Frequently Asked Questions about the Value Investing framework of Benjamin Graham — Warren Buffett's mentor — and its application on GrahamValue.

Topics

Video Tutorials

Given below is the YouTube Playlist of Video Tutorials from the Quick Reference, that answers almost all commonly asked questions.

Size of Playlist: 10 Videos

Total Viewing Time: 32 Minutes

Note: The filter calculators required for some of the videos are given in the links in the Footnotes of the Quick Reference.

GrahamValue

If your card is being declined by PayPal, please see possible causes and solutions.

Please note that GrahamValue simply forwards the payment request to PayPal. GrahamValue does not control what payment options PayPal presents, or how it processes them.

Orders on GrahamValue are marked Complete after an internal review. But access is granted automatically as soon as payment is completed, even when the order is still marked Pending.

The payment can be linked to the account, so long as the email addresses used on both PayPal and GrahamValue are identical. If the two email addresses are different, please include a note with the payment; or drop a note using email or chat.

When payment is made with an eCheck, the plan will activate as soon as the eCheck clears. The process is automated and requires no human intervention.

An eCheck usually clears in about 3-5 days. PayPal should send an email as soon as the eCheck clears, and access is automatically granted.

All other modes of payment — apart from eChecks — will result in instant access.

Accounts that have never been used can sometimes get deleted during cyber attacks. Accounts that are actually being used and have data, apart from that given during registration, will not be affected.

If this sounds like your scenario, please create your account again.

If you are shown a message that your account already exists when you try to create it again, your account may have been locked for security.

GrahamValue prevents brute force attacks on accounts; by either locking an account that has more than 5 failed login attempts (within six hours), or blocking an IP address that has more than 50 failed login attempts (within one hour).

If this sounds like your scenario, please wait before trying to login again (6 hours).

Anyone with an account can post on GrahamValue's forums. But when under cyber attack, posting by free accounts is temporarily disabled till the offending accounts are identified and purged.

For your security, it is recommended that your public username be different from your email address.

The system will allow you to retrieve your account with either your username or your email address. They do not have to be the same for account access or password recovery.

Graham Number

Graham Numbers on GrahamValue are calculated using the average Earnings Per Share (EPS) of the past three years, exactly as Graham required. However, this averaging procedure is rarely followed elsewhere; and so Graham Numbers on GrahamValue are quite likely to differ from those on other sources.

The Defensive price (Graham №) is the price that would be acceptable for a stock, if it were to clear all Defensive qualitative requirements. Typically, such a stock would be worth more; since Defensive qualitative requirements are more stringent than Enterprising qualitative requirements.

Graham

Graham's framework comes very highly recommended, with Buffett recommending it again as recently as 2018. Additionally, the full framework is so exhaustive as to require several days to even peruse.

GrahamValue is therefore designed to be as faithful to Graham's framework as possible, adjusting only for bond yields and inflation. This is also based on the reasoning that including any additional material would be both superfluous and unnecessarily distracting, from that which is both essential and adequate.

Investing in Index Funds is very much part of Graham's framework, and is therefore in line with Buffett's previous recommendations to follow Graham.

The extreme selectivity of Graham's framework is exactly what makes it so effective (and possibly unpopular). Stocks that clear Graham's rules may be few, but an automated broad-market statistical analysis can dig up enough of them for a full portfolio (check your exchanges),

Graham specifically prescribes Book Value for Defensive investors, and Net Tangible Assets for Enterprising investors.

Therefore, the prices for Defensive quality stocks (or Graham Numbers) on GrahamValue are calculated using Book Values; and the prices for Enterprising quality stocks (or Serenity Numbers) are calculated using Net Tangible Assets.

Note: The subject is discussed in more detail in the forum topics, Defensive Investor Questions and TBVPS.

Net Current Assets (or Working Capital) is defined as Current Assets minus Current Liabilities. This is the generally accepted definition; and is even mentioned in Graham's own book, The Interpretation of Financial Statements.

For NCAV stocks however, Graham specifically mentions "after deducting all prior claims... fixed and other assets". This is the reason Total Liabilities is used to identify NCAV stocks, both on GrahamValue and elsewhere.

Benjamin Graham specifies three different Intrinsic Value calculations — the Graham Number, the Enterprising price calculation and the NCAV — in his framework, with supporting qualitative rules for each.

Graham also wrote extensively about the unreliability of estimates in finance. His actual framework only uses objective past and present figures, and requires no subjective assumptions about the future.

So, a stock's intrinsic value is not subjective; at least, not according to Value Investing as taught by its founder.

In very basic terms, qualitative factors tell us how good a stock is; while quantitative factors tell us how much it delivers at its current price.

Earnings is thus a qualitative factor when used to measure growth, but a quantitative one when compared against stock price.

The Graham Ratings section of the Quick Reference has a description of each filter.

Graham Ratings are defined such that they're better when higher, and that Graham's Defensive requirements default to 100%. The filters go past 100% where applicable, up to 1000% in some cases, to allow for screening past 100%.

The Quick Reference also has filter-preset links for opening the screeners with Graham's standard filters set in advance.

The Save Search feature on the screeners can be used to preset your preferred exchanges for regular use. The Save Search feature can be used to save or bookmark any of your preferred filter parameters.

The optional columns can be shown or hidden using the checkboxes above the filters. The optional columns are hidden by default, and the Intrinsic Value columns at the end should be visible by default; on a standard size screen.

GrahamValue's screeners do not have Lesser Than filters since Graham parameters are designed to be better when higher.

For example, NCAV grade stocks having Intrinsic Values above 60% of their stock prices and Graham Numbers above 20% of their stock prices can be listed as follows on the free Classic Graham Screener.

But one can always check for stocks with low values in a parameter, using the sort feature. For example, NCAV grade stocks having Intrinsic Values above 60% of their stock prices — and having the lowest Graham Numbers — can be listed as follows on the free Classic Graham Screener.

Most parameters on GrahamValue are defined such that they are better when higher. This is the reason GrahamValue displays Equity ÷ Debt, instead of Debt ÷ Equity.

Intrinsic Value(%) is defined as Intrinsic Value ÷ Previous Close. Therefore, a higher value is preferable, since more Intrinsic Value is always better. The same applies for the Graham Number(%) as well.

Graham's stock selection framework is designed to work regardless of Sector or Industry. Lower Assets can be offset by higher Earnings, and vice versa, in most of Graham's Intrinsic Value calculations.

The basic idea is that if two companies have identical figures and histories — balance sheets, dividends, EPS, BVPS etc — how they get there is largely irrelevant.

Sectors are relevant only in an advanced application of Graham's framework, screening for Utilities and Financials; and so only supported by the Advanced Graham Screener.

The Rating Score is simply a sum of all Graham Ratings. For example, a score of 4.5 indicates that the stock clears four Defensive ratings (including any Utility / Financial ratings), and one Enterprising rating.

It's quite easy to search for any combination of Graham Ratings using the Advanced Graham Screener, such as all stocks with total ratings above 8. But the Rating Score was only introduced as way for users to quickly understand a stock's position, and has little relevance to Graham's actual framework.

Graham required specific combinations of these ratings, such as the rating combination for defensive stocks, which can be more simply screened as follows; or on the free Classic Graham Screener as follows.

The Graham grading system exists because not all of Graham's requirements are actually covered by the Graham Ratings. For example, the growth rule for Enterprising grade stocks and the earnings rule for NCAV stocks are not covered by the Graham Ratings.

So the Graham Ratings are more for getting a quick understanding and for customized screening, while the Graham grading system is actually a comprehensive Graham evaluation.

To avoid ambiguity with Graham's definitions, some of the terms used on GrahamValue have been renamed.

a. Qualitative Result is now known as the Graham Grade.

b. Quantitative Result is now known as Intrinsic Value(%).

c. GN÷PC or GN/PC or Graham Number ÷ Previous Close, is now known as Graham Number(%).

Intrinsic Value(%) is also no longer capped at 100%, and it is thus now possible to screen for stocks exceeding Graham's Requirements (such as two-thirds NCAV etc).

Of the seven Defensive ratings, the first six are minimum qualitative requirements. Only the last one, Graham Number(%), is a price-dependent quantitative metric.

The first six ratings usually change only when the next audited financial statement for the stock becomes available, which is typically once a year. On the other hand, the last rating often changes every day with the stock price.

Graham Grades on GrahamValue are therefore based only on qualitative factors. The quantitative factors are dealt with separately; using Graham Number(%), NCAV or Net-Net(%) and Intrinsic Value(%).

Graham Grades and Intrinsic Values on GrahamValue change rarely. But Graham Number(%), NCAV or Net-Net(%) and Intrinsic Value(%) can — and usually do — change every day.

Graham's Intrinsic Value calculations were also based on contemporary bond yields; and Intrinsic Value(%) may therefore need to be independently adjusted for current interest rates, which may differ across countries and economies.

Note: There may be rare cases where a stock has an Enterprising Price (Serenity №) greater than its Defensive Price (Graham №), or an NCAV Price (Net-Net) greater than its Enterprising Price (Serenity №) or Defensive Price (Graham №). Such stocks can change Graham Grades more often, if they were at a higher Graham Grade earlier with an insufficient Intrinsic Value and a price drop now allows them to completely clear a lower Graham Grade; or vice versa.

GrahamValue's default analyses follow Graham's principles as closely as possible. So all Ungraded stocks on GrahamValue have an Intrinsic Value(%) of Zero.

But unprofitable NCAV stocks can be screened on the free Classic Graham Screener as follows:

NCAV or Net-Net(%) ≥ 100%

Graham Grade Ungraded

Please note that such stocks are neither recommended by Graham, nor by GrahamValue.

GrahamValue does not need access to any data on mobile devices that other Apps might.

GrahamValue therefore does not have a mobile app, and recommends that users bookmark the Graham Analysis Search on their mobile browsers.

Your browser may have an ad-blocker or popup-blocker that's interfering with the export code. Please try using another browser.

The export functionality is a simple piece of client-side code that copies the current contents of the screener, in unformatted HTML, into an Excel (*.xls) spreadsheet file.

The Classic Graham Screener can therefore display, and export, only ten stocks at a time. But the Advanced Graham Screener can be configured to display, and export, up to a hundred stocks at a time.

Whenever there is a discrepancy in currencies between the price data and fundamental data for a stock, the stock's price is marked Zero to prevent it from being accidentally cleared on GrahamValue's screeners.

Intrinsic Values on GrahamValue are marked Zero for Ungraded stocks. Intrinsic Values are also marked Zero if the price calculated for any of the other Graham Grades is non-positive.

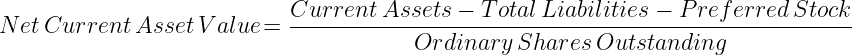

The NCAV price is calculated by taking a company's Current Assets and subtracting its Total liabilities, and then dividing the result by the total number of shares outstanding. This can be negative number if Total Liabilities exceed Current Assets.

Graham recommended using Annual Sales (Revenue) to measure company size. GrahamValue therefore evaluates companies based on Annual Sales, adjusting for Inflation; and the Advanced Graham Screener also supports screening specifically by Annual Sales.

Communication is often a balance between brevity and clarity, especially online where readers are already overloaded with information and have short attention spans. Write too little and the information may prove insufficient, but write too much and the reader may lose interest.

The descriptions on GrahamValue are therefore usually a compromise between these two extremes; attempting to try and convey all relevant information in as few words as possible.

Value Investing is also a complex subject, and there may not even be any simple ways of communicating such complex ideas.

One of GrahamValue's earliest articles is A Unique List Of Fully Defensive Graham Stocks, which was published in 2012. Links to other articles from 2012 and 2013 too can be seen in the sitemap. These articles have been published on multiple mainstream financial portals as well.

Reviews from users on GrahamValue, and the returns from the stocks mentioned in these articles — as portfolios and not individually — should give an adequate indication of how well these techniques have performed since 2012.

However, numbers alone do not capture the complex behavioral and psychological advantages of Value Investing. Explicit performance statistics are also very easy to falsify, either by retrospectively changing data or by selectively highlighting results.

In the end, the best tests of Graham's framework are the consistent endorsements from his students such as Buffett. The fact that GrahamValue follows Graham's framework exactly can also be easily verified by comparing the documented rules applied, with the results on any of the displayed stocks.

Automated stock trading based on technical signals is quite common today.

But real investment involves more than just transactions. There's also the monitoring of the portfolio, and the general economic landscape etc, to consider.

So it may not be possible to completely eliminate human validation, experience and judgement from real investment. Automated tools just make investment research easier, by helping narrow the field of possibilities.

Filtering by automated statistical or quantitative analysis is only the first step of the investment research process.

When multiple complex and autonomous informational systems are interfacing with one another — for providing data, extracting analyses, processing payments and so on — there is always some room for the occasional technical error to creep in.

This is why it's imperative that one always do one's personal due diligence — and verify shortlisted stocks oneself — before making a final investment decision.

Note: The subject is discussed in more detail in the forum under Data And Network Issues.

Benjamin Graham's books contain invaluable information on the larger allocational, historical and behavioral aspects of investing; and are highly recommended reading for any aspiring investor. GrahamValue's Graham screeners are only intended as a technological aid to the application of Graham's investment framework, and not as a replacement for his books.

The free [Advanced Search](https://www.grahamvalue.com/search/node/quick reference) can be used to find forum topics and blog entries on specific queries and issues.

Value Investing Resources

1. Graham Reference

Keywords: Academy, Bootcamp, Checklist, Course, Explained, Examples, Equation, Guide, Journal, Key Ratios, Key Metrics, Learning, Made Easy, Methods, Online Course, Principles, Resources, Techniques, Tutorial, Theory, University, Videos, Workshop, Criteria, Financial Statements, Financial Ratios, Fair Value Formula, How To Value A Stock, Investment Strategy, Investing Rules, Key Points, Lessons.

Related: Basics, Leverage, Security Analysis, YouTube, Margin Of Safety Formula.

2. Graham Applications

Keywords: Excel Model, Options, Portfolio, Quotation, Research, Shares, Tools, XLS, Spreadsheet, Formula Calculator, Intrinsic Value Calculator, Number Calculator, Net-Net Working Capital Screener, Stock Valuation, Fundamental Analysis, Portfolio Management, Risk Analysis.

Related: Database, Opportunities.