Mentor of Warren Buffett, Sir John Templeton, Bill Ruane, Irving Kahn and Walter Schloss. Author of the definitive Value Investing texts, Security Analysis and The Intelligent Investor. The man Buffett and Kahn named their sons after.

Benjamin Graham is the only investment guru you really need to know.

Benjamin Graham (May 9, 1894 – September 21, 1976) was a British-born American investor and professor. Graduating from Columbia University at age 20, he started his career on Wall Street and eventually founded the Graham-Newman Partnership. He also held an adjunct teaching position at Columbia University. Graham passed away in 1976 at the age of 82.

Protégés

1. Warren Buffett

Buffett studied under Graham in Columbia Business School, and has described Graham as the second most influential person in his life after his own father. Buffett even named his son — Howard Graham Buffett — after Graham.

Superinvestors of Graham-and-Doddsville (1984)

In 1984, Buffett gave a talk at Columbia Business School describing how Graham's record of creating exceptional investors (such as himself) is unquestionable; and how Graham's principles are everlasting. The talk is known today as The Superinvestors of Graham-and-Doddsville [PDF].

A transcript of the talk is available as an appendix in all editions of Graham's book — The Intelligent Investor — that have been published since 1986.

2. Irving Kahn

Irving Kahn, one of Graham's earliest students, also went on to become the oldest active money manager on Wall Street. Like Buffett, Kahn too named his son — Thomas Graham Kahn— after Graham.

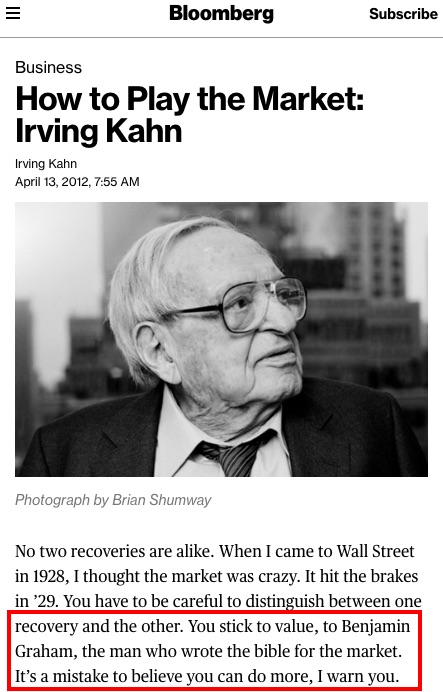

Bloomberg Article (2012)

In a 2012 article for Bloomberg Business titled How to Play the Market, Kahn wrote:

"You stick to value, to Benjamin Graham, the man who wrote the bible for the market. It’s a mistake to believe you can do more."

Irving Kahn, Bloomberg Business: How to Play the Market (2012).

3. Others

Other well-known students of Graham include:

- Creator of the world's largest international investment funds, Sir John Templeton.

- Famed value investor, Walter Schloss.

- Founder of the Sequoia Fund, William Ruane.

"I took Ben’s course in Advanced Security Analysis at the New York Stock Exchange Institute (New York Institute of Finance)... Many bright Wall Streeters such as Gus Levy of Goldman Sachs, who later became the top arbitrageur in the country, used to take his course. I often wondered how much money people made on Ben’s ideas by transforming them into investments."

Walter J. Schloss, Benjamin Graham and Security Analysis: A Reminiscence (1976) [PDF].

"Heed the words of the great pioneer of stock analysis Benjamin Graham: 'Buy when most people...including experts...are pessimistic, and sell when they are actively optimistic'."

Sir John Templeton, Franklin Templeton Investments: 16 Rules For Investment Success (1993).

"[Graham] is the genius who literally created the framework for investment analysis that leads to successful investing. Like that other genius Edison, Graham created light where there was none."

Bill Ruane (Sequoia Fund), The Rediscovered Benjamin Graham: Selected Writings of the Wall Street Legend (1999).

Many contemporary value investors — such as Seth Klarman and Bill Ackman — too claim to have been strongly influenced by Graham's principles of investing.

Books

1. The Intelligent Investor

The newer and more concise of Graham's investment texts, The Intelligent Investor was last written by Graham himself in 1973 and published as the 4th Revised edition. This edition was reprinted in 1986; with a preface by Warren Buffett, and with the transcript of Buffett's 1984 talk The Superinvestors of Graham-and-Doddsville as an appendix.

Buffett's Preface (1986)

Buffett writes in the preface that "more than any other man except my father, [Graham] influenced my life", while describing The Intelligent Investor itself as "by far the best book about investing ever written".

Buffett also writes:

"To invest successfully over a lifetime does not require a stratospheric IQ, unusual business insights, or inside information. What’s needed is a sound intellectual framework for making decisions and the ability to keep emotions from corroding that framework. This book precisely and clearly prescribes the proper framework."

Warren Buffett, Preface (1986): The Intelligent Investor (by Benjamin Graham).

Bogle's Foreword (2005)

In his Foreword to the 2005 reprint of the original 1949 edition of The Intelligent Investor, John Bogle writes:

"The basic principles of intelligent investing that [Graham] set forth... have remained virtually intact and unassailable."

John Bogle, Foreword (2005): The Intelligent Investor (by Benjamin Graham).

2. Security Analysis

The earlier and more voluminous of Graham's books, Security Analysis was co-authored with Graham's student David Dodd. Security Analysis served as the introduction and foundation to what would eventually come to be known as Value Investing.

Security Analysis was last reprinted in 2008, with a foreword by Warren Buffett and a preface by Seth Klarman. Given below are excerpts from both.

Buffett's Foreword (2008)

"My intellectual odyssey ended, however, when I met Ben and Dave, first through their writings and then in person. They laid out a roadmap for investing that I have now been following for 57 years. There’s been no reason to look for another."

Warren Buffett, Foreword (2008): Security Analysis (by Benjamin Graham).

Klarman's Preface (2008)

"The real secret to investing is that there is no secret to investing. Every important aspect of value investing has been made available to the public many times over, beginning in 1934 with the first edition of Security Analysis."

Seth Klarman, Preface (2008): Security Analysis (by Benjamin Graham).

Legacy

Graham's legacy in the investing world is almost impossible to overstate. In addition to mentoring — and later inspiring — generations of investors, Graham has been credited with single-handedly creating the field of security analysis and bringing structure to the activity of investing.

Graham was also one of the first to point out that the market indices often beat actively-managed funds. This paved the way for the eventual creation of Index Funds, which would provide retail investors with more freedom and accountability in their investments than ever before.

So perhaps it would be best to end with Buffett's own conclusion to The Superinvestors of Graham-and-Doddsville:

"Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace, and those who read their Graham & Dodd will continue to prosper."

Warren Buffett, Columbia Business School: The Superinvestors of Graham-and-Doddsville (1984).

Watch Videos

Graham at Columbia University

Buffett, Bezos etc

In the 2018 Balance of Power interview for Bloomberg Markets, Buffett was quoted again as saying that the principles of sound investment have not changed at all since his mentor first defined them.

"The principles haven't changed at all... It's exactly what Ben Graham wrote in 1949."

Warren Buffett, Bloomberg Markets: Balance of Power (2018).

Lauren Templeton, great niece of Sir John Templeton, talks at Google in 2017 about Sir John being Graham's Student and the Templeton maxim "To buy when others are despondently selling...".

Seth Klarman, chief executive of the Baupost Group, talks about Graham's influence on him; in a 2011 interview with Charlie Rose.

The complete playlist of videos is given below.

Size of Playlist: 14 Videos

Total Viewing Time: 26 Minutes