B2B and B2C SaaS have managed a “soft landing” after 2 years of post-COVID volatility, and revenue is likely to continue growing at current rates, until the end of the year.

The driving forces of growth - new sales, churn, upgrades & downgrades - have seen 5 consecutive months of remarkable stability; and we foresee few major disturbances in Q3 or Q4.

We are now confident in forecasting growth rates of 11% CAGR for B2B and 8% CAGR for B2C, for the remainder of 2024. Please note that these predictions are best applied to SMB SaaS companies, which compose the majority of the ProfitWell SaaS Index.

In this report, we’ll examine the driving forces behind this stability, strategies for operating in a “slow and steady” market, and tactics for optimizing your company's unit economics.

This is the latest in our ongoing SaaS Market Reports, which track the movement of the ProfitWell Subscription Index, and its underlying growth and retention trends. This month, we examine 2024 performance.

KP and Gavin discuss this month's data. Scroll down to read the full report.

B2B: Back to stability

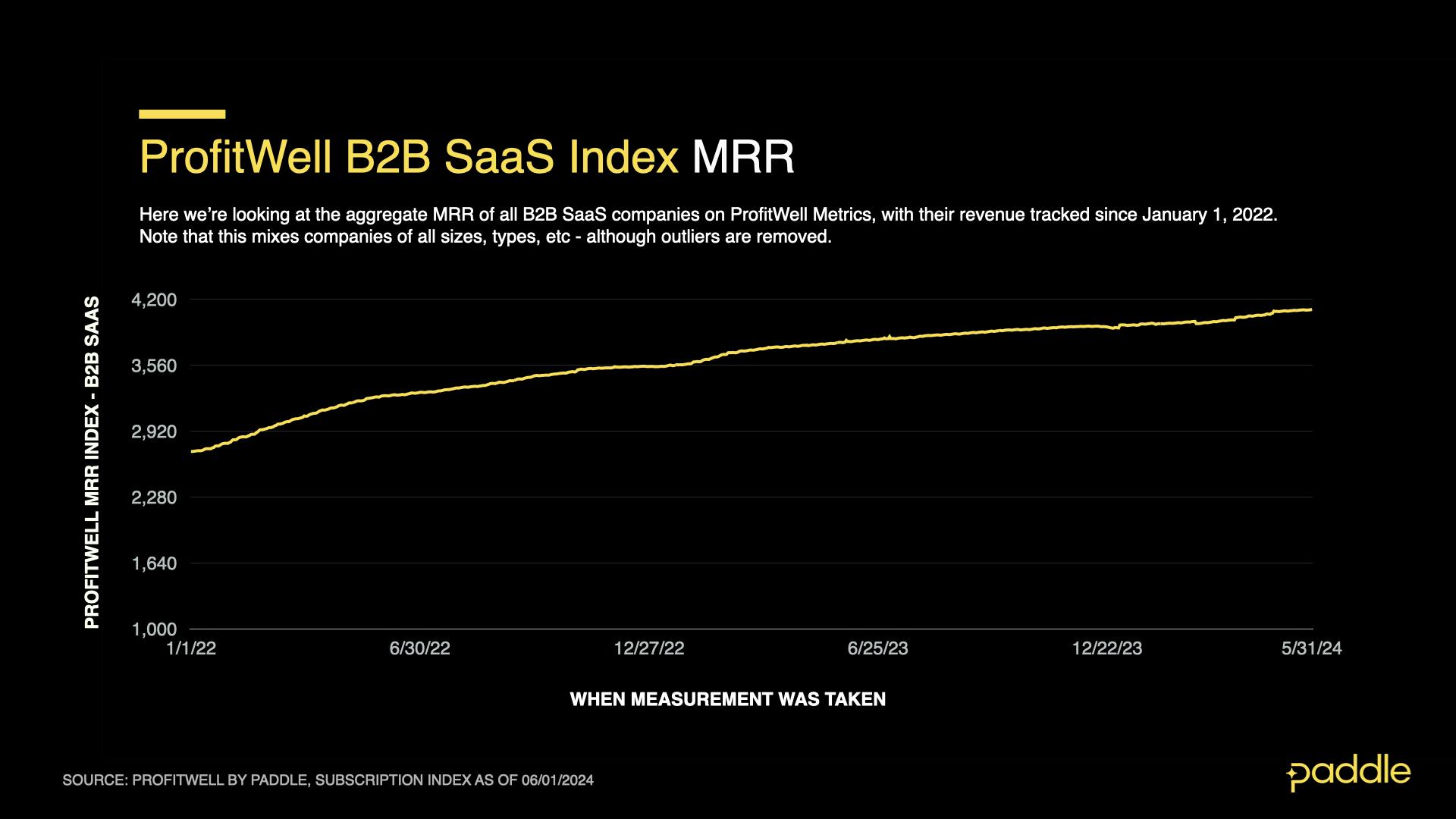

The ProfitWell B2B SaaS Index tracks the cumulative monthly recurring revenue (MRR) from a sample of the 34,000+ companies on ProfitWell Metrics. By measuring the revenue performance of this cross-section of companies over time, we can objectively observe how quickly the sector is growing (or not). The index does not adjust for inflation. Explore the free demo of ProfitWell Metrics here.

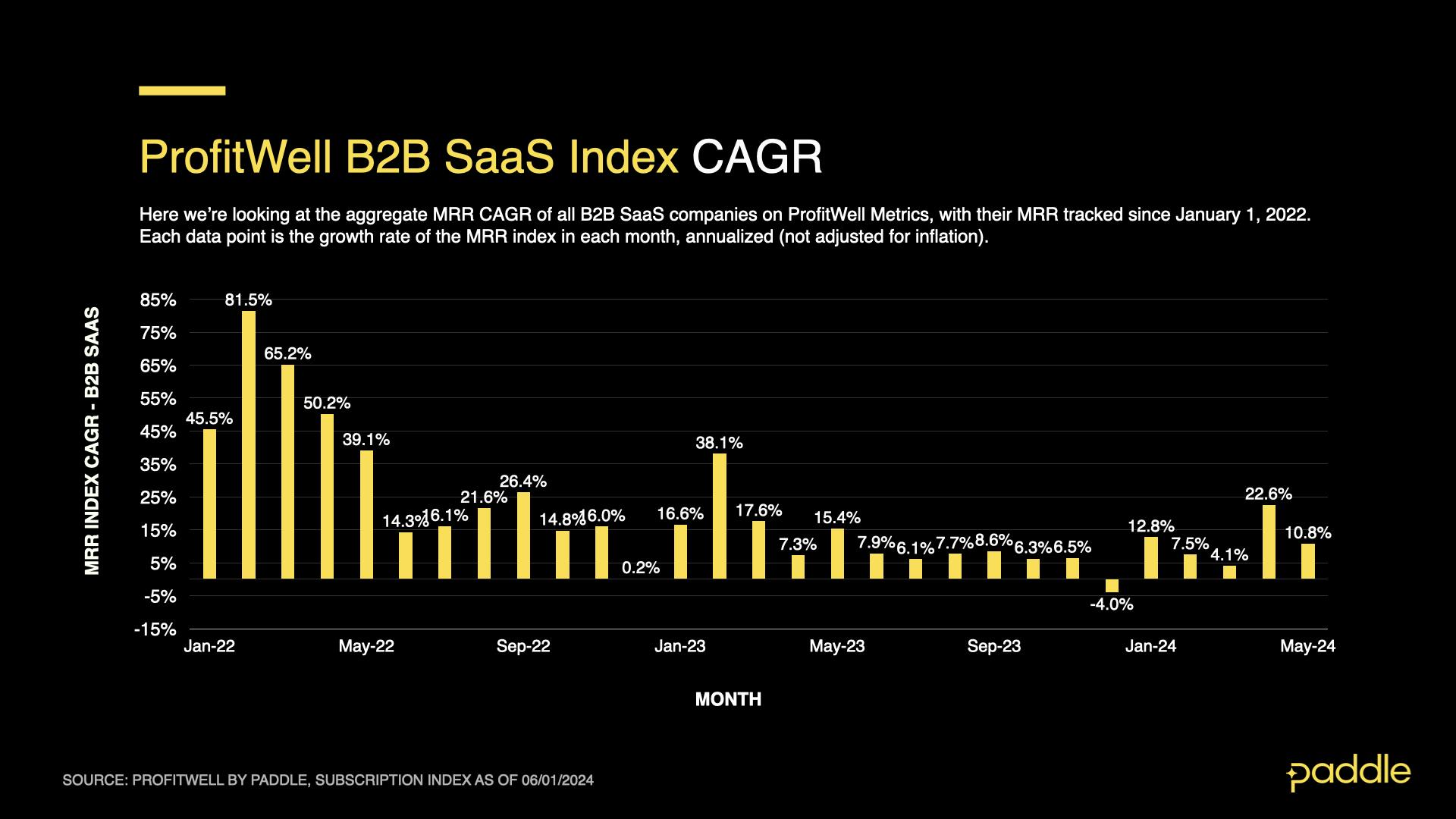

After exceptional B2B growth in April (22.6% CAGR), May’s correction to 10.8% CAGR (a drop of 52%) might feel disappointing. However, if the market’s recent volatility has made planning difficult and the future uncertain, this correction is actually great news.

It indicates that the drivers of B2B revenue - new sales, churn, downgrades and upgrades - are in a stable equilibrium after two, highly volatile years. Barring any new disturbances to the macro environment, their stability will ensure B2B growth remains stable around 11% CAGR for the rest of the year (and maybe beyond).

Downgrades return to normal

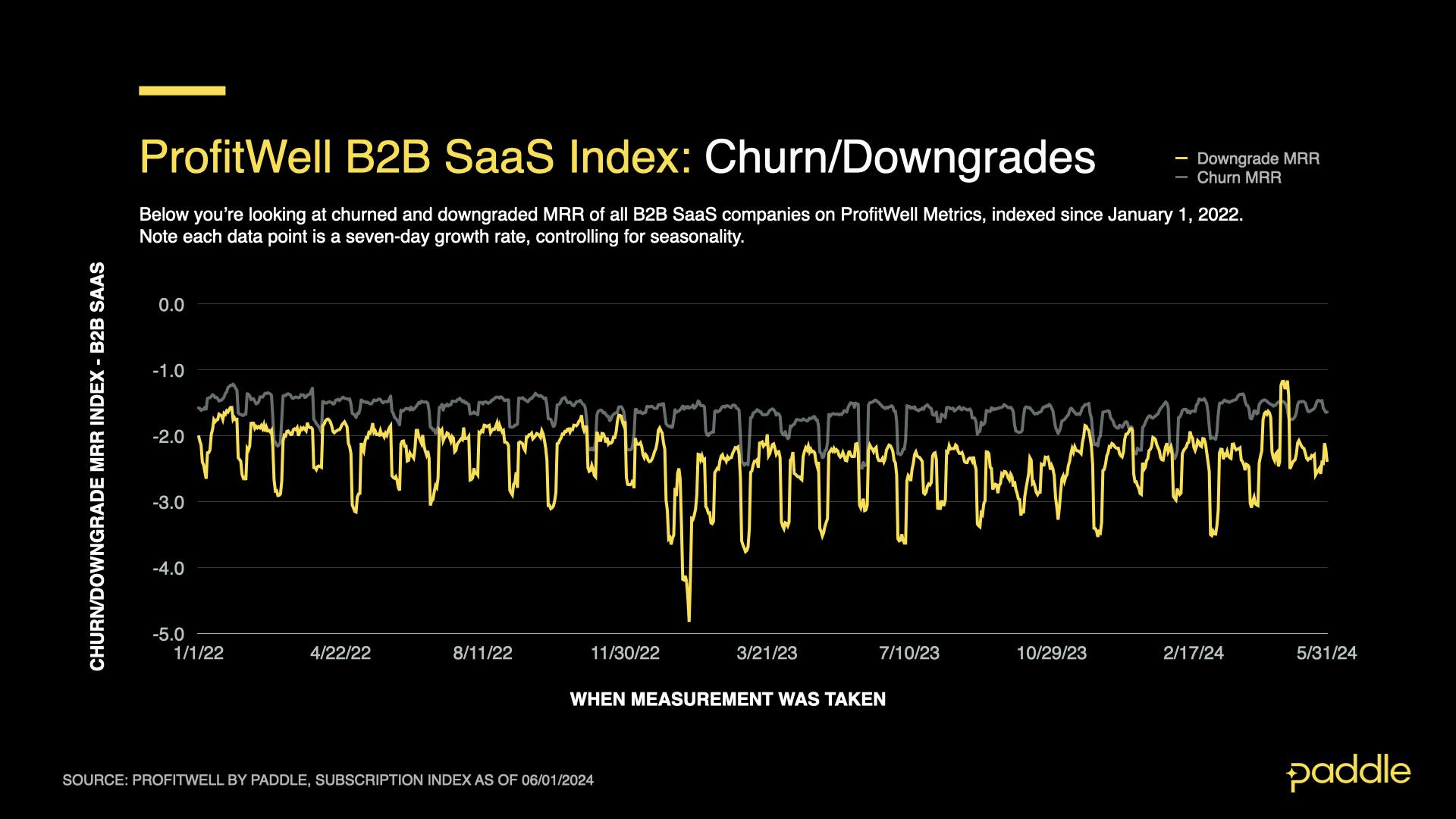

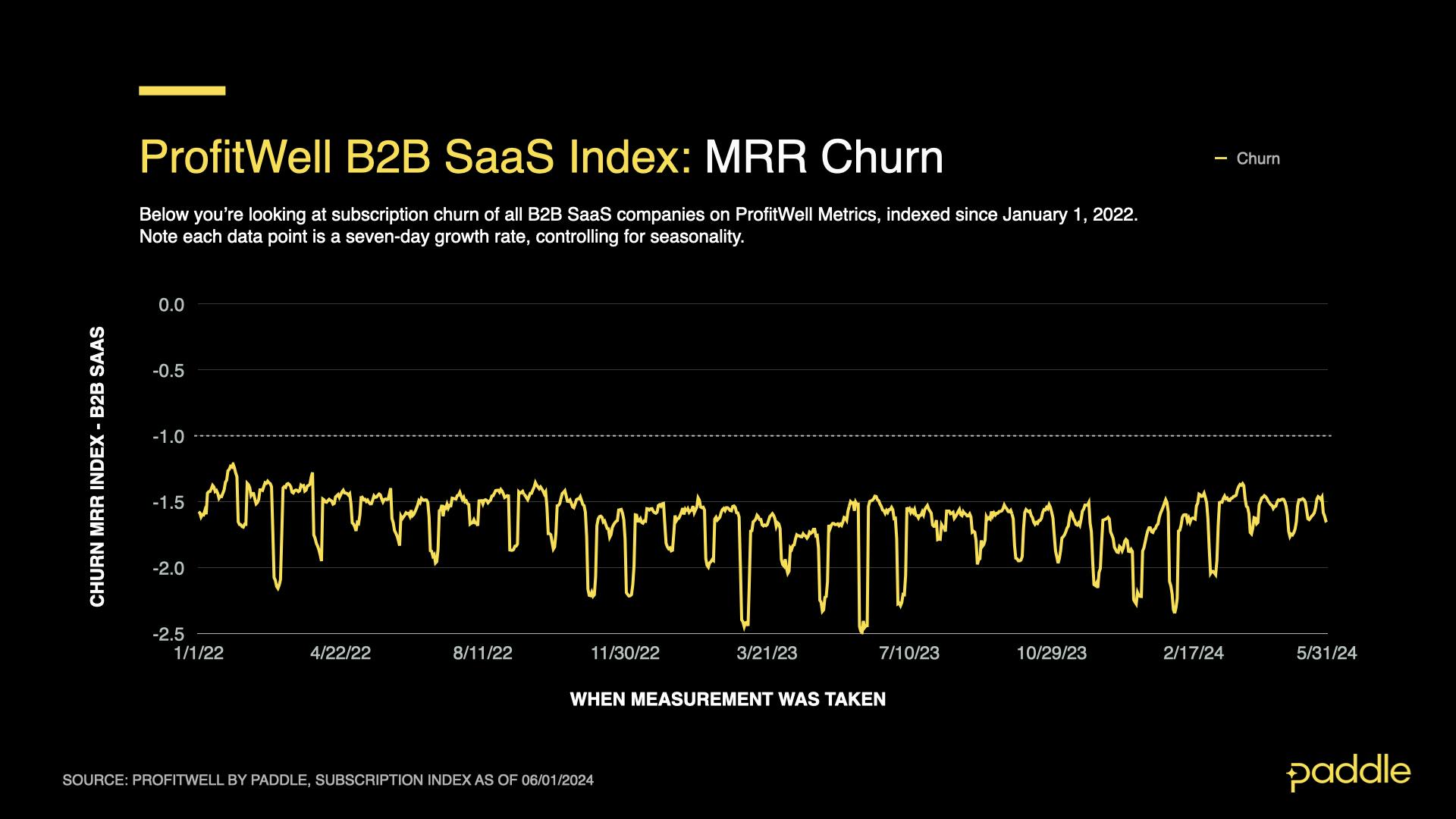

For the ProfitWell B2B SaaS Sales Index, a 1.00 reading represents sales on an “average” day in 2019, while a 1.10 reading would be 10% higher sales. The ProfitWell B2B SaaS Churn Index is calculated similarly, but will be negative, with -1.00 being an “average” 2019 figure).

Digging into the first driver of B2B growth, downgrades, we can see that April’s 17% drop was a temporary fluctuation in an otherwise stable Downgrade Index, which has hovered around a mean of 2.326 since January, with a standard deviation of just 6.6%.

Note: If your eyes roll when you see statistical jargon like “standard deviation” - this just means that on average, our Downgrade Index has varied by 6.6% per month, since January.

Churn, upgrades & sales remain stable

Looking at churn, we find an increase of only 2.6% in May, to -1.587 on the index. Stability here is also strong, with a standard deviation of 7.3% since January.

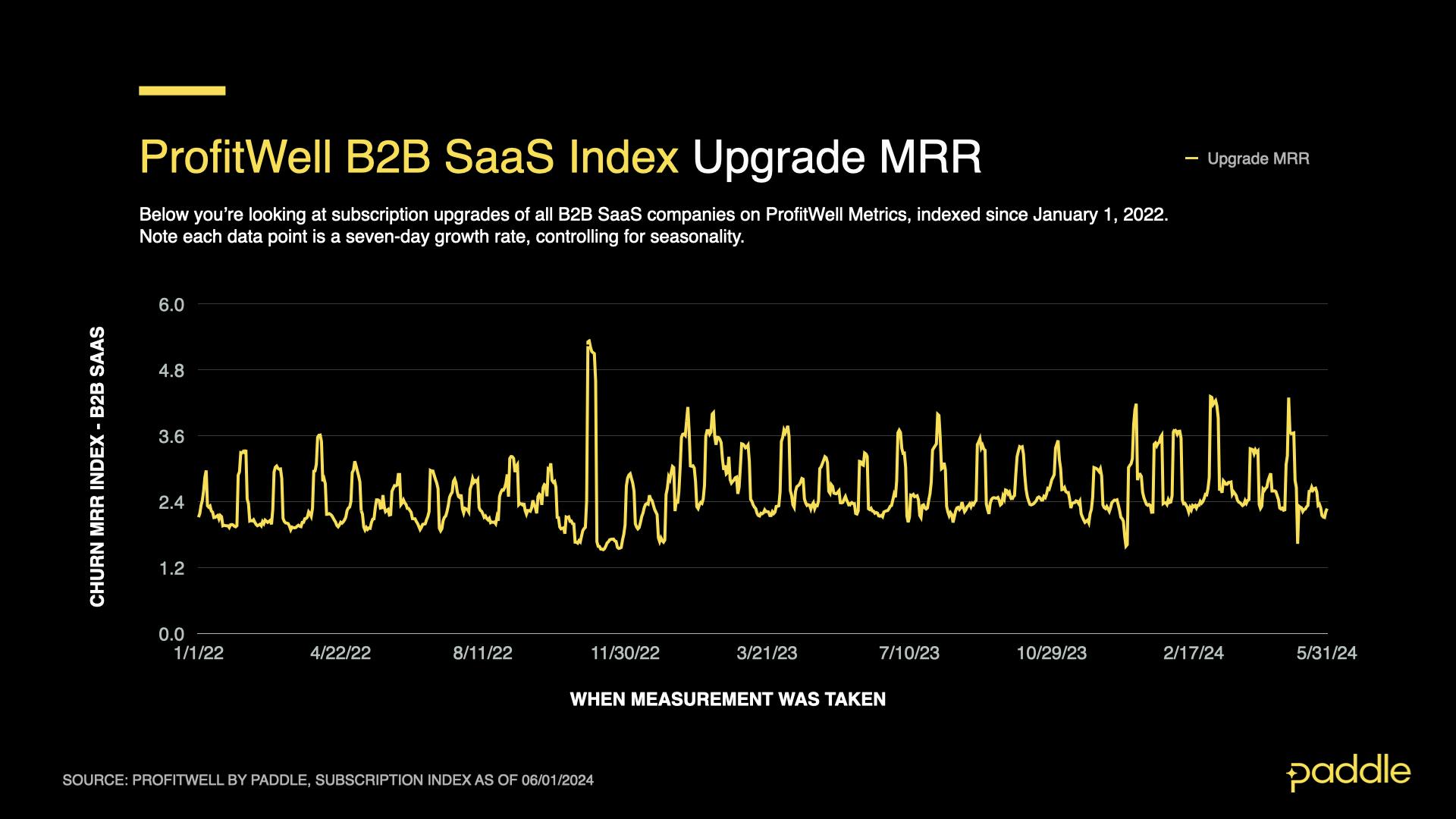

Upgrades tell a similar story, with an index value of 2.614 (a 4.4% drop compared to April’s average). It is the most stable of all our growth drivers, with month-to-month fluctuations of less than 4.5% since January.

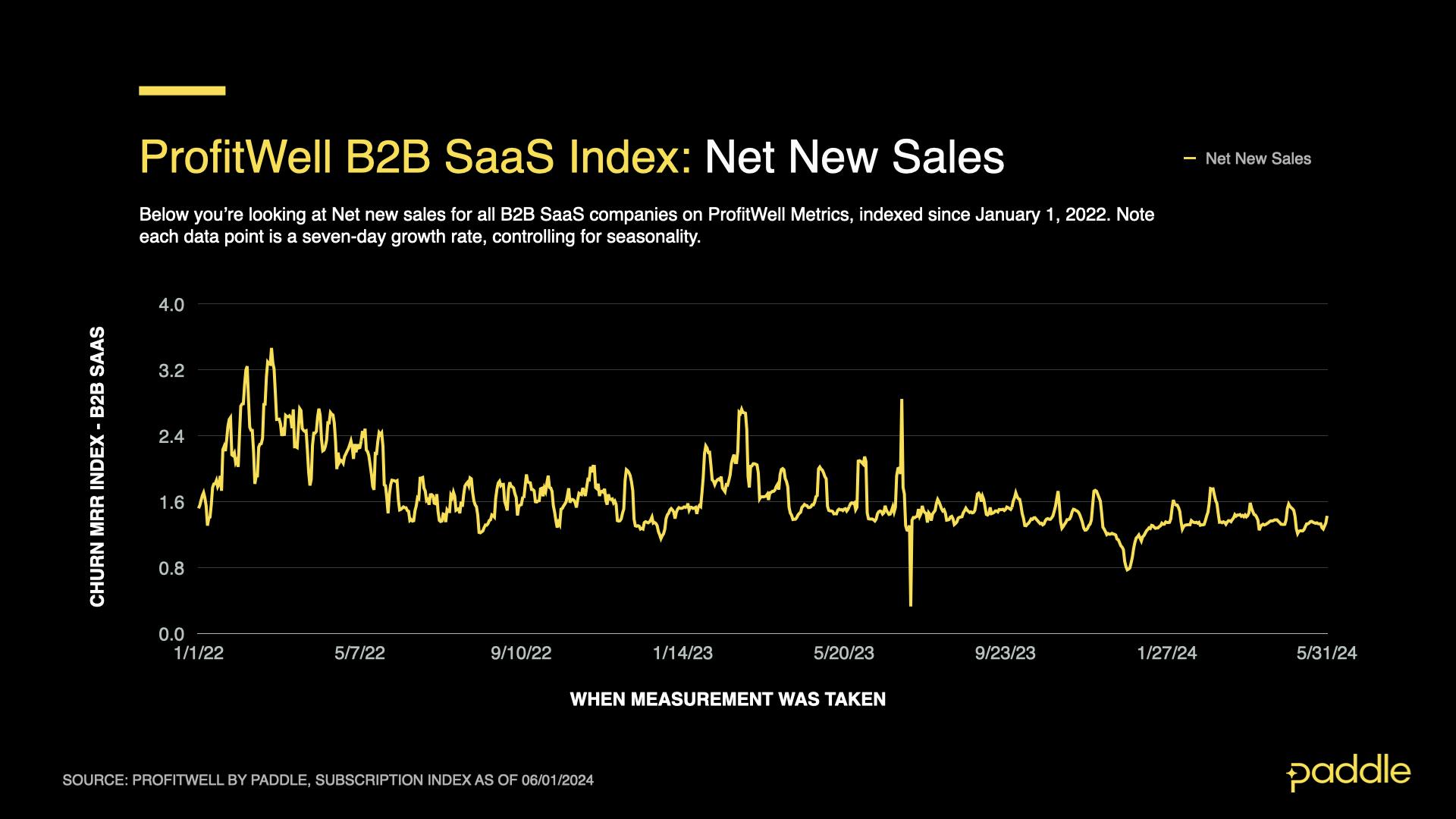

Finally, when examining the net new sales index, we see a 1.8% drop in sales, to 1.353, compared to last month. Since January, new sales have only seen a 5.4% standard deviation.

Bringing all this together, it’s clear that churn, downgrades, upgrades and new sales are in equilibrium - fluctuating less than 7% per month since January. This is far more stable than 2022 and 2023, where the standard deviation for these metrics peaked at 85%.

Accordingly, B2B growth has officially settled on its new normal this May, and is unlikely to deviate much from 11% CAGR… until another major event disrupts how businesses buy software (COVID v2, anyone? 😅).

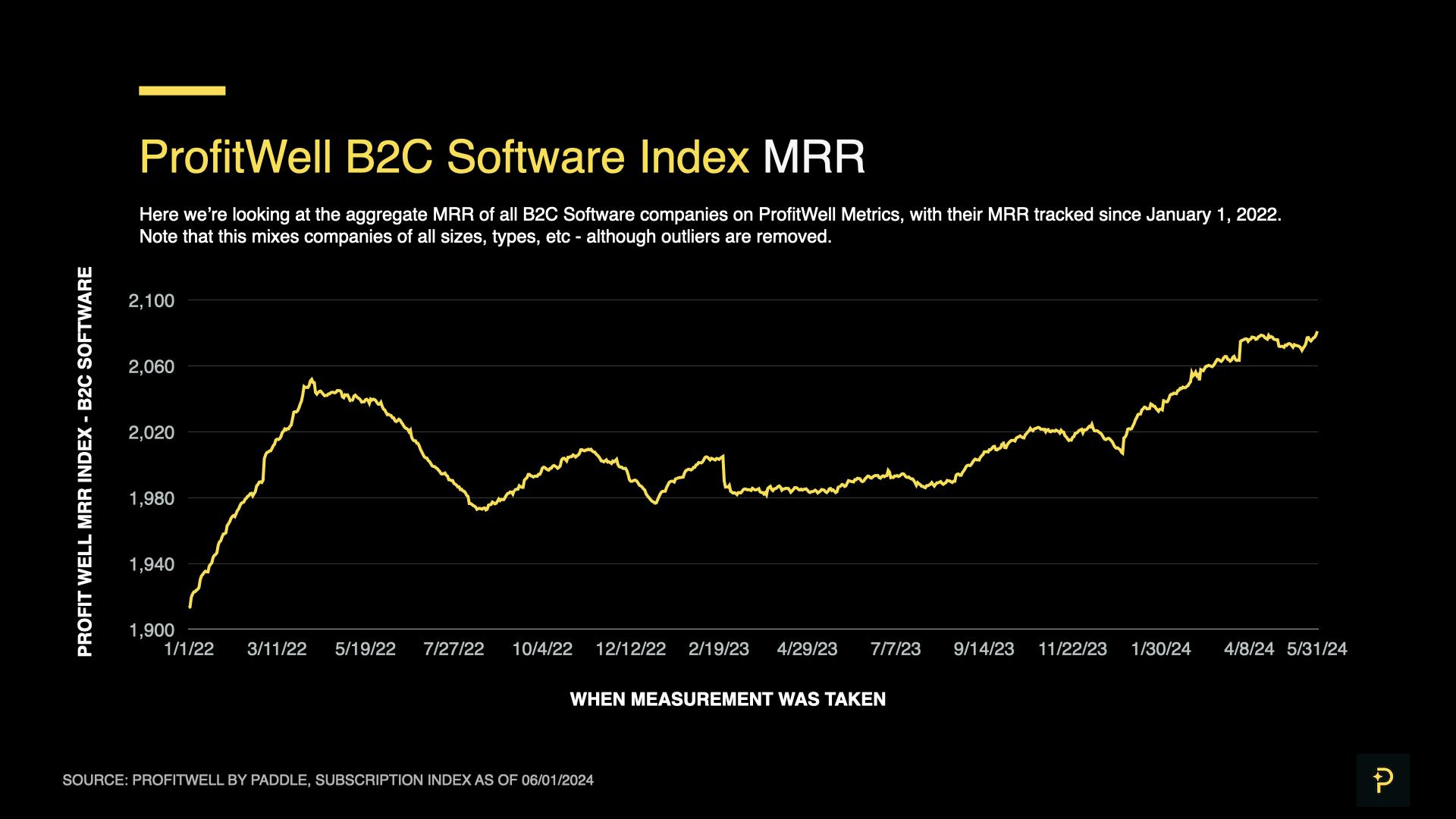

B2C: Stability, despite the dip

Moving on to our B2C index, the consumer market reached a new high of 2081, after nearly 10 months of stable growth (excluding annual slowdowns around Christmas). However, this month, annualised B2C growth dropped to 3.0% - less than half the growth rate we saw in April (7.6% CAGR).

5 consecutive months of stable growth

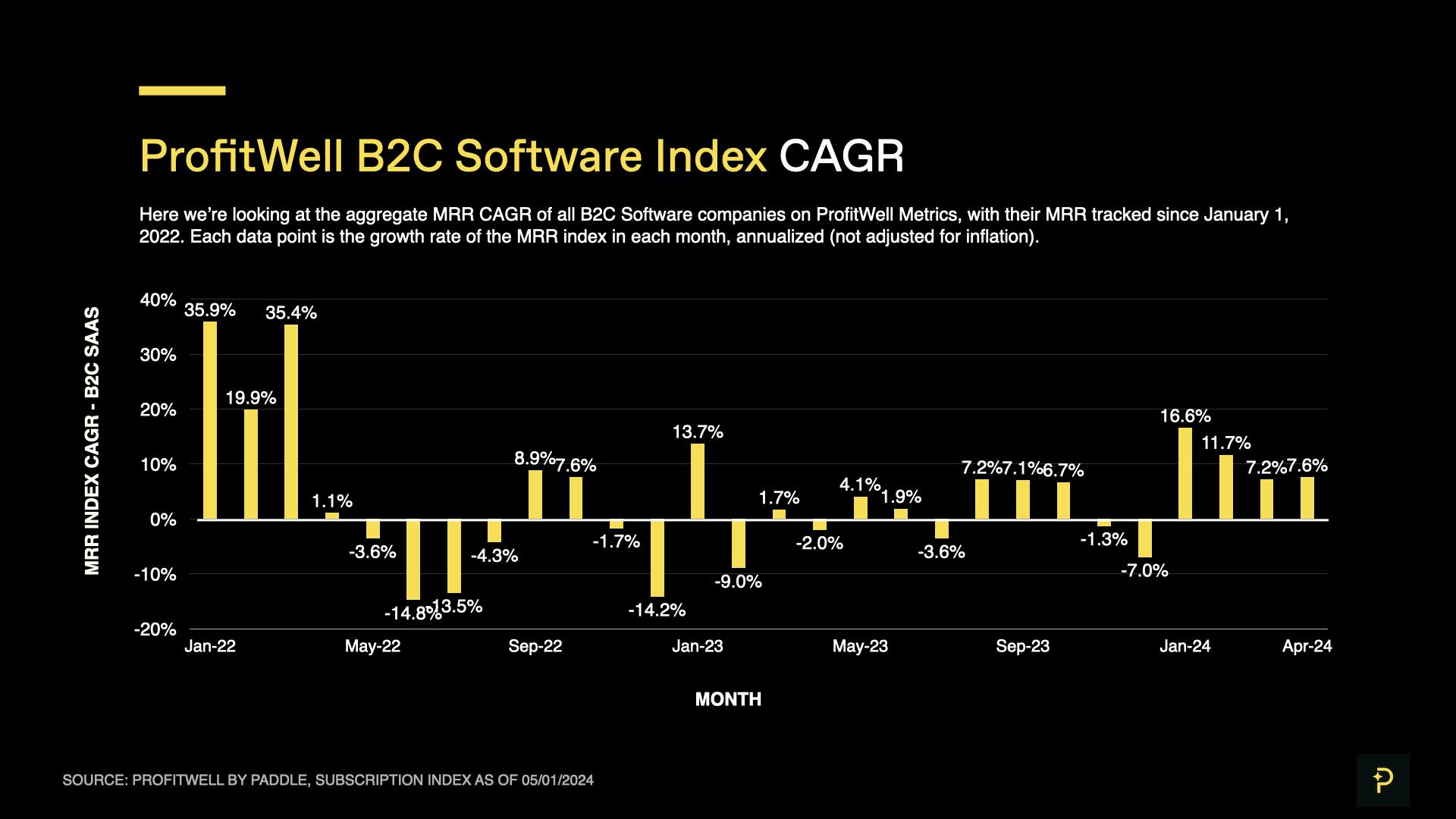

So what’s going on? Despite the sharp drop, B2C revenue is still growing at an average of 7-8% CAGR. May’s lacklustre growth is due to the inherent volatility of the consumer market (with occasional month-to-month swings in CAGR over 34%) rather than an overall downturn in consumer spending.

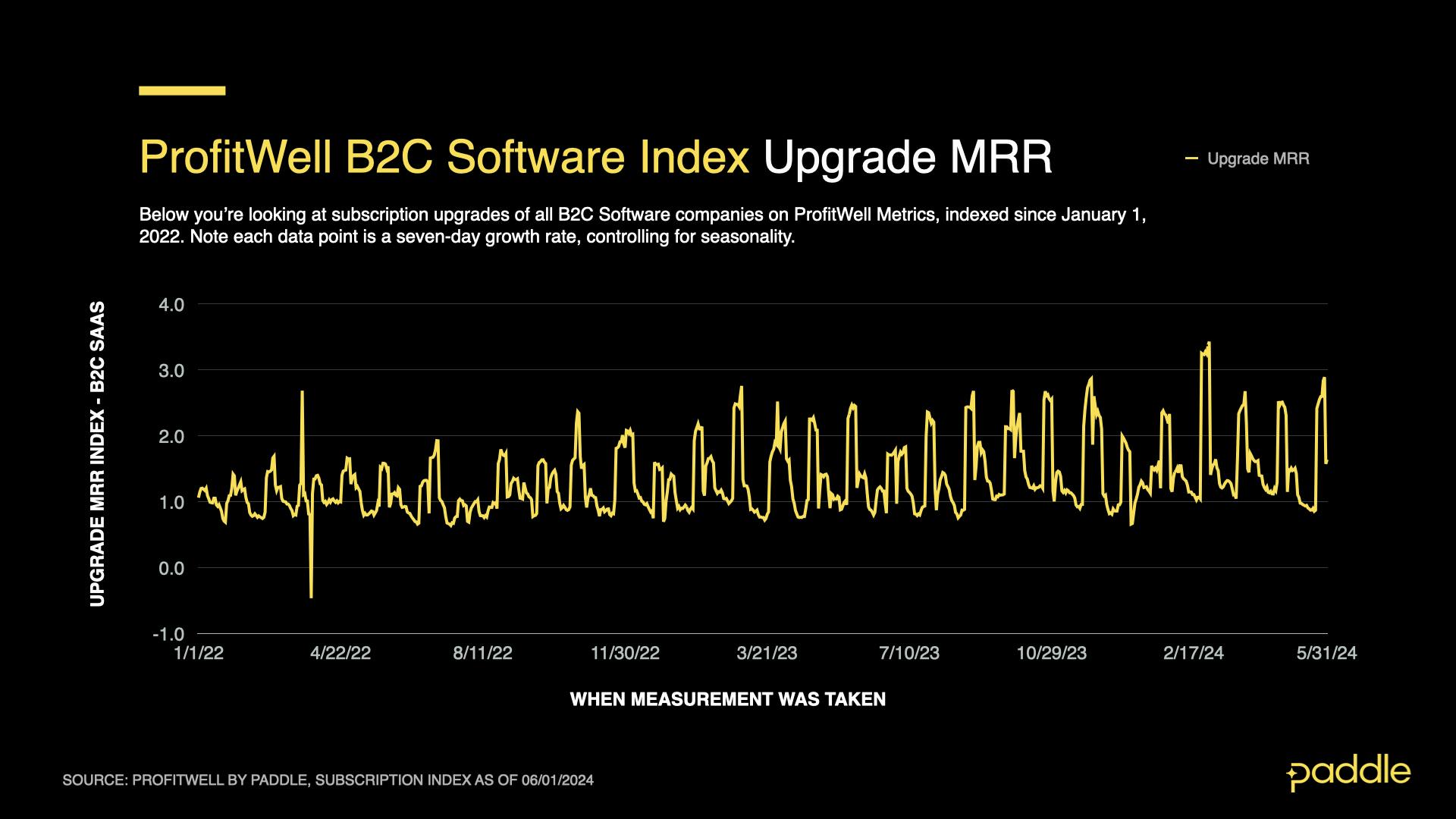

Looking at the drivers of B2C revenue, we find that May’s growth was impacted by a large decline in upgrades (8.2% lower than April), without enough sales growth (0.6% increase) to compensate.

Upgrades drop, still stable (probably)

Digging deeper into upgrades, we find that May’s 8.2% drop (to 1.473) is slightly larger than the index’s 2024 standard deviation of 6.7%.

With no apparent causes, we’ll need to wait and see if this is a large, random fluctuation, or the beginning of a sustained decrease in upgrades.

New sales, churn, downgrades still stable

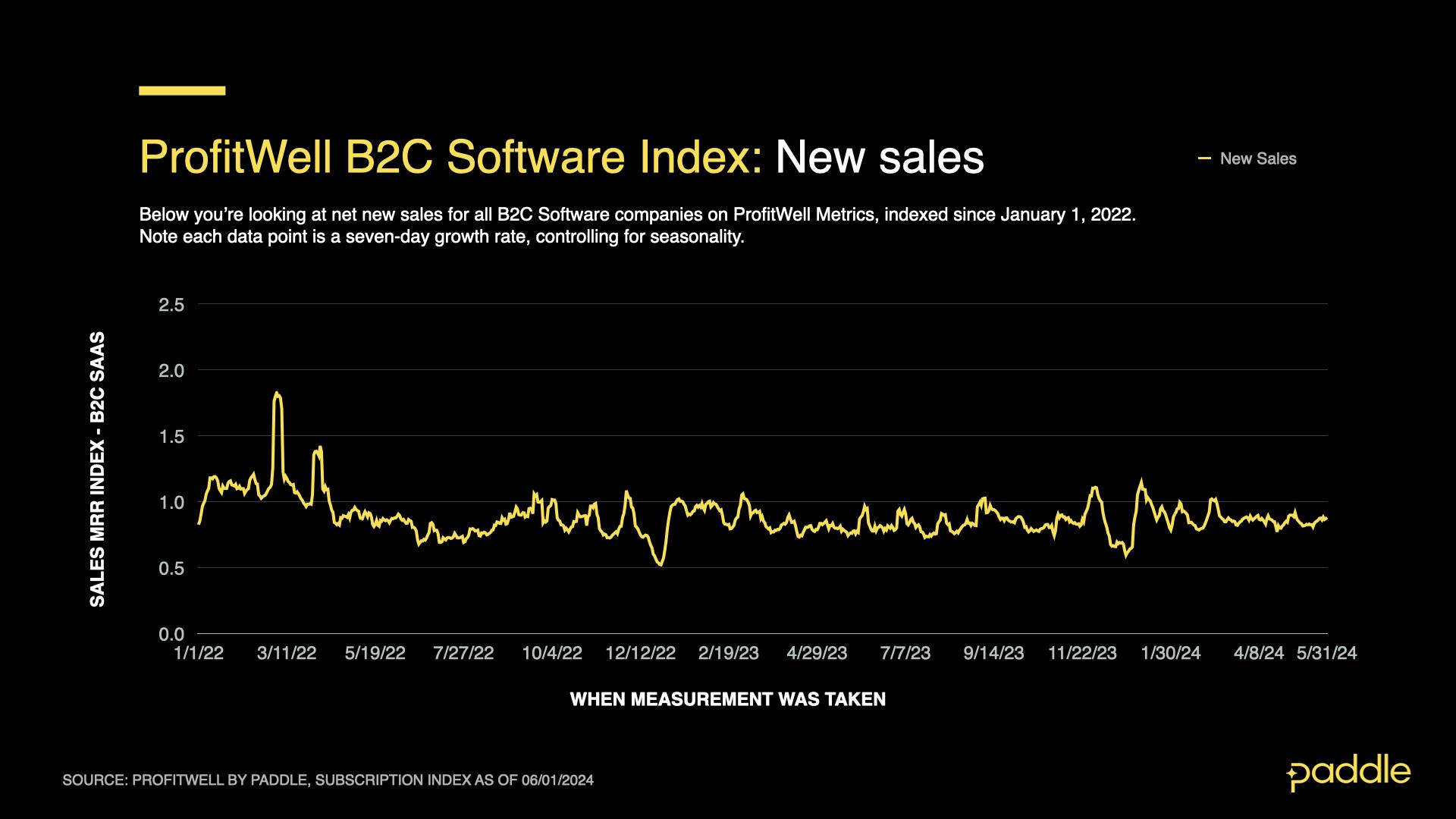

Analysing new sales, we observe much more stability, with fluctuations of about 4.3% per month. Given this stability, we expect new sales to remain in the ballpark of May’s value (0.856), for the rest of the year.

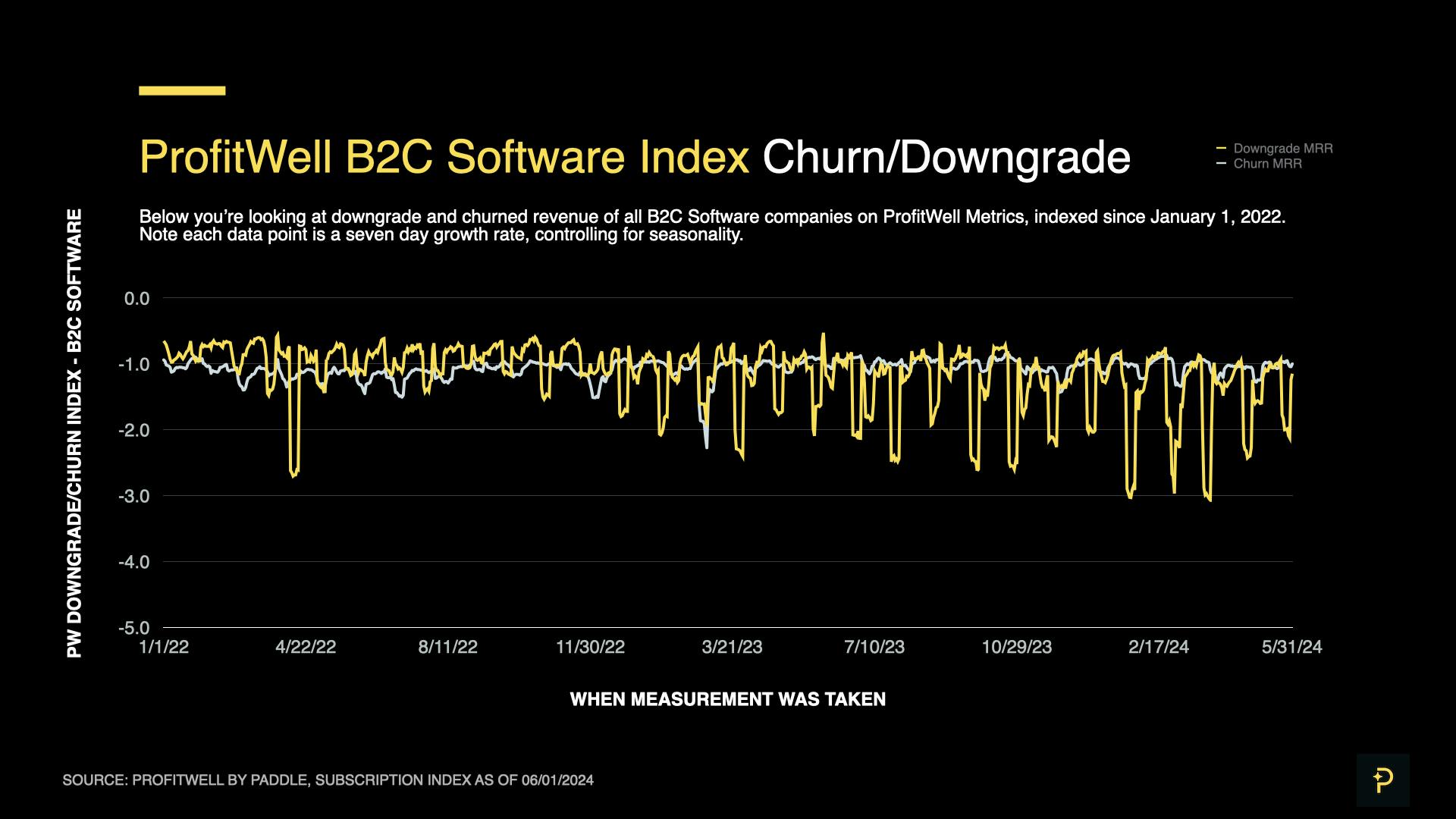

Examining our churn and downgrades indices, we find that churn decreased 1.5% to a value of -1.064 this month; while downgrades decreased by 5.3% to -1.382.

Looking at their stability, churn has been very steady (with a standard deviation of 3.0%); while downgrades have been the main source of fluctuations in B2C growth, due to a standard deviation of 9.9%.

Bringing it all together, we find that B2C revenue drivers - new sales, churn, downgrades and upgrades - are hovering around stable averages, with a bit more volatility than in B2B. The sharp drop in upgrades this month will require further monitoring, but we currently don’t believe it’s indicative of a larger trend.

Because of this, we conclude that B2C revenue growth will continue to hover around 8% CAGR, occasionally spiking or dipping, before reverting back to the mean.

Strategies to consider

Optimizing SaaS unit economics

Now that B2B and B2C are in their “slow and steady” era, it’s especially important to have a clear picture of your SaaS company’s subscription revenue and unit economics.

In today’s environment, you won’t have access to unlimited growth capital, like we saw in 2022. So, efficient growth is the name of the game. The SaaS companies with more capital leftover, to re-invest in product and growth will far outstrip their competitors, no matter how sluggish the market.

This means running countless experiments on pricing, product and distribution - and ensuring you have a single source of truth to track their impact on your revenue.

If your subscription analytics are spread over multiple platforms, or it requires tons of manual effort to set-up analyses & track new metrics, consider switching to a dedicated subscription analytics platform to streamline your experimentation.

Profitwell Metrics is one of the best free solutions, with industry-leading analytics ready out-of-the-box; and benchmarking data, to see how your company stacks up against other SaaS companies by stage, revenue or industry. Explore a demo of ProfitWell Metrics here.

Lean into different strategies to retain customers and revenue

Value in a SaaS business is not binary; it exists on a spectrum. Your customer base includes critics, satisfied customers, and strategic advocates. By understanding this spectrum, you can tailor your retention strategies to engage and retain each segment effectively.

Here are 3 key areas to focus on, to boost retention:

Get in front of cancellations

Retention strategies should start before a customer decides to cancel, and plan optimization is a powerful way to get in front of this.

Offering longer-term plans, such as quarterly or annual subscriptions, to increase the lifetime value (LTV) of customers. However, be sure not to overwhelm customers with these options at the point of purchase.

Instead, wait until you have established value with them, before presenting any upgrade offers. This approach ensures that upgrading feels like a natural progression and strengthens customer loyalty.

To make the upgrade process seamless, leverage emails and in-app notifications. By targeting customers with personalised messages, then making the upgrade process frictionless, you increase the likelihood of retention and provide an exceptional experience.

Expansion revenue

The top 10% of fastest growing companies receive at least 20-30% of their revenue from existing customers. It’s easier to expand your relationship with customers who already trust your product, than win over new customers. Look at upselling, cross-selling, and multi-product strategies to unlock this growth potential.

By leveraging add-ons, you can increase customer lifetime value (LTV) without introducing complex features - this can be something as simple as premium support, or white-glove on-boarding.

Make sure to lean on the right value metric in your pricing model rather than comparing features across competitors.

Payment failures

Delinquent payments are a major cause of customer churn. However, there are many strategies you can employ to recover failed payments and prevent unintentional cancellations.

- Communication with your customers is key - implement targeted messaging and leverage plain text emails to keep them engaged.

- Implementing tactical retries based on factors such as transaction type and decline code can significantly improve recovery rates.

- Use in-app notifications and expiration tracking to inform the customer of an impending payment expiration or a failure. From here, businesses can instigate a quicker response and make it easy for a customer to rectify the situation.

- Offer popular payment options like Apple Pay and Google Pay to make the payment process smoother and more convenient for your customers.

Building a successful retention strategy is not about drastic transformations; it's about small, incremental improvements. Implementing a combination of tactics tailored to your unique business and customer needs will pave the way for significant improvements to customer retention.

Prepare for an exit now (even if it feels early)

Many companies leave money on the table when they exit, by entering the process without laying the early groundwork. Due diligence is an intensive process, and leaving a few boxes unchecked can cost you millions. Now that we’re past the slump of 2023, the window for selling your company is opening again.

If you’re selling your product to customers all over the world, then sales tax compliance becomes very important when preparing for an exit. Non-compliance in countries where you should have been collecting and remitting taxes can result in fines, penalties, and even taking the tax liability amount off your valuation.

Here’s what Paddle CFO, Philip Watson had to say in a recent webinar:

"If you have not thought about this, it could result in a materially lower amount than you were expecting upon your exit."