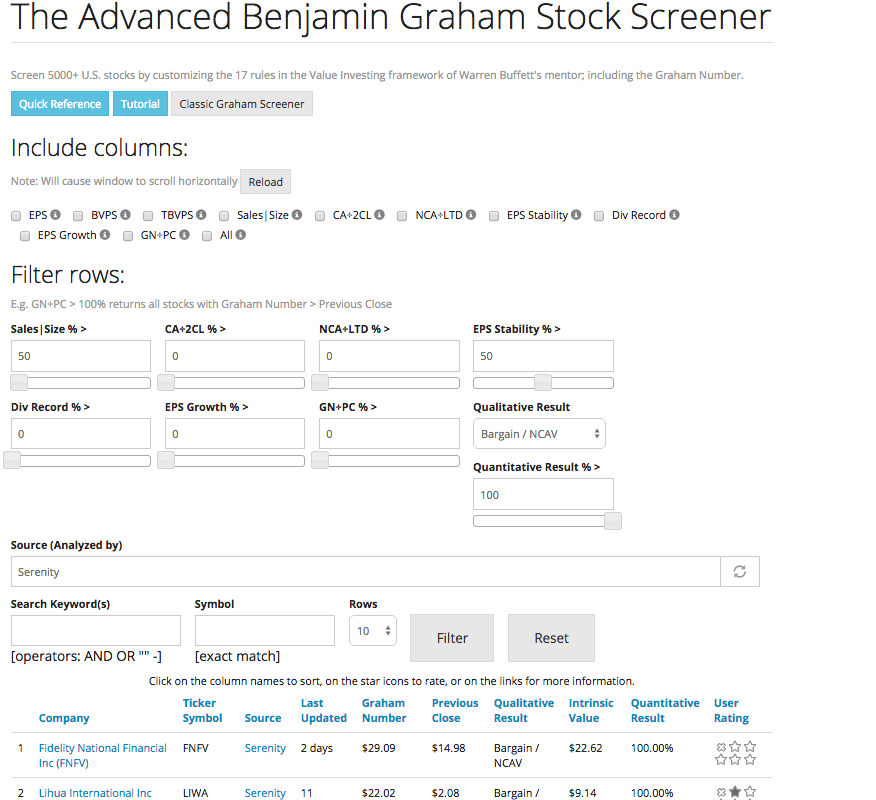

The Advanced Benjamin Graham Stock Screener allows for customized combinations of the Value Investing parameters of Warren Buffett's mentor.

NCAV + Sales + Stability

For example, here is a partial list of stocks that completely meet Graham's NCAV criteria, and also have $250 Million in Sales and 5 years of uninterrupted positive earnings.

Note: Only two stocks are shown here due to limited screen space.

NCAV + Enterprising

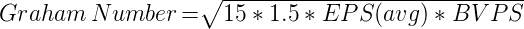

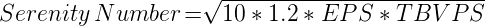

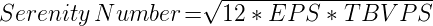

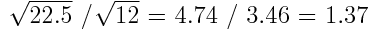

The Graham Number is 137% of the Serenity Number (for a stock with no intangibles in its Book Value).

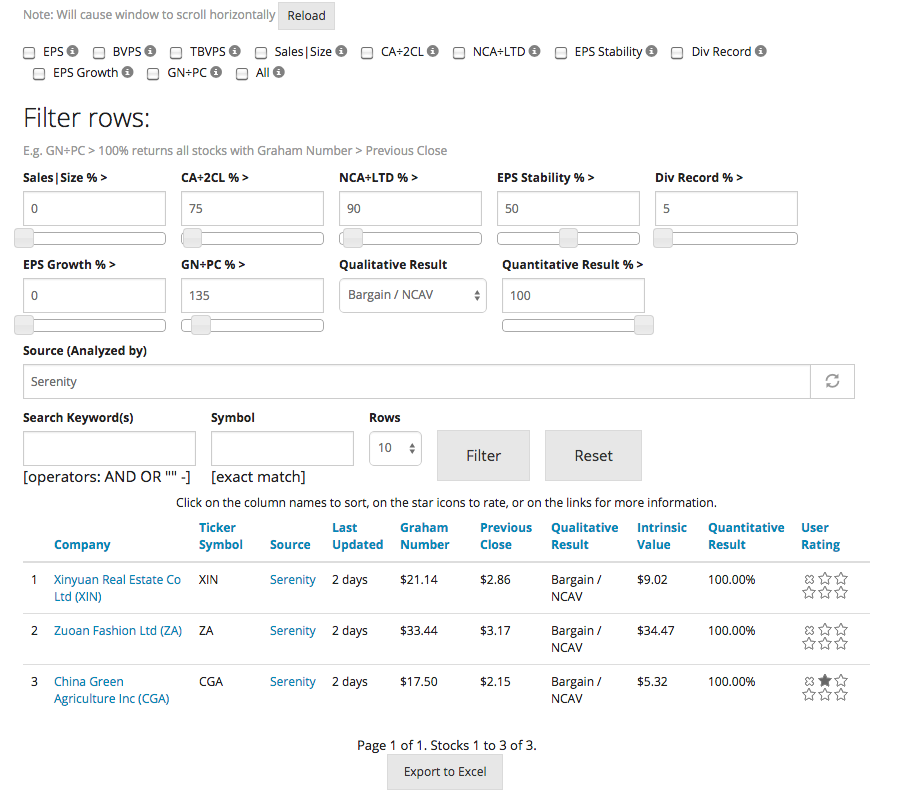

Essentially, for a given EPS and BVPS, we pay 137% more for a Defensive grade stock since it is of higher quality than an Enterprising grade stock. Thus, the criteria for Enterprising grade stocks can be approximately replicated on the Advanced Graham Screener using the values — Assets / Liabilities: 75%, Assets / Debt: 90%, Earnings Stability: 50%, Dividend Record: 5% and Graham Number(%): 137%.

Note: This is just an example. If the reported BVPS includes intangibles, Graham Number(%) would need to be higher than 137%. True Enterprising grade stocks also need to have an EPS higher than they did 5 years ago.

Example

Shown below is a list of stocks that completely meet Graham's NCAV criteria, and additionally clear all the above criteria.

Note: GN÷PC (now called Graham Number(%)) shows 135 instead of 137 because the slider for that particular filter moves in steps of 5.

Each one of these stocks already clears Graham's NCAV criteria completely, in addition to clearing most of the criteria for Enterprising investors.

Excel Export + API

GrahamValue is designed on the belief that since Graham spent nearly his whole life developing his framework for maximum efficiency and that's what it comes so highly recommended; any additions to the framework would actually reduce its effectiveness rather than increase it.

Finnhub

GrahamValue's data provider — Finnhub — provides 30+ years of financials and hundreds of metrics for every stock. But GrahamValue is designed to restrict itself to the most authentic Graham analysis possible.

Each additional metric that's not mentioned in Graham's stock selection chapters would not only add to the complexity of an already advanced system; but could also potentially reduce performance of the database, and incur additional data costs as well.

For those with coding experience, Finnhub too has a Free Tier which allows one to build one's own personal tools around its API.

Finsheet

Both of GrahamValue's screeners have supported Excel Exports since inception.

Technically, one could integrate the exported data with Finnhub's API; either using Google Sheets or using Microsoft Excel.

But Finnhub's documentation indicates that they already provide direct integration for Microsoft Excel and Google Sheets through Finsheet; their official partner for Spreadsheet plugins, which too — like Finnhub and GrahamValue — has a Free Tier.

In the 2018 Balance of Power interview for Bloomberg Markets, Warren Buffett says yet again:

"The principles [of investing] haven't changed at all... It's exactly what Ben Graham wrote in 1949."

Warren Buffett, Bloomberg Markets: Balance of Power (2018).