Customizing the seventeen-rule framework of Benjamin Graham — Warren Buffett's mentor — for non-U.S. currencies, Interest Rates and Inflation.

United Kingdom

Although Graham's framework comprises primarily of ratios that are self-calibrating, there are a few region-specific parameters that may need to be customized if one is investing in countries other than the United States.

Shown below is one such customization using the currency conversion rates, Interest Rates and Consumer Price Index (CPI) values of the United Kingdom.

A point of interest here as well, is that Graham was British-born.

1. Size in Sales

The first region-specific parameter in Graham's framework is the Size rating.

Graham recommended a minimum Sales figure of $100 million for Defensive grade stocks, which works out to $700 million in 2022 based on the increase in CPI in the United States.

Since the Pound Sterling (GBP) is worth roughly 1.21 times the United States Dollar (USD) as of 2022, and since GrahamValue lists values for U.K. stocks in GBP, the Sales rating will simply need to be reduced by 1.21 times to screen for Defensive grade U.K. stocks.

140% ÷ 1.21 = 115%

700M ÷ 1.21 = 578M

This yields a Sales figures of £578 million, which corresponds to the $700 million required for a U.S. stock. Rounding up yields a Size in Sales filter value of 120%. A Size in Sales filter value of 120% yields a Sales figures of £600 million.

Size in Sales = 120%

1a. Size in Assets

For Public-Utilities and Financial Enterprises in the U.S., Graham recommended a Total Assets figure of $50 million which works out to $350 million today.

A similar calculation yields a Size in Assets filter value of 120%. A Size in Assets filter value of 120% yields a Total Assets figures of £300 million, which corresponds to the $350 million required for U.S. stocks.

Size in Assets = 120%

2. Earnings Growth

An Earnings Growth rating of 100% on GrahamValue corresponds to an actual averaged earnings growth of 33% over the past ten years, just as Graham recommended for U.S. stocks.

Since the change in CPI in the U.K. over the decade 2012-2022 is almost identical to the U.S. number — 25% — this rating requires the same adjustment in the U.K. today as in the U.S.

The CPI data required is available on the Office for National Statistics, and is discussed in more detail on the Forum.

Earnings Growth = 75%

3. Intrinsic Value

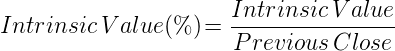

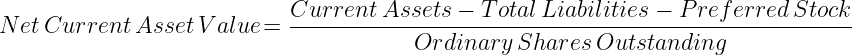

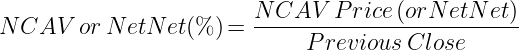

Intrinsic Value is the price corresponding to a stock's Graham Grade: Defensive, Enterprising or NCAV (Net-Net).

a. Defensive

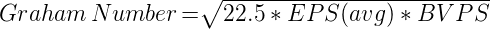

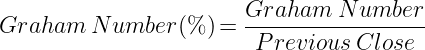

The Intrinsic Value of a Defensive grade stock is the same as its Graham Number.

A Graham Number(%) of 60% on GrahamValue corresponds to the 10-year AA Corporate Bond Yield of 2.16% in the U.S. as of January 2022.

Since Bond Yields in the U.K. are close to 2.21% in July 2022, this too allows for a P/E ratio of up to 45. The Graham Number of a stock would need to be multiplied by 1.73 to adjust it to a P/E of 45. This corresponds to a minimum Graham Number(%) of 58% on GrahamValue, which can be rounded up to 60%.

Graham Number(%) = 60%

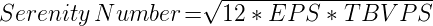

b. Enterprising

Enterprising grade stocks too would need to have their Intrinsic Value(%) adjusted similarly, as both calculations are based on similar principles.

Intrinsic Value(%) = 60%

c. NCAV (Net-Net)

NCAV figures are calculated based on asset values alone, and so NCAV (Net-Net) grade stocks do not require having their Intrinsic Value(%) adjusted.

NCAV or Net-Net(%) = 100%

Screening

The below links will open the Classic Graham Screener (free) and Advanced Graham Screener (paid) with all U.K. exchanges selected. The Advanced Graham Screener will have the adjusted parameters discussed above selected as well.

Currencies

GrahamValue gets all its Price Data and Fundamental Data from its data provider, and is designed to err on the side of caution. The Currency Codes for the Price Data and Fundamental Data of a stock are usually identical.

GBP / GBp

U.K. stocks are often traded in GBX (or GBp) while their fundamentals are reported in GBP. GrahamValue takes care of this 100x conversion.

For any other discrepancies between the Currency Codes of the Price Data and Fundamental Data, the stock's Previous Close is marked Zero; so as to prevent it from being accidentally cleared on GrahamValue's screeners.

Please note that while Graham cautions investors about foreign stocks and ADRs, he does not recommend against investing in non-U.S. economies.

Regional Distribution

Use the filters below to see how many stocks with Intrinsic Values exceeding 70% are available across countries and exchanges.

These lists only include analyses with Fiscal Years in the current or previous years. Older analyses are not counted.

Graham Grade

Stocks

Defensive

864

Graham Grade

Stocks

Defensive

277

Enterprising

1,727

NCAV (Net-Net)

1,179

Watch Video

Warren Buffett

Warren Buffett explains how, all else being equal, the location of a company does not affect the evaluation of its investment worthiness. The same framework can applied across countries and regions.