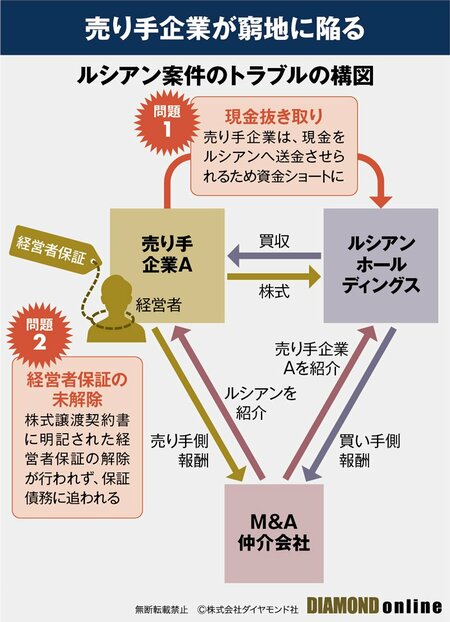

Looking back at the troubles caused by Lucian, there were mainly two issues. First was the "cash extraction."

Lucian had instructed the companies under his umbrella to transfer funds to the accounts managed by Lucian in several installments. It is said that this was based on the premise of returning funds to the subsidiary companies at the necessary timing, such as for employee salaries, repayment of debts to banks and other financial institutions, and payment of expenses such as office rent.

However, it seems that the promise was not always fulfilled. There were instances where funds were not returned or were delayed, and the subsidiary companies from which cash was siphoned off naturally fell into unpaid wages and defaults on debts. The trust of customers, business partners, and employees was damaged, and some subsidiary companies faced management difficulties in no time.

The second issue is "Unreleased Management Guarantee."

The management guarantee is a debt guarantee set up when a company receives loans from financial institutions, which the manager personally bears. If the company is unable to repay, the manager must repay on behalf of the company. It is common for a mortgage to be placed on the manager's home.

When a company is sold through M&A, this management guarantee should be released after the procedures with financial institutions. It is often clearly stated in the stock transfer agreement that it will be carried out by the buyer at the timing when the M&A is established.

However, in the cases that became problematic, Lucian had not lifted the restrictions. Therefore, as explained in the first issue, when falling into financial difficulties and defaulting on debts, creditors such as banks will proceed to collect from the former president, who has already sold the company and stepped down from the front lines of management. The former president, who thought the management guarantee had been lifted, would realize the seriousness of the situation upon receiving contact from the financial institution demanding repayment.

The representative of Lucian has been missing since January 24. Since around January, contacts have been coming in from the executives of the selling companies to those involved in mediating Lucian's M&A, with cries such as, "I can't get in touch with Lucian" and "The management guarantee has not been lifted, and we have no choice but to go bankrupt."

However, as explained on the previous page, intermediary companies basically do not get involved in the management of the seller and buyer after the M&A is established. Therefore, the intermediary company was also caught off guard.

What will happen in the future? Among the seller companies, there are movements to file lawsuits against the intermediary companies. However, the general view is that it is unlikely that the damages suffered by the seller companies and their former executives will be compensated. This is because the seller companies have agreed to proceed with the M&A with Lucian as the buyer and have also signed a shareholder transfer agreement.

The Diamond editorial department contacted the representative of Lucian to inquire about the reasons for the repeated acquisitions and the reasons for transferring funds, using the phone number, mobile phone, and email listed on the business card, but no response had been received by the time of writing this article.

Key Visual: SHIKI DESIGN OFFICE, Hitomi Namura

[

]

[

]

[

]

[

]