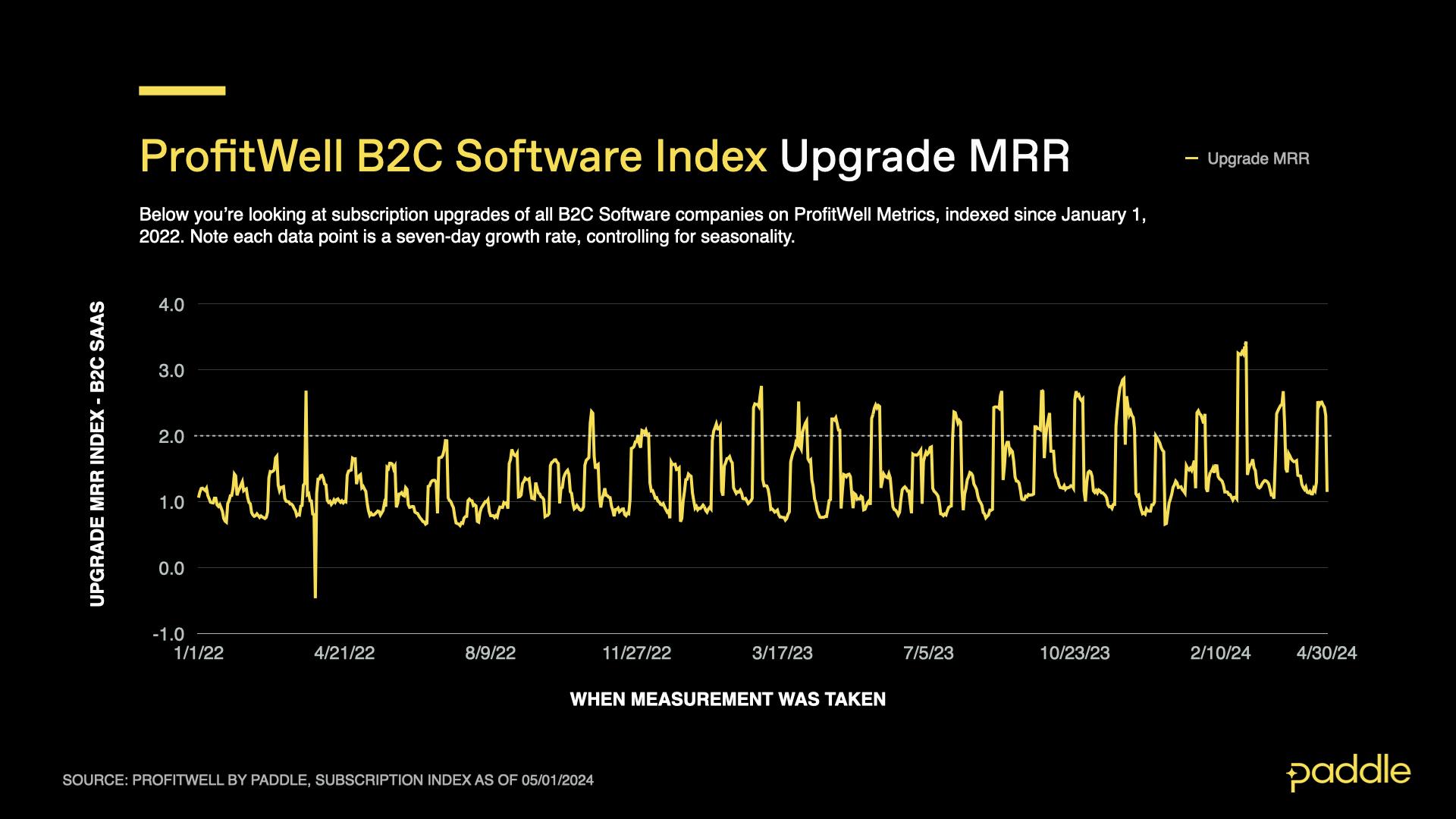

This steady growth can be attributed to stability across the primary driving forces of revenue growth - net new sales, churn, and upgrades/downgrades.

Analysing our index for net new sales in B2C, we can see it holding steady in April at a value of 0.851 (85% of the net new sales rate, from when our index was created in 2019).

Although this number is 4.7% lower than last month, it is a lot less volatile, and again points to B2C reaching a stable state, albeit slower than in 2019 and 2021.

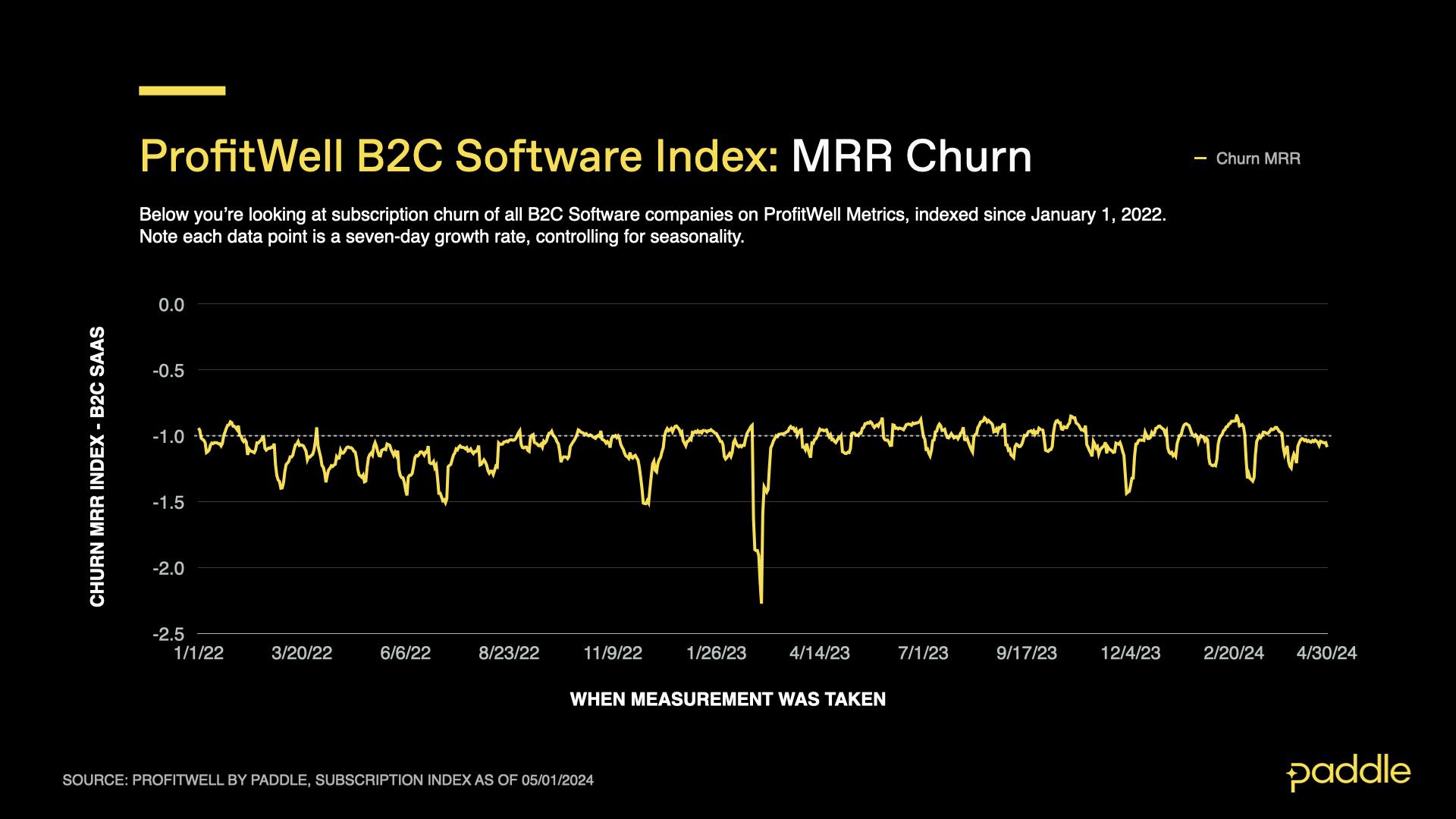

Churn in April tells the same story, demonstrating much less volatility than in previous months this quarter, and stabilizing at a churn rate only 1.1% higher than in March.

Zooming out, we also see that churn has remained relatively stable over the last 12 months, fluctuating around a value of -1.0, the same churn rate recorded in 2019, pre-pandemic.

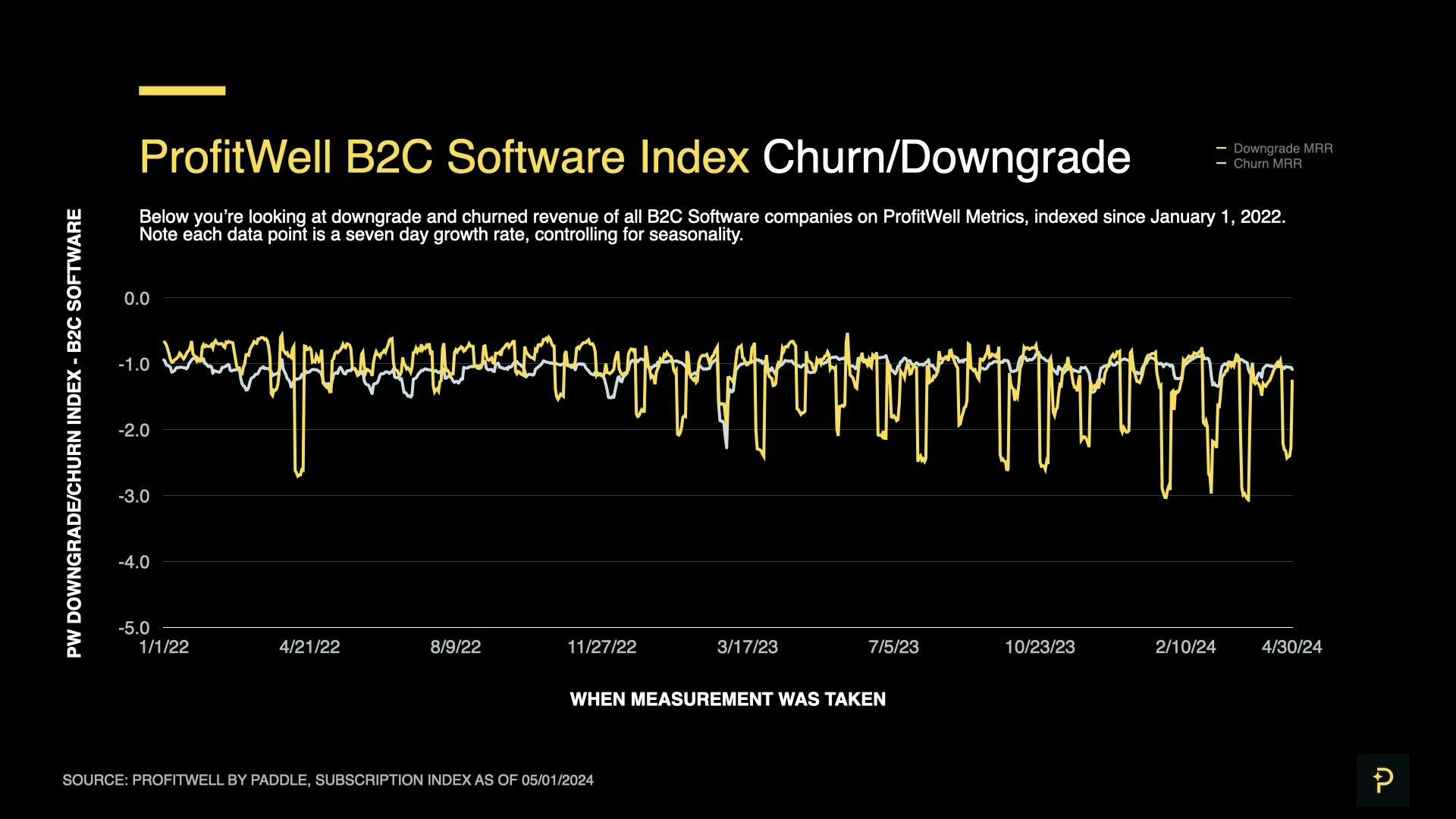

Examining upgrades and downgrades in April, we find large spikes, however, compared to March, these only represented a drop of 2.7% and 15.2% respectively, and level out at the end of the month.

The Big Picture

Bringing this all together, we see the potential for a few more months of elevated growth in B2B, before it stabilises at a more sustainable level. In addition, B2B growth will likely face further headwinds this year, as 58% of 1000+ polled SaaS operators report longer sales cycles this year.

The B2C data (a bellwether for B2B growth) backs this, as it has had its first 4 months of stable, positive growth in 2 years - albeit at a much lower, more sustainable level than in the past 4 years.

It appears that after strict fiscal “belt-tightening” during the market slowdown of late 2022 and 2023, B2B SaaS sentiment is cautiously optimistic, and companies are willing to invest more in the growth of their businesses - and the software tools that enable this.

Companies that have fortified their finances while working to improve operational efficiency, are now in a good position for the coming year of slow and steady growth; and when the market does begin to heat up, they’ll be in an excellent position to aggressively invest in growth, and grab significant market share.

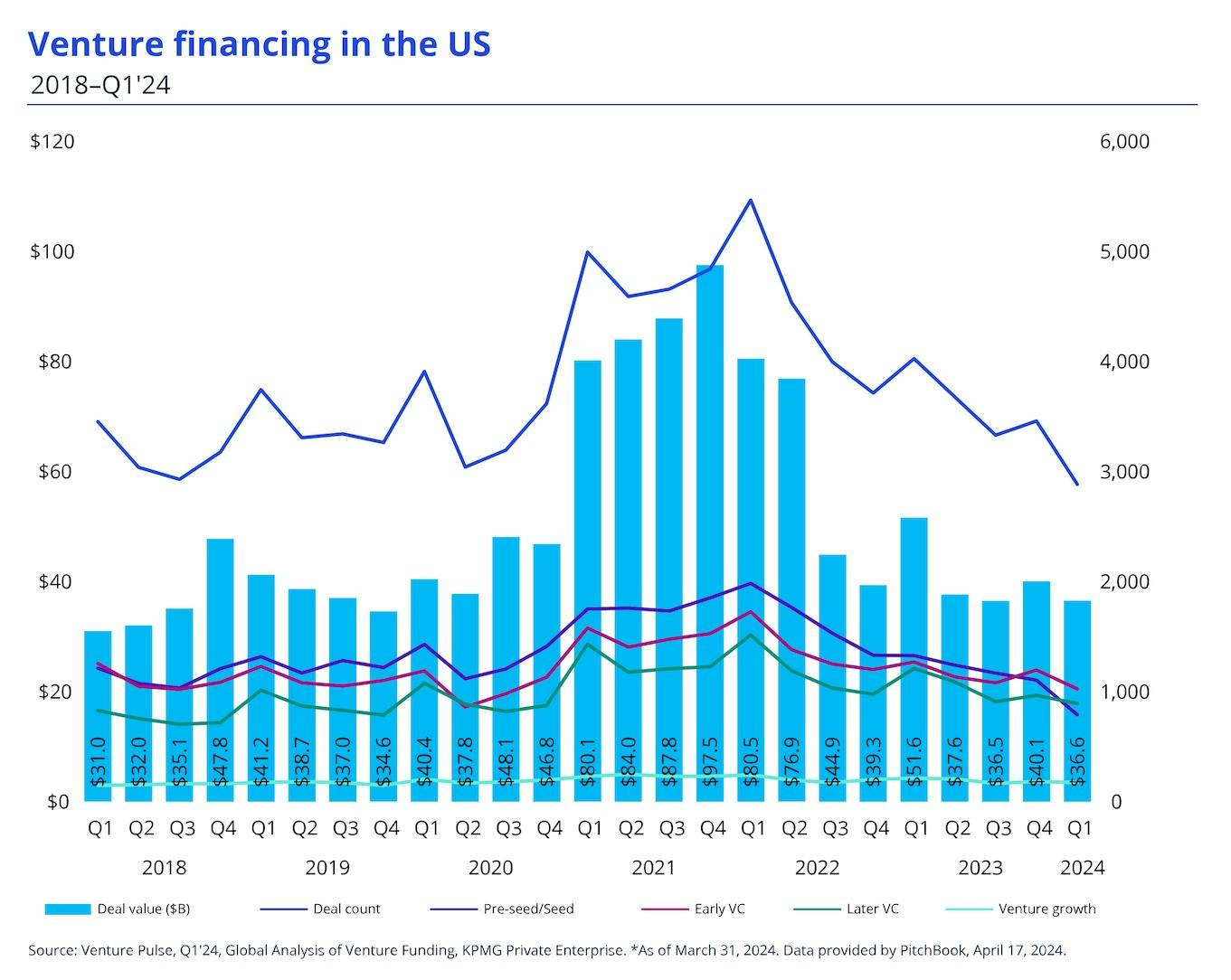

VC activity also heads to a new normal

External data sources, such as the dollar value of venture capital financings in the US, tell a similar story. After reaching enormous heights in 2021 and 2022, VC funding has come back down to earth, flattening out near pre-2019 levels. This is a great indicator that growth in SaaS will follow a similar pattern, as a great deal of SaaS companies are venture-backed, and can only deploy aggressive growth tactics if well funded.

Unsurprisingly, AI hasn’t been subject to these slow downs, and continues to attract a flurry of investment. According to the report from KPMG, AI is expected to remain “very attractive” to investors globally this year.

But that doesn’t mean that anything and everything with an “AI” tag will spark a flurry of interest and investment. It looks like AI solutions with unique value propositions will be a key area for VC investment, such as industry-specific tools aimed at sectors like financial services, law and real estate.

Is this an AI bubble?

Right now, it seems like there's a bubble emerging with AI. With 76% of SaaS companies saying they have AI on their roadmap, the hype is definitely there. But at what point in the timeline are we? Are we riding the hype upwards, or is everything about to come crashing down?

We talked to Ray Rike, CEO of Benchmarkit, for his take on how previous economic crashes can shed light on the potential AI hype bubble. Check it out here.

And you can also see the data Ray has crunched for the Benchmarkit 2024 SaaS Metrics Benchmarks Report here.

Strategies to consider

Be ready to hit go on growth

With all signs pointing to the market stabilizing at a new normal, it’s time to start getting yourself in the best position to hit go on growth mode. You’ve managed to weather the tougher business environment so far, so where can you look to drive more revenue?

Go downmarket or upmarket with a hybrid GTM model

The beauty of SaaS is that you’re essentially available on a global scale from the get-go. But are you creating an all-inclusive sales process that’s suited to both your customers and your team? Opting for a hybrid sales motion in your go-to-market strategy solves this.

By combining sales-led and product-led approaches, you’re able to make moves both upmarket and downmarket. The aim? To cover as much ground as possible in terms of your audience, focusing on their business goals and user preferences to drive revenue growth.

Benefits of moving upmarket:

- Bigger ACV, tailored packages, personalized sales experience

Benefits of going downmarket:

- Bigger audience, easier to purchase and faster time to value, lower CAC

Of course, you can’t just simply turn on one motion. You’ll need to evaluate if you can create a product-led experience for PLG or if you can bring on a sales team to drive a sales motion.

And our pricing experts also recently shared how companies can effectively price their product for this strategy.

Identify opportunities to drive revenue from customers

Move customers on legacy price plans onto updated ones.

This allows companies to maximize revenue earned from existing customers who already gain value from your product.

While no one likes to talk about a price increase, it’s a necessary exercise to ensure your business continues to grow. If you’ve added more features to your product over time, you should be able to charge accordingly.

Here are some tactics you can use to help move customers from old plans to new price plans:

- Set timeline expectations with customers for price changes.

- Communicate your value proposition and be transparent about the changes.

- If you must, offer transition discounts to very specific customer segments.

Double down on efforts to reduce churn and increase customer lifetime value.

When you can keep more customers for longer, you can focus on growing your customer base instead of constantly finding new customers to replace the ones who churned.

One way to do this is to upsell customers on longer-term plans, whether that’s moving customers from monthly to quarterly or 6-month or annual plans. Do this by:

- Identifying active users on monthly plans.

- Creating a limited-time offer like a discount on a higher plan if they commit and pay annually upfront.

- Send a message to these users with a link to a landing page explaining the difference between their current plan and the upsell offer.

_You can also use [Paddle Retain](https://www.paddle.com/retain) to automate and run term optimization in the background. _