Warren Buffett's mentor recommended various Value Investing strategies that offered differing returns, and required varying degrees of due diligence.

Introduction

Benjamin Graham was an economist and professional investor who mentored Warren Buffett, Irving Kahn, Walter J. Schloss and other famous Value Investors at Columbia Business School.

Buffett, who credits Graham with grounding him with a sound intellectual investment framework, describes Graham as the second most influential person in his life after his own father. In fact, Graham had such an overwhelming influence on his students that two of them — Buffett and Kahn — named their sons after him.

In the preface to Graham's book, The Intelligent Investor, Buffett calls it "by far the best book about investing ever written".

Greater Effort, Greater Returns

Contrary to common thinking that greater profits require greater risks, Graham said that if he had to distill the secret of sound investment into three words, they would be Margin of Safety. The chapter on Margin of Safety in Graham's book is also the one most highly recommended by Buffett.

"There has developed the general notion that the rate of return which the investor should aim for is more or less proportionate to the degree of risk he is ready to run. Our view is different. The rate of return sought should be dependent, rather, on the amount of intelligent effort the investor is willing and able to bring to bear on his task."

Chapter 4: General Portfolio Policy, The Intelligent Investor.

Graham taught that the returns an investor could expect were not proportional to the risk he was willing to assume, but rather, to the effort he was willing to put into his investments. He thus recommended various investing strategies that offered differing returns, and required varying degrees of due diligence.

In this article, we will look at each of these Value Investing strategies in turn, and see how one can implement them today.

Strategy 1: Zero Effort - Blue Chips / Index Funds

Graham often emphasized that most mutual funds did not beat the market average, as measured by the indices. He thus recommended that the first strategy for any investor — one that required nearly no effort — was to proportionally invest in Blue Chips, or stocks that comprise one of the Indices. This is something that can be done a lot more easily today, by simply investing in an index fund.

"In the first he acquires a true cross-section sample of the leading issues, which will include both some favored growth companies, whose shares sell at especially high multipliers, and also less popular and less expensive enterprises. This could be done, most simply perhaps, by buying the same amounts of all thirty of the issues in the Dow-Jones Industrial Average (DJIA)."

Chapter 14: Stock Selection for the Defensive Investor, The Intelligent Investor.

Thus it would be safe to say that Graham's first recommended strategy today would be to invest in a reputed index fund following a popular index like the DIJA or the S&P 500. Graham believed that the choice of index would make very little difference.

General research on fund performance seems to indicate that the S&P 500 Index Funds rate the highest, especially against managed mutual funds (as expected). Some of the best performing S&P 500 Index Funds appear to be those by Vanguard [VFINX], Fidelity [FUSEX] and Schwab [SWPPX].

However, there are numerous resources available online specifically for the purpose of analyzing index funds. So we shall move on to the more complex, and more profitable, of Graham's strategies — the ones concerning the selection of stocks.

Strategy 2: Minimum Effort - Defensive Grade Stocks

The first grade of stocks recommended by Graham are called Defensive stocks. The criteria that Graham specified for identifying Defensive stocks are as follows:

1. Not less than $100 million of annual sales. 2-A. Current assets should be at least twice current liabilities. 2-B. Long-term debt should not exceed the net current assets. 3. Some earnings for the common stock in each of the past 10 years. 4. Uninterrupted [dividend] payments for at least the past 20 years. 5. A minimum increase of at least one-third in per-share earnings in the past 10 years. 6. Current price should not be more than 15 times average earnings. 7. Current price should not be more than 1½ times the book value.

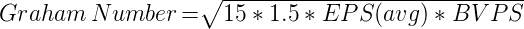

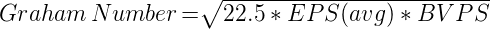

As a rule of thumb, we suggest that the product of the multiplier times the ratio of price to book value should not exceed 22.5.

Chapter 14: Stock Selection for the Defensive Investor, The Intelligent Investor.

Criterion #1 works out to $500 million today based on the increase in CPI / Inflation.

Graham's recommended price for Defensive stocks can be calculated from criteria #6 and #7. This price is popularly known as the Graham Number.

Graham recommended a minimum portfolio size of 10 and a maximum of 30 for Defensive investors. Since Defensive stocks are the most well established stocks meeting the most stringent of criteria, the effort required to create and maintain the portfolio can be reduced to a minimum by restricting the portfolio to 10 Defensive stocks.

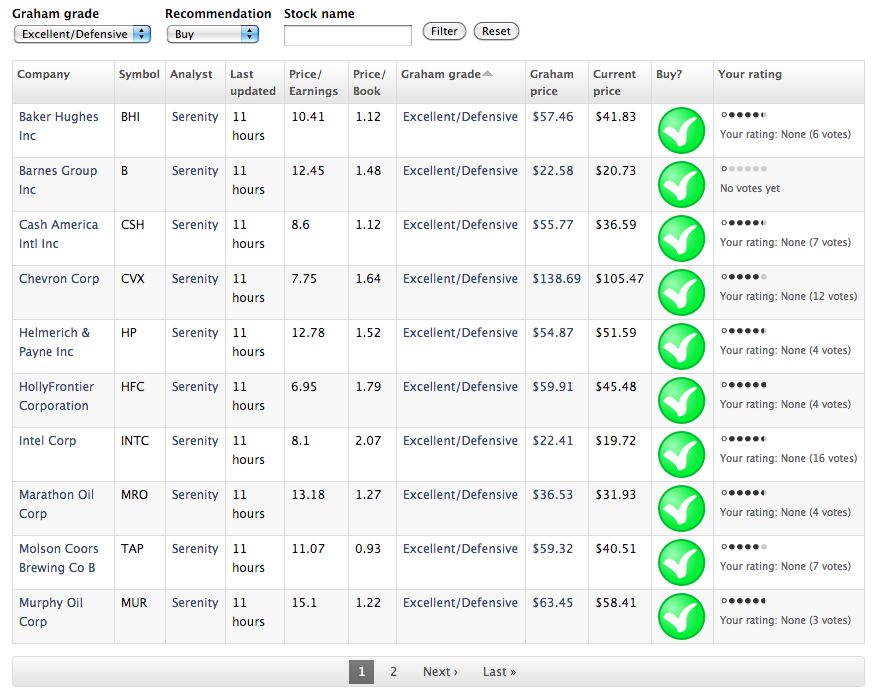

A full Graham analysis of all 4000 NYSE and NASDAQ stocks brings up 12 stocks meeting all of Graham's Defensive criteria, even with calculations adjusted for inflation. Shown here are the first 10 from the Classic Graham Screener:

Latest Defensive Stocks

The following links will open GrahamValue's Graham stock screeners preloaded with stocks that clear Graham's rules for Defensive Industrials today. At today's Interest Rates, completely Defensive and Enterprising grade Graham stocks require Intrinsic Values of 70% or higher.

The following link will open the Advanced screener preloaded with stocks that clear Graham's rules for Defensive Utilities and Financials today.

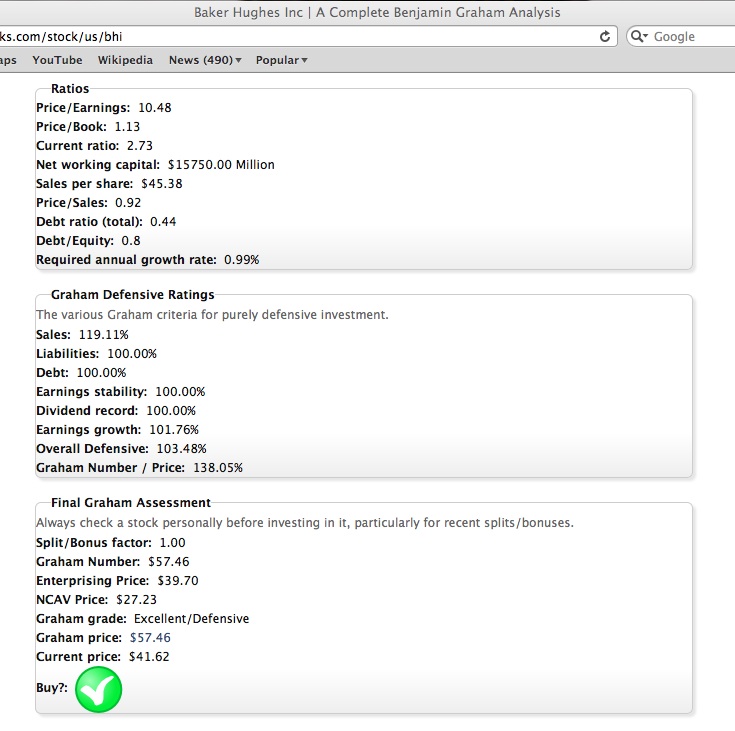

Graham Analysis Example - BHI

[For a more recent example, please see the 2018 analysis for Apple Inc (AAPL)]

To better understand how this result was arrived at, let us look at the detailed analysis for the first of these stocks - Baker Hughes Inc. (BHI).

The first section on BHI's page gives some useful financial ratios. But this information is not directly required for the actual Graham analysis.

The next section is of more interest since it gives an individual rating for each of the eight Defensive criteria specified by Graham. As can be seen, BHI scores more than 100% on all ratings, as is required for an approved Defensive stock.

But the most important section is the last one. This section gives all the three different Graham prices for a stock, and then gives the final Graham analysis for the stock. In the case of BHI, it shows that BHI is a Defensive stock, and hence BHI's final Graham price is the same as its Graham Number. Finally, this section shows that the current price of this stock is less than its Graham price, so the stock is approved for purchase.

Strategy 3: Medium Effort - Enterprising Grade Stocks

For Enterprising investors who are looking for greater profits, and are willing to put in more effort into the maintenance of their portfolio, Graham then recommends the following criteria for identifying Enterprising grade stocks:

[For issues selling at earnings "multipliers under 10"]

1-A. Current assets at least 1½ times current liabilities. 1-B. Debt not more than 110% of net current assets. 2. Earnings stability: No deficit in the last five years covered in the Stock Guide. 3. Dividend record: Some current dividend. 4. Earnings growth: Last year's earnings more than those of 1966.

5. Price: Less than 120% net tangible assets.

Chapter 15: Stock Selection for the Enterprising Investor, The Intelligent Investor.

Criterion #4 corresponds approximately to the earnings figure of four years ago.

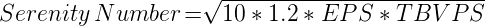

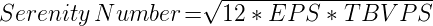

This second set of criteria gives us a Graham price for a stock meeting Enterprising conditions as the lower of 120% net tangible assets (book value), or 10 times Trailing EPS. We can combine the two — as Graham did for the Defensive Price — to yield a price calculation similar to the Graham Number. Let's call this the Serenity Number.

Since Enterprising stocks are not as well established as Defensive stocks, the portfolio needs to be diversified more. GrahamValue's recommendation is for a minimum of 20 Enterprising stocks. Such a portfolio will also require more effort in the selection, verification, tracking and balancing of the component stocks.

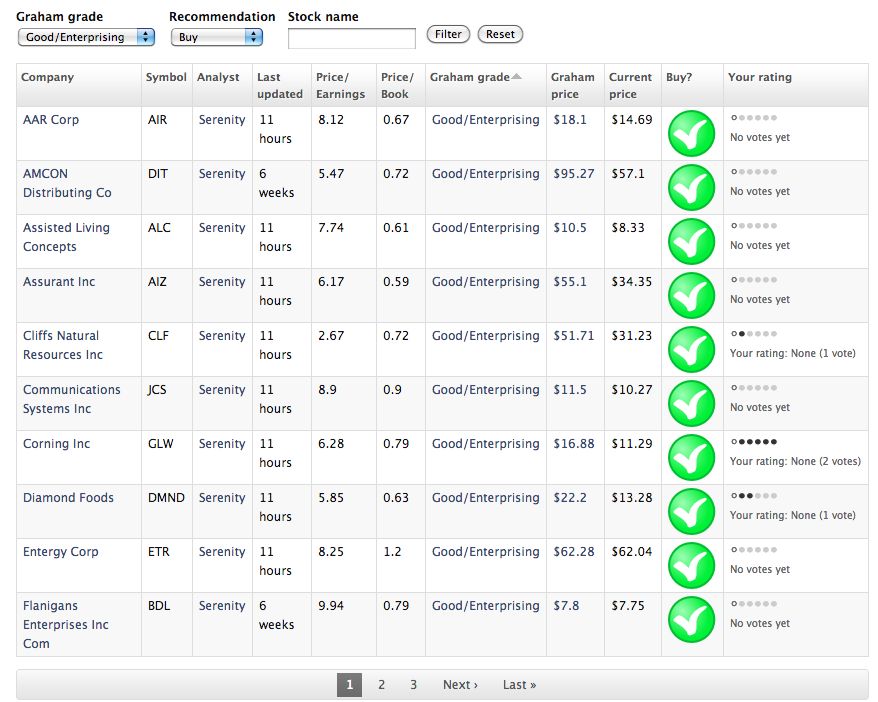

An automated analysis of all 4000 NYSE and NASDAQ stocks brings up 25 stocks meeting all of Graham's Enterprising criteria, with calculations adjusted for inflation. Shown here are the first 10 from the Classic Graham Screener:

Latest Enterprising Stocks

The following links will open the screeners preloaded with stocks that clear Graham's rules for Enterprising investors today.

Strategy 4: Maximum Effort - NCAV Grade Stocks

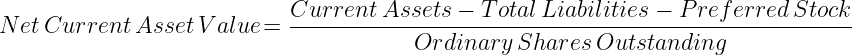

For investors who were willing to put in the most effort into the maintenance of their portfolio, Graham finally recommended NCAV grade stocks, which he defined as:

"Bargain Issues, or Net-Current-Asset Stocks ...price less than the applicable net current assets alone - after deducting all prior claims, and counting as zero the fixed and other assets.

...eliminated those which had reported net losses in the last 12-month period."

Chapter 15: Stock Selection for the Enterprising Investor, The Intelligent Investor.

These criteria give us stocks selling for less than the value of their cash worth alone, and with positive earnings in the last one year. These stocks are also the most famous of Graham's stocks, and the source of the general misconception that Graham only recommended cheap stocks. These were, in fact, the last grade of stocks that Graham recommended.

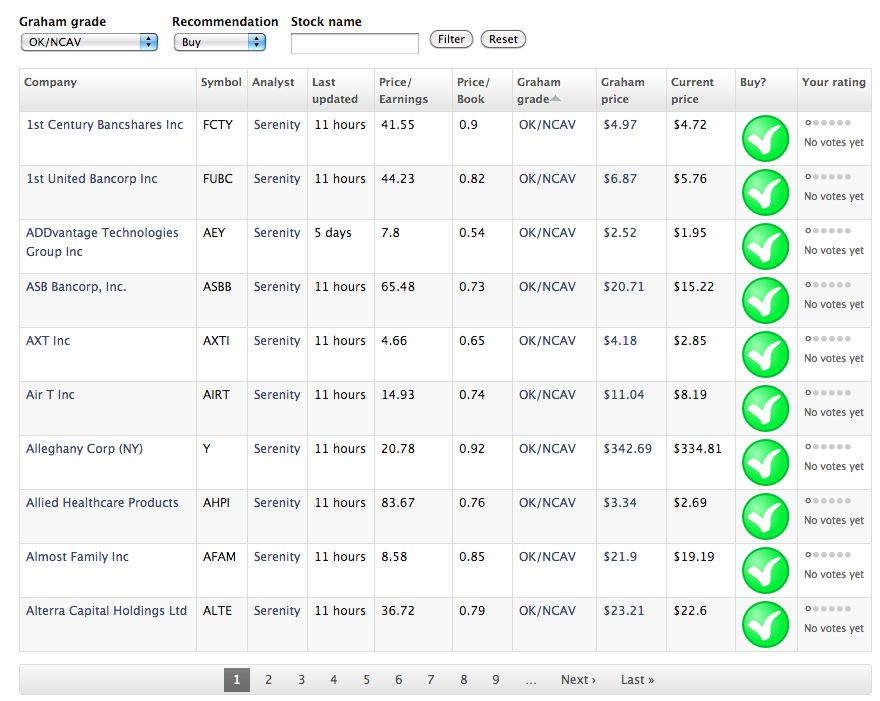

Since NCAV stocks are the least established stocks of all stocks, such a portfolio will have to be the most diversified, requiring at least 30 NCAV stocks. Such a portfolio will also require the most effort in the selection, verification, tracking and balancing of its component stocks.

An automated analysis of all 4000 NYSE and NASDAQ stocks brings up more than 300 stocks meeting all of Graham's NCAV criteria, with calculations adjusted for inflation. Shown here are the first 10 from the Classic Graham Screener:

Latest NCAV Stocks

The following links will open the screeners preloaded with stocks that clear Graham's NCAV rules today.

Strategy 5: Special Situations or "Workouts"

Graham considered Special Situations theoretically a part of the program of operations of an Enterprising investor, but classified them as a business altogether different from regular investing.

As the name indicates, these are special strategies that follow no specific rules or calculations. Some of the operations that Graham classified under this category are acquisitions of smaller firms by larger ones, arbitrage operations, the breakup of public-utility holding companies pursuant to legislation, issues that are involved in any sort of complicated legal proceedings and with prices beaten down to unduly low levels due to the ensuing prejudice, etc.

Being able to identify and take advantage of a special situation requires years of experience with Graham's previous strategies. Graham himself wrote:

"The exploitation of special situations is a technical branch of investment which requires a somewhat unusual mentality and equipment. Probably only a small percentage of our enterprising investors are likely to engage in it..."

Chapter 7: Portfolio Policy for the Enterprising Investor: The Positive Side, The Intelligent Investor.

Elsewhere, he noted about "workout or arbitrage" opportunities:

"This has become more than ever a field for professionals, with the requisite experience and judgment..."

Chapter 15: Stock Selection for the Enterprising Investor, The Intelligent Investor.

Thus, special situations will need to be studied on a case by case basis and are not open to any general analysis. But any investment of this kind will still need to meet Graham's basic requirements of a Margin of Safety, as well as his definition of an investment operation (as distinguished from speculation).

"An investment operation is one which, upon thorough analysis promises safety of principal and an adequate return. Operations not meeting these requirements are speculative."

Chapter 1: Investment versus Speculation, The Intelligent Investor.

To Conclude

The effort Graham foresaw in investing was not only in finding and verifying stocks, but also in monitoring and balancing the portfolio — selling stocks that have corrected themselves and buying new ones etc. Thus, the more stocks in your portfolio, the greater is the overall effort involved.

So it important to choose an investment strategy carefully. A good approach would be to start with a low effort strategy and evolve as you get more comfortable; possibly starting with 10 Defensive stocks, and gradually replacing 5 of them for 10 Enterprising ones and so on.

Graham's principles have been recommended again and again over the years — by Buffett and by Graham's other students — in books and in speeches. Buffett even gave a famous speech in 1984, called The Superinvestors of Graham-and-Doddsville [PDF] about why the most successful investors in the world were all students of Graham.

Watch Video

Buffett: Fisher, Munger and Graham

At the 1997 Berkshire Hathaway Annual Shareholders Meeting, Buffett describes how he graduated into Special Situations.