Benjamin Graham was Warren Buffett's professor and mentor at Columbia Business School. Buffett even named his son - Howard Graham Buffett - after Graham. In the preface to Graham's book - "The Intelligent Investor" - Buffett calls it "by far the best book about investing ever written."

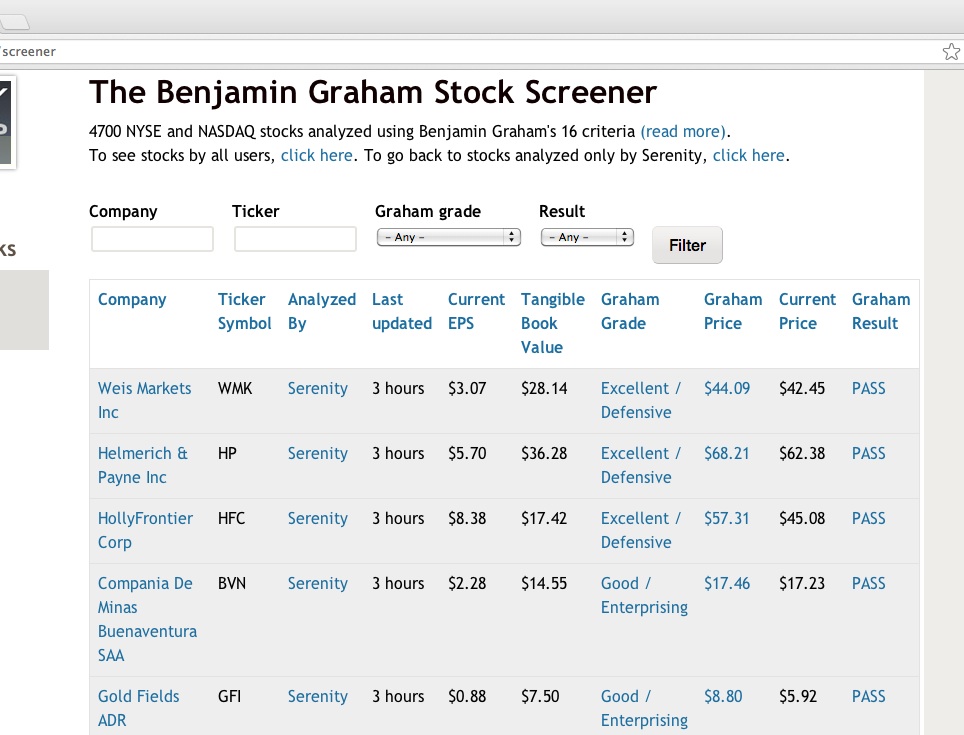

Earlier, we looked at how to How To Build A Complete Benjamin Graham Portfolio using the 17 financial criteria given by Graham. GrahamValue's Classic Graham Screener applies these 17 criteria to 4700 NYSE and NASDAQ stocks every day to screen valid Graham stocks.

Today, we will look at ways in which modern technology lets us both customize Graham's criteria and apply them on a hitherto unprecedented scale, all without violating Graham's basic definition:

"An investment operation is one which, upon thorough analysis, promises safety of principal and an adequate return. Operations not meeting these requirements are speculative."

The Defensive and Enterprising Criteria

The safest grade of stocks recommended by Graham are called Defensive stocks. The criteria that Graham specified for identifying Defensive stocks are as follows:

Summarized from Chapter 14 of The Intelligent Investor - Stock Selection for the Defensive Investor:

1. Not less than $100 million of annual sales.

[Note: This works out to $500 million today based on the difference in CPI/Inflation from 1971]

2-A. Current assets should be at least twice current liabilities.

2-B. Long-term debt should not exceed the net current assets.

3. Some earnings for the common stock in each of the past 10 years.

4. Uninterrupted [dividend] payments for at least the past 20 years.

5. A minimum increase of at least one-third in per-share earnings in the past 10 years.

6. Current price should not be more than 15 times average earnings.

7. Current price should not be more than 1-1⁄2 times the book value.

As a rule of thumb, we suggest that the product of the multiplier times the ratio of price to book value should not exceed 22.5.

For Enterprising investors who were looking for greater profits, Graham then recommended the following criteria:

Summarized from Chapter 15 of The Intelligent Investor - Stock Selection for the Enterprising Investor:

[Note: For issues selling at P/E multipliers under 10]

1-A. Current assets at least 1 1⁄2 times current liabilities.

1-B. Debt not more than 110% of net current assets.

2. Earnings stability: No deficit in the last five years covered in the Stock Guide.

3. Dividend record: Some current dividend.

4. Earnings growth: Last year's earnings more than those of 1966.

[Note: This corresponds approximately to the earnings of 2008 today]

5. Price: Less than 120% net tangible assets.

The third and last set of criteria, specified for NCAV stocks, are far too simple for customization and thus not dealt with in this article.

However, Graham's Defensive and Enterprising criteria are extremely selective and applying all 17 criteria to 4700 NYSE and NASDAQ stocks, after adjustments for inflation, brings up only the following stocks today.

While seen as a shortcoming by some, such extreme selectivity is actually a testament to Graham's decades of research and back-testing. Only the very best stocks clear his criteria.

"Spinoza’s concluding remark applies to Wall Street as well as to philosophy: “All things excellent are as difficult as they are rare.”"

Benjamin Graham, Chapter 8: The Investor and Market Fluctuations, The Intelligent Investor.

Tweaking The Defensive and Enterprising Criteria

Let us now see if we can use modern technology to apply Graham's criteria in ways that would have been far more difficult in his time.

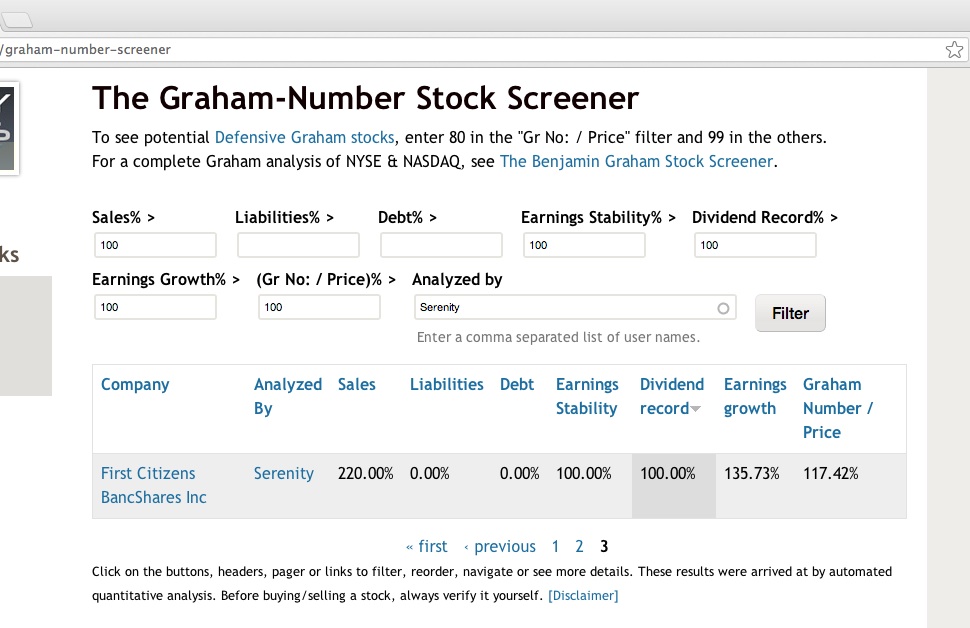

A quick look at GrahamValue's second screener, the Advanced Graham screener, will show that of the 4700 NYSE and NASDAQ stocks, nearly 630 have been paying dividends for 20 consecutive years. And of these, about 110 are selling for less than their Graham Number.

In fact, applying all but 2 of the Defensive criteria still validates 21 of the 4700 stocks. It's only the criteria for Current Liabilities and Long Term Debt that bring down the number of approved stocks drastically.

Now, the Enterprising stock selection criteria are, for the most part, a modification of the Defensive criteria - where one simply pays less for a stock that has a less impressive history than a Defensive stock.

Let's now see how we can apply each of the Enterprising criteria as a percentage of the Defensive criteria.

1. Sales - Not required. Since the Enterprising criteria mention no specific sales requirement, we will leave this criteria out entirely.

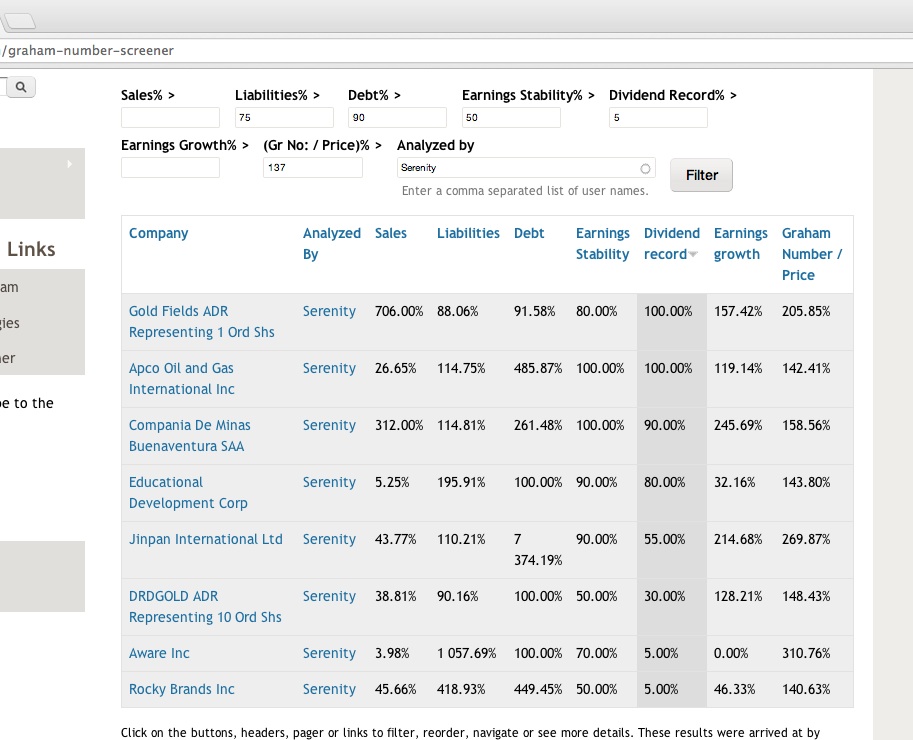

2. Current Liabilities - 75%. The Defensive criteria specify that Current assets should be at least twice current liabilities. The Enterprising criteria specify that Current assets be at least 1-1⁄2 times current liabilities. Thus, a stock that meets 75% of this Defensive criterion will meet this Enterprising criterion completely.

3. Long Term Debt - 90%. The Defensive criteria specify that Long-term debt should not exceed the net current assets. The Enterprising criteria specify Debt not more than 110% of net current assets. Thus, a stock that meets 90% of this Defensive criterion will meet this Enterprising criterion completely.

4. Earnings Stability - 50%. The Defensive criteria specify some earnings for the common stock in each of the past 10 years. The Enterprising criteria specify no deficit in the last five years. Thus, a stock that meets 50% of this Defensive criterion will meet this Enterprising criterion completely.

5. Dividend Record - 5%. The Defensive criteria specify uninterrupted payments for at least the past 20 years. The Enterprising criteria specify some current dividend. Thus, a stock that meets 5% of this Defensive criterion will meet this Enterprising criterion completely.

7. Earnings Growth - 0%. The Defensive criteria specify a minimum increase of at least one-third in per-share earnings in the past 10 years (using 3 year averages). The Enterprising criteria require last year's earnings to be more than those of 2008 (Graham specified 1966 in 1971).

We will not use this criteria as entering a value here will wrongly eliminate any stocks that did not have earnings 8-10 years ago. Also, criteria #4 already ensures that all stocks have uninterrupted earnings for at least the last 5 years. So any stock with a drastic reduction in earnings since then can simply be eliminated manually.

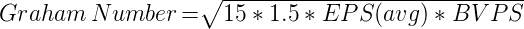

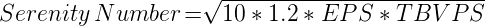

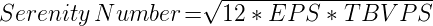

7. Graham Number / Price - 137%. The Defensive criteria specify that the product of the multiplier times the ratio of price to book value should not exceed 22.5 (15 x 1.5). The Graham Number is thus defined as:

The Enterprising criteria require a price lower than 120% net tangible assets (book value), or lower than 10 times Trailing EPS. We can combine the two - as Graham did for the Defensive Price - to yield a price calculation similar to the Graham Number. To avoid wrongly attributing this number to Graham, let's call this the Serenity Number.

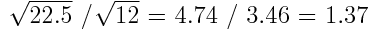

The Graham Number is essentially 137% of the Serenity Number.

Thus, any stock for which the Graham Number is 137% or more of its current price will meet this Enterprising criterion completely.

The Final List of Stocks

Applying the above customized Enterprising criteria to 4700 NYSE and NASDAQ stocks now gives us a much larger list of stocks.

We do not violate any of Graham's fundamental principles in generating this list either. Technology simply allows us to do statistical exercises in minutes that would have taken months earlier.

To Conclude

As can be seen, while Graham's Enterprising criteria in themselves don't validate many stocks under today's market conditions, customizing them even a little brings up at many more stocks. Thus, using a combination of both exact Graham criteria (such as those used in the Ben Graham Screener) and customized Graham criteria (as shown above) should yield a good number of stocks for further verification and investment under most normal market conditions.

The example given above is of one such customization, using a set of criteria that Graham himself prescribed. With today's technology, it's easy to try out various such combinations of criteria to find stocks best suited to our investment goals. But important to remember at all times are Graham's fundamental requirements for any investment operation - Safety of Principal and Adequate Return.

Disclaimer: The results were arrived at by automated quantitative analysis and were not verified manually. Verify the validity of the data used - most importantly, for any recent stock splits - before making an investment decision.

2019 Update

Warren Buffett explains how the Intrinsic Value of a stock is dependent on prevailing bond yields and interest rates.