Though his exact Net Worth is unknown, Benjamin Graham — Warren Buffett's mentor — was definitely a rich man; as described by Buffett himself.

Buffett's View

Benjamin Graham — Warren Buffett's mentor — was definitely a rich man.

In the video below, Buffett explains how Graham was routinely in the habit of buying expensive gifts for those around him; and how he bought Buffett a camera and a projector when Buffett's son — who incidentally was named after Graham — was born, and Buffett himself was still a young employee.

But Buffett also explains how Graham was not driven by money, and was instead focused on refining methods that ordinary investors could apply to achieve results similar to his (Grahams's) own.

Then there was the GEICO episode.

Graham's Own View

Graham himself says in his 1976 interview that:

"We could have built up an enormous business had we wanted to, but we limited ourselves to a maximum of $15 million of capital-only a drop in the bucket these days. The question of whether we could earn the maximum percentage per year was what interested us. It was not the question of total sums, but annual rates of return that we were able to accomplish."

Benjamin Graham, Hartman L. Butler, Jr.: An Hour with Mr. Graham (1976) [PDF].

Buffett and Munger Concur

In their 1997 Berkshire Hathaway Annual Shareholders Meeting, Buffett and Munger spoke at length about this essential difference in priorities between Graham and his students.

The entire video clip of the below conversation is given at the end of this page.

Charlie Munger: Ben Graham was a truly formidable mind. And he also had a clarity in writing. And we've talked over and over again about the power of a few simple ideas thoroughly assimilated. And that happened with Graham's ideas, which came to me indirectly through Warren, but also some directly from Graham...

Warren Buffett: I enjoyed making money more than Ben. I mean, candidly. With Ben, it just — it really was incidental, at least by the time I knew him. It may have been different when he was younger...

Charlie Munger: But Graham had some blind spots, partly of sort an ethical professorial nature. He was looking for things to teach that would work for every man, that any intelligent layman could learn and do well. Well, if that's the limitation of what you're looking for, they'll be a lot of reality you won't go into, because it's too hard to figure out and too hard to explain. Buffett, if there was money in it, had no such restriction.

Warren Buffett: Yeah. Ben sort of thought it was cheating if we went out and talked to the management, because he just felt that the person who read his book, you know, living in Pocatello, Idaho, could not go out and meet the management. So he didn't — and we didn't do it. I mean, when I worked for Graham-Newman, I don't think I ever visited a management in the 21 months I was there... Ben didn't think there was anything wrong with that. He just felt that if you had to do that, then his book was not the complete answer. And he didn't really want to do anything that the reader of his book couldn't do if he was on a desert island, you know, basically, with just one line to a broker.

Charlie Munger: But if you stop to think about it, Graham was trying to play the game of "Pin the Donkey" wearing very dark glasses. And Warren, of course, would use the biggest search light he could find."

Warren Buffett / Charlie Munger, Berkshire Hathaway: Annual Shareholders Meeting (1997).

Graham's Objectives

Graham was experimenting with different methods to see which ones work best. Also — as Buffett says above — Graham would avoid meeting with company executives and so on, just so that he was in the same position as his readers.

Graham was interested in more than just money. He was developing an investment framework that would stand the test of time for generations of investors.

"The ability to think clearly in the investment field without the emotions that are attached to it, is not an easy undertaking... Fear and greed tend to affect one’s judgment. Because Ben was not really very aggressive about making money, he was less affected by these emotions than were many others."

Walter J. Schloss, Benjamin Graham and Security Analysis: A Reminiscence (1976) [PDF].

GEICO Millionaires

While Graham doesn't say so directly, it's quite well-known that he was referring to his own GEICO investment experience in the following; and Buffett too refers to it in his interview below.

It may also be worth noting that $1M in 1948, when Graham's fund bought half of GEICO, was the equivalent of $12M today.

"what was decisive for them was that the price was moderate in relation to current earnings and asset value... it did so well that the price of its shares advanced to two hundred times or more the price paid... [participants in their funds] became millionaires through their holding in this one enterprise... profits accruing from this single investment decision far exceeded the sum of all the others realized through 20 years... But behind the luck, or the crucial decision, there must usually exist a background of preparation and disciplined capacity."

Benjamin Graham, Postscript, The Intelligent Investor.

In Closing

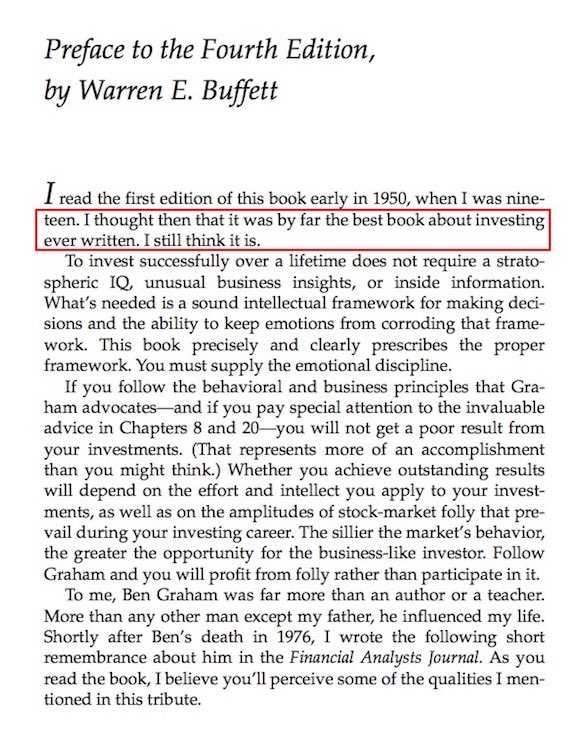

From Buffett's Preface to the fourth edition of The Intelligent Investor:

"To invest successfully over a lifetime does not require a stratospheric IQ, unusual business insights, or inside information. What’s needed is a sound intellectual framework for making decisions and the ability to keep emotions from corroding that framework. This book precisely and clearly prescribes the proper framework."

Warren Buffett, Preface (1986): The Intelligent Investor (by Benjamin Graham).

Buffett also gave a talk in 1984 at Columbia Business School explaining how Benjamin Graham's principles are everlasting, their results irrefutable, and his students consistently exceptional. The talk is now popularly known as The Superinvestors of Graham-and-Doddsville [PDF].

Though a very successful fund manager himself, Graham was more focused on developing and propagating an investment framework that generations of investors could use.